Pizza Hut 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

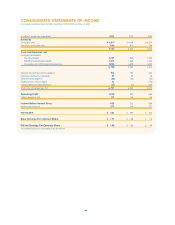

36.

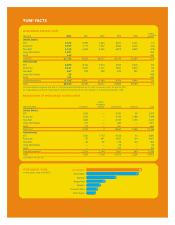

WORLDWIDE INTEREST EXPENSE, NET

2002 2001 2000

Interest expense $ 180 $ 172 $ 190

Interest income (8) (14) (14)

Interest expense, net $ 172 $ 158 $ 176

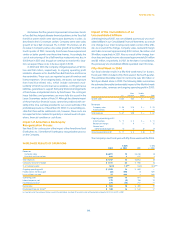

Net interest expense increased $14 million or 8% in 2002. Interest

expense increased $8 million or 5% in 2002. Excluding the impact

of the YGR acquisition, interest expense decreased 12%. The

decrease was driven by a reduction in our average debt balance

partially offset by an increase in our average interest rate. Our

average interest rate increased due to a reduction in our variable-

rate borrowings using proceeds from the issuance of longer term,

fixed-rate notes.

Net interest expense decreased $18 million or 10% in 2001.

The decrease was primarily due to a decrease in our average

interest rate.

WORLDWIDE INCOME TAXES

2002 2001 2000

Reported

Income taxes $ 275 $ 241 $ 271

Effective tax rate 32.1% 32.8% 39.6%

Ongoing(a)

Income taxes $ 270 $ 243 $ 268

Effective tax rate 31.3% 33.1% 37.7%

(a) Excludes the effects of facility actions net loss (gain) and unusual items (income)

expense. See Note 7 for a discussion of these items.

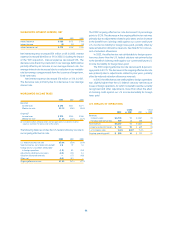

The following table reconciles the U.S. federal statutory tax rate to

our ongoing effective tax rate:

2002 2001 2000

U.S. federal statutory tax rate 35.0% 35.0% 35.0%

State income tax, net of federal tax benefit 2.0 1.9 1.8

Foreign and U.S. tax effects attributable

to foreign operations (1.9) 0.2 (0.4)

Adjustments relating to prior years (3.5) (2.2) 5.3

Valuation allowance reversals

—

(1.7) (4.0)

Other, net (0.3) (0.1)

—

Ongoing effective tax rate 31.3% 33.1% 37.7%

The 2002 ongoing effective tax rate decreased 1.8 percentage

points to 31.3%. The decrease in the ongoing effective tax rate was

primarily due to adjustments related to prior years and an increase

in the benefit from claiming credit against our current and future

U.S. income tax liability for foreign taxes paid, partially offset by

reduced valuation allowance reversals. See Note 22 for a discus-

sion of valuation allowances.

In 2002, the effective tax rate attributable to foreign opera-

tions was lower than the U.S. federal statutory rate primarily due

to the benefit of claiming credit against our current and future U.S.

income tax liability for foreign taxes paid.

The 2001 ongoing effective tax rate decreased 4.6 percent-

age points to 33.1%. The decrease in the ongoing effective tax rate

was primarily due to adjustments related to prior years, partially

offset by reduced valuation allowance reversals.

In 2001, the effective tax rate attributable to foreign operations

was slightly higher than the U.S. federal statutory rate because

losses of foreign operations for which no benefit could be currently

recognized and other adjustments more than offset the effect

of claiming credit against our U.S. income tax liability for foreign

taxes paid.

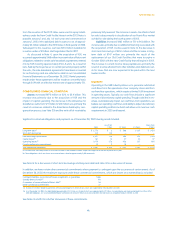

U.S. RESULTS OF OPERATIONS

% B(W) % B(W)

2002 vs. 2001 2001 vs. 2000

Revenues

Company sales $ 4,778 11 $ 4,287 (5)

Franchise and license fees 569 5 540 2

Total revenues $ 5,347 11 $ 4,827 (5)

Company restaurant margin $ 764 18 $ 649 (5)

% of Company sales 16.0% 0.8ppts. 15.2%

—

Ongoing operating profit $ 825 14 $ 722 (3)