Pizza Hut 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

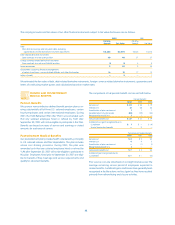

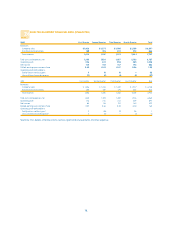

Long-Lived Assets(e)

2002 2001 2000

United States $ 2,805 $2,195 $ 2,101

International 1,021 955 828

Corporate 60 45 30

$ 3,886 $3,195 $ 2,959

(a) Includes equity income of unconsolidated affiliates of $31 million, $26 million and

$25 million in 2002, 2001 and 2000, respectively.

(b) See Note 7 for a discussion by reportable operating segment of facility actions net

(loss) gain and unusual items income (expense).

(c) Includes investment in unconsolidated affiliates of $225 million, $213 million and $257

million for 2002, 2001 and 2000, respectively.

(d) Primarily includes deferred tax assets, fair value of derivative instruments, and prop-

erty, plant and equipment, net, related to our office facilities.

(e) Includes property, plant and equipment, net; goodwill, net; and intangible assets, net.

See Note 7 for additional operating segment disclosures related

to impairment and the carrying amount of assets held for sale.

GUARANTEES, COMMITMENTS AND

CONTINGENCIES

Lease Guarantees

As a result of (a) assigning our interest in and obligations under

real estate leases as a condition to the refranchising of certain

Company restaurants; (b) contributing certain Company restau-

rants to unconsolidated affiliates; and (c) guaranteeing certain

other leases we are frequently contingently liable on lease agree-

ments. These leases have varying terms, the latest of which

expires in 2030. As of December 28, 2002 and December 29,

2001, the potential amount of undiscounted payments we could

be required to make in the event of non-payment by the primary

lessee was $388 million and $435 million, respectively. The pres-

ent values of these potential payments discounted at our pre-tax

cost of debt at December 28, 2002 and December 29, 2001, were

$278 million and $293 million, respectively. Current franchisees

are the primary lessees under the vast majority of these leases. We

generally have cross-default provisions with these franchisees that

would put them in default of their franchise agreement in the event

of non-payment under the lease. We believe these cross-default

provisions significantly reduce the risk that we will be required to

make payments under these leases. Accordingly, the liability

recorded for our exposure under such leases at December 28,

2002 and December 29, 2001, was not significant.

Guarantees Supporting Financial Arrangements

of Certain Franchisees, Unconsolidated Affiliates

and Other Third Parties

At December 28, 2002 and December 29, 2001, we had guaran-

teed approximately $32 million of financial arrangements of

certain franchisees, including partial guarantees of franchisee loan

NOTE

24

pools related primarily to the Company’s refranchising programs.

The total loans outstanding under these loan pools were approx-

imately $153 million at December 28, 2002. In support of these

guarantees, we have posted $32 million of letters of credit. We also

provide a standby letter of credit under which we could potentially

be required to fund a portion (up to $25 million) of one of the

franchisee loan pools. Any funding under the guarantees or let-

ters of credit would be secured by the franchisee loans and any

related collateral. We believe that we have appropriately provided

for our estimated probable exposures under these contingent lia-

bilities. These provisions were primarily charged to refranchising

(gains) losses.

We have guaranteed certain financial arrangements of uncon-

solidated affiliates and third parties. These financial arrangements

primarily include lines of credit, loans and letters of credit and

totaled $41 million and $28 million at December 28, 2002 and

December 29, 2001, respectively. If all such lines of credit and letters

of credit were fully drawn down, the maximum contingent liability

under these arrangements would be approximately $53 million

and $56 million as of December 28, 2002 and December 29, 2001,

respectively. We have varying levels of recourse provisions and

collateral that mitigate our risk under these guarantees. Accord-

ingly, we have no recorded liability as of December 28, 2002 or

December 29, 2001.

Insurance Programs

We are currently self-insured for a portion of our current and prior

years’ workers’ compensation, employment practices liability, gen-

eral liability and automobile liability losses (collectively, “casualty

losses”) as well as property losses and certain other insurable

risks. To mitigate the cost of our exposures for certain property and

casualty losses, we make annual decisions to either retain the risks

of loss up to certain maximum per occurrence or aggregate loss

limits negotiated with our insurance carriers, or to fully insure those

risks. Since the Spin-off, we have elected to retain the risks subject

to certain insured limitations. Since August 1999, we have bundled

our risks for casualty losses, property losses and various other

insurable risks into one pool with a single self-insured retention

and purchased reinsurance coverage up to a specified limit that

is significantly above our actuarially determined probable losses.

We are self-insured for losses in excess of the reinsurance limit;

however, we believe the likelihood of losses exceeding the rein-

surance limit is remote. We are also self-insured for healthcare

claims for eligible participating employees subject to certain

deductibles and limitations. We have accounted for our retained

liabilities for property and casualty losses and healthcare claims,

including reported and incurred but not reported claims, based

on information provided by independent actuaries.

Due to the inherent volatility of our actuarially determined

property and casualty loss estimates, it is reasonably possible that

69.

Yum! Brands Inc.