Pizza Hut 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

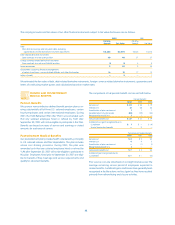

LEASES

We have non-cancelable commitments under both capital and

long-term operating leases, primarily for our restaurants. Capital

and operating lease commitments expire at various dates through

2087 and, in many cases, provide for rent escalations and renewal

options. Most leases require us to pay related executory costs,

which include property taxes, maintenance and insurance.

Future minimum commitments and amounts to be received as

lessor or sublessor under non-cancelable leases are set forth below:

Commitments Lease Receivables

Direct

Capital Operating Financing Operating

2003 $ 14 $ 276 $ 2 $ 1 1

2004 14 243 3 10

2005 13 213 3 9

2006 12 179 2 8

2007 11 158 2 7

Thereafter 117 905 19 45

$ 181 $1,974 $ 31 $ 90

At year-end 2002, the present value of minimum payments under

capital leases was $99 million.

The details of rental expense and income are set forth below:

2002 2001 2000

Rental expense

Minimum $ 318 $ 283 $ 253

Contingent 25 10 28

$ 343 $ 293 $ 281

Minimum rental income $11 $14 $18

Contingent rentals are generally based on sales levels in excess

of stipulated amounts contained in the lease agreements.

NOTE

15

60.

FINANCIAL INSTRUMENTS

Derivative Instruments

Interest Rates

We enter into interest rate swaps and forward rate agreements

with the objective of reducing our exposure to interest rate risk and

lowering interest expense for a portion of our debt. Under the con-

tracts, we agree with other parties to exchange, at specified

intervals, the difference between variable rate and fixed rate

amounts calculated on a notional principal amount. At both

December 28, 2002 and December 29, 2001, we had outstand-

ing pay-variable interest rate swaps with notional amounts of

$350 million. These swaps have reset dates and floating rate

indices which match those of our underlying fixed-rate debt and

have been designated as fair value hedges of a portion of that

debt. As the swaps qualify for the short-cut method under SFAS

133 no ineffectiveness has been recorded. The fair value of these

swaps as of December 28, 2002 and December 29, 2001 was

approximately $48 million and $36 million, respectively, and has

been included in other assets. The portion of this fair value which

has not yet been recognized as a reduction to interest expense

(approximately $44 million and $34 million at December 28, 2002

and December 29, 2001, respectively) has been included in long-

term debt.

During the second quarter of 2002, we entered into treasury

locks with notional amounts totaling $250 million. These treasury

locks were entered into to hedge the risk of changes in future inter-

est payments attributable to changes in the benchmark interest

rate prior to issuance of additional fixed-rate debt. These locks

were designated and effective in offsetting the variability in cash

flows associated with the future interest payments on a portion of

the 2012 Notes. Thus, the insignificant loss at which these treasury

locks were settled will be recognized as an increase to interest on

the debt through 2012.

NOTE

16