Pizza Hut 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

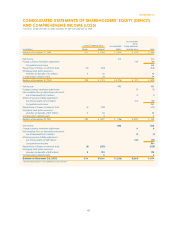

PROPERTY, PLANT AND EQUIPMENT, NET

2002 2001

Land $ 621 $ 572

Buildings and improvements 2,742 2,569

Capital leases, primarily buildings 102 91

Machinery and equipment 1,736 1,628

5,201 4,860

Accumulated depreciation and amortization (2,164) (2,123)

$ 3,037 $ 2,737

Depreciation and amortization expense related to property, plant

and equipment was $357 million, $320 million and $319 million in

2002, 2001 and 2000, respectively.

GOODWILL AND INTANGIBLE ASSETS

The Company’s business combinations have included acquiring

restaurants from our franchisees. Prior to the adoption of SFAS 141,

the primary intangible asset to which we generally allocated value

NOTE

12

NOTE

11

in these business combinations was reacquired franchise rights.

We determined that reacquired franchise rights did not meet the

criteria of SFAS 141 to be recognized as an asset apart from good-

will. Accordingly, on December 30, 2001, we reclassified $241

million of reacquired franchise rights to goodwill, net of related

deferred tax liabilities of $53 million.

The changes in the carrying amount of goodwill, net for the

year ended December 28, 2002 is as follows:

Inter-

U.S. national Worldwide

Balance as of December 29, 2001 $ 21 $ 38 $ 59

Reclassification of reacquired

franchise rights(a) 145 96 241

Impairment(b)

—

(5) (5)

Acquisitions, disposals and other, net(c) 206 (16) 190

Balance as of December 28, 2002 $ 372 $ 113 $ 485

(a) Amounts reported net of deferred tax liabilities of $27 million for the U.S. and $26 mil-

lion for International.

(b) Represents impairment of the goodwill of the Pizza Hut France reporting unit.

Impairment was recorded in connection with our annual impairment review performed

as of the beginning of the fourth quarter, and resulted from the poor performance of

the Pizza Hut France reporting unit during 2002.

(c) Includes goodwill related to the YGR purchase price allocation. For International,

includes a $13 million transfer of goodwill to assets held for sale (see Note 7).

57.

Yum! Brands Inc.

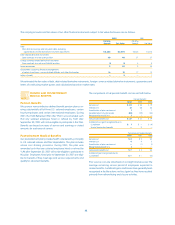

Intangible assets, net for the years ended 2002 and 2001 are as follows:

2002 2001

Gross Carrying Accumulated Gross Carrying Accumulated

Amount Amortization Amount Amortization

Amortized intangible assets

Franchise contract rights $ 135 $ (43) $ 102 $ (40)

Favorable operating leases 21 (13) 13 (11)

Pension-related intangible 18

—

8

—

Other 26 (23) 23 (21)

$ 200 $ (79) $ 146 $ (72)

Unamortized intangible assets

Brand/Trademarks $ 243 $31