Pizza Hut 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

29.

Yum! Brands Inc.

INTRODUCTION

On May 16, 2002, TRICON Global Restaurants, Inc. changed its

name to YUM! Brands, Inc. in order to better reflect our expanding

portfolio of brands. In addition, on the same day, Tricon Restaurants

International changed its name to YUM! Restaurants International.

YUM! Brands, Inc. and Subsidiaries (collectively referred to as

“YUM” or the “Company”) comprises the worldwide operations of

KFC, Pizza Hut, Taco Bell, Long John Silver’s (“LJS”) and A&W All-

American Food Restaurants (“A&W”) (collectively “the Concepts”)

and is the world’s largest quick service restaurant (“QSR”) company

based on the number of system units. LJS and A&W were added

when YUM acquired Yorkshire Global Restaurants, Inc. (“YGR”) on

May 7, 2002. Separately, KFC, Pizza Hut and Taco Bell rank in the

top ten among QSR chains in U.S. system sales and units. With

11,798 international units, YUM is the second largest QSR company

outside the U.S. YUM became an independent, publicly owned

company on October 6, 1997 (the “Spin-off Date”) via a tax-free dis-

tribution of our Common Stock (the “Distribution” or “Spin-off”) to

the shareholders of our former parent, PepsiCo, Inc. (“PepsiCo”).

Throughout Management’s Discussion and Analysis

(“MD&A”), we make reference to ongoing operating profit which

represents our operating profit excluding the impact of facility

actions net loss (gain) and unusual items income (expense). See

Note 7 to the Consolidated Financial Statements for a detailed dis-

cussion of these exclusions. We use ongoing operating profit as

a key performance measure of our results of operations for pur-

poses of evaluating performance internally. Ongoing operating

profit is not a measure defined in accounting principles generally

accepted in the United States of America and should not be con-

sidered in isolation or as a substitute for measures of performance

in accordance with accounting principles generally accepted in

the United States of America.

All references to per share and share amounts in the follow-

ing MD&A have been adjusted to reflect the two-for-one stock split

distributed on June 17, 2002.

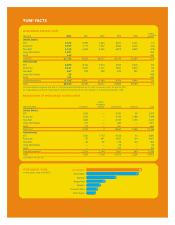

In 2002, our international business, YUM! Restaurants

International (“YRI” or “International”) accounted for 35% of system

sales, 31% of revenues and 32% of ongoing operating profit

excluding unallocated and corporate expenses. We anticipate

that, despite the inherent risks and typically higher general and

administrative expenses required by international operations, we

will continue to invest in certain international markets with sub-

stantial growth potential.

This MD&A should be read in conjunction with our

Consolidated Financial Statements on pages 44 through 47 and

the Cautionary Statements on page 43. All Note references herein

refer to the Notes to the Consolidated Financial Statements on

pages 48 through 72. Tabular amounts are displayed in millions

except per share and unit count amounts, or as otherwise specif-

ically identified.

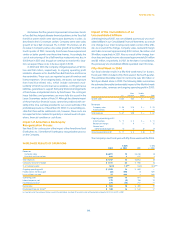

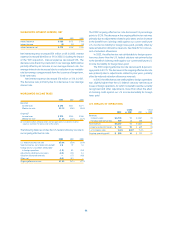

CRITICAL ACCOUNTING POLICIES

Our reported results are impacted by the application of certain

accounting policies that require us to make subjective or complex

judgments. These judgments involve estimations of the effect of

matters that are inherently uncertain and may significantly impact

our quarterly or annual results of operations or financial condi-

tion. Changes in the estimates and judgments could significantly

affect our results of operations, financial condition and cash flows

in future years. A description of what we consider to be our most

significant critical accounting policies follows.

Impairment or Disposal of Long-Lived Assets

We evaluate our long-lived assets for impairment at the individual

restaurant level. Restaurants held and used are evaluated for

impairment on a semi-annual basis or whenever events or cir-

cumstances indicate that the carrying amount of a restaurant may

not be recoverable (including a decision to close a restaurant). Our

semi-annual test includes those restaurants that have experienced

two consecutive years of operating losses. These impairment

evaluations require an estimation of cash flows over the remain-

ing useful life of the primary asset of the restaurant, which can be

for a period of over 20 years, and any terminal value. We limit

assumptions about important factors such as sales growth and

margin improvement to those that are supportable based upon

our plans for the unit and actual results at comparable restaurants.

If the long-lived assets of a restaurant on a held and used

basis are not recoverable based upon forecasted, undiscounted

cash flows, we write the assets down to their fair value. This fair

value is determined by discounting the forecasted cash flows,

including terminal value, of the restaurant at an appropriate rate.

The discount rate used is our cost of capital, adjusted upward

when a higher risk is believed to exist.

When it is probable that we will sell a restaurant we write

down the restaurant to its fair value. We often refranchise restau-

rants in groups and therefore perform impairment evaluations at

the group level. Fair value is based on the expected sales proceeds

less applicable transaction costs. Estimated sales proceeds are

based on the most relevant of historical sales multiples or bids

from buyers, and have historically been reasonably accurate esti-

mations of the proceeds ultimately received.

See Note 2 for a further discussion of our policy regarding the

impairment or disposal of long-lived assets.

Impairment of Investments in Unconsolidated

Affiliates

We record impairment charges related to an investment in an

unconsolidated affiliate whenever events or circumstances indi-

cate that a decrease in the value of an investment has occurred

which is other than temporary. In addition, we evaluate our invest-

ments in unconsolidated affiliates for impairment when they have

experienced two consecutive years of operating losses. Our