Pizza Hut 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FACTORS AFFECTING COMPARABILITY

OF 2002 RESULTS TO 2001 RESULTS AND

2001 RESULTS TO 2000 RESULTS

YGR Acquisition

On May 7, 2002, the Company completed its acquisition of YGR,

the parent company of LJS and A&W. See Note 4 for a discussion

of the acquisition.

As of the date of the acquisition, YGR consisted of 742 and

496 company and franchise LJS units, respectively, and 127 and

742 company and franchise A&W units, respectively. In addition,

133 multibranded LJS/A&W restaurants were included in the LJS

unit totals. Except as discussed in certain sections of the MD&A,

the impact of the acquisition on our results of operations in 2002

was not significant.

Impact of Recently Adopted Accounting

Pronouncement

Effective December 30, 2001, the Company adopted Statement of

Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and

Other Intangible Assets” (“SFAS 142”), in its entirety. In accordance

with the requirements of SFAS 142, we ceased amortization of

goodwill and indefinite-lived intangibles as of December 30, 2001.

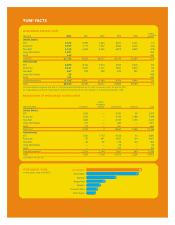

The following table summarizes the favorable effect of SFAS 142

on restaurant profit, restaurant margin and ongoing operating

profit had SFAS 142 been effective in 2001.

Year Ended December 29, 2001

Inter-

U.S. national Worldwide

Restaurant profit $21 $11 $32

Restaurant margin (%) 0.5 0.6 0.5

Ongoing operating profit $22 $16 $38

Additionally, if SFAS 142 had been effective in 2001, reported net

income would have increased approximately $26 million and diluted

earnings per common share (“EPS”) would have increased $0.09.

Unusual Items (Income) Expense

We recorded unusual items income of $27 million in 2002 and

$3 million in 2001 and unusual items expense of $204 million in

2000. See Note 7 for a detailed discussion of our unusual items

(income) expense.

Impact of New Unconsolidated Affiliates

Consistent with our strategy to focus our capital on key interna-

tional markets, we formed ventures in Canada and Poland with

our largest franchisee in each market. The venture in Canada was

formed in the third quarter of 2000 and the venture in Poland was

effective in the first quarter of 2001. At the date of formation, the

Canadian venture operated over 700 stores and the Poland ven-

ture operated approximately 100 stores. We did not record any

gain or loss on the transfer of assets to these new ventures.

Previously, the results from the restaurants we contributed to

these ventures were consolidated. The impact of these trans-

actions on operating results is similar to the impact of our

refranchising activities, which is described in the Store Portfolio

Strategy section below. Consequently, these transactions resulted

in a decline in our Company sales, restaurant margin dollars and

general and administrative (“G&A”) expenses as well as higher

franchise fees. We also record equity income (loss) from invest-

ments in unconsolidated affiliates (“equity income”) and, in

Canada, higher franchise fees since the royalty rate was increased

for those stores contributed by our partner to the venture. The for-

mation of these ventures did not have a significant net impact on

ongoing operating profit in 2001.

Store Portfolio Strategy

Since 1995, we have been strategically reducing our share of

total system units by selling Company restaurants to existing and

new franchisees where their expertise can generally be lever-

aged to improve the restaurants’ overall operating performance,

while retaining Company ownership of key U.S. and International

markets. This portfolio-balancing activity reduces our reported

revenues and restaurant profits, which increases the importance

of system sales as a key performance measure. We substantially

completed our U.S. refranchising program in 2001.

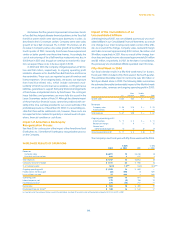

The following table summarizes our refranchising activities:

2002 2001 2000

Number of units refranchised 174 233 757

Refranchising proceeds, pre-tax $81 $ 111 $ 381

Refranchising net gains, pre-tax(a) $19 $ 39 $ 200

(a) 2001 includes $12 million of previously deferred refranchising gains and a charge of

$11 million to mark to market the net assets of our Singapore business, which was

sold during 2002 at a price approximately equal to its carrying value.

In addition to our refranchising program, we have closed certain

restaurants over the past several years. Restaurants closed include

poor performing restaurants, restaurants relocated to a new site

within the same trade area or U.S. Pizza Hut delivery units con-

solidated with a new or existing dine-in traditional store within the

same trade area.

31.

Yum! Brands Inc.