Pizza Hut 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

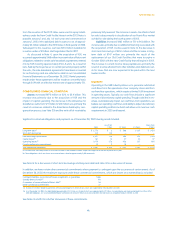

We believe that the general improvement in business trends

at Taco Bell has helped alleviate financial problems in the Taco Bell

franchise system which were due to past downturns in sales. As

described in the U.S. revenues section, Company same-store sales

growth at Taco Bell increased 7% in 2002. This follows an 8%

increase in Company same-store sales growth at Taco Bell in the

fourth quarter of 2001. Generally, franchisees have experienced

similar or better growth over these time frames. Accordingly, the

cost of restructurings of Taco Bell franchise restaurants was less in

2002 than in 2001 and, though we continue to monitor this situa-

tion, we expect these costs to be less again in 2003.

In 2002 and 2001, the Company charged expenses of $8 mil-

lion and $18 million, respectively, to ongoing operating profit

related to allowances for doubtful Taco Bell franchise and license

fee receivables. These costs are reported as part of franchise and

license expenses. On an ongoing basis, we assess our exposure

from franchise-related risks, which include estimated uncol-

lectibility of franchise and license receivables, contingent lease

liabilities, guarantees to support third party financial arrangements

of franchisees and potential claims by franchisees. The contingent

lease liabilities and guarantees are more fully discussed in the

Lease Guarantees section of Note 24. Although the ultimate impact

of these franchise financial issues cannot be predicted with cer-

tainty at this time, we have provided for our current estimate of the

probable exposure as of December 28, 2002. It is reasonably pos-

sible that there will be additional costs; however, these costs are

not expected to be material to quarterly or annual results of oper-

ations, financial condition or cash flows.

Impact of AmeriServe Bankruptcy

Reorganization Process

See Note 25 for a discussion of the impact of the AmeriServe Food

Distribution, Inc. (“AmeriServe”) bankruptcy reorganization process

on the Company.

33.

Yum! Brands Inc.

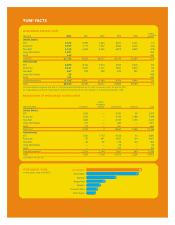

WORLDWIDE RESULTS OF OPERATIONS

% B(W) % B(W)

2002 vs. 2001 2001 vs. 2000

Revenues

Company sales $ 6,891 12 $ 6,138 (3)

Franchise and license fees 866 6 815 3

Total revenues $ 7,757 12 $ 6,953 (2)

Company restaurant margin $ 1,101 22 $ 906 (5)

% of Company sales 16.0% 1.2ppts. 14.8% (0.3)ppts.

Ongoing operating profit $ 1,035 16 $ 889

—

Facility actions net (loss) gain (32) NM (1) NM

Unusual items income 27 NM 3NM

Operating profit 1,030 16 891 4

Interest expense, net 172 (8) 158 10

Income tax provision 275 (15) 241 11

Net income $ 583 18 $ 492 19

Diluted earnings per share(a) $ 1.88 16 $ 1.62 17

(a) See Note 6 for the number of shares used in this calculation. See Note 12 for a discussion of the pro-forma impact of SFAS 142 on EPS in 2001.

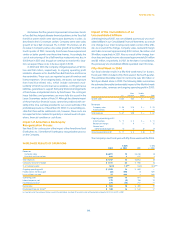

Impact of the Consolidation of an

Unconsolidated Affiliate

At the beginning of 2001, we consolidated a previously unconsol-

idated affiliate in our Consolidated Financial Statements as a result

of a change in our intent to temporarily retain control of this affili-

ate. As a result of this change, Company sales, restaurant margin

and G&A increased approximately $100 million, $6 million and

$9 million, respectively, in 2001. Also as a result of the change, fran-

chise fees and equity income decreased approximately $4 million

and $2 million, respectively, in 2001. At the date of consolidation,

this previously unconsolidated affiliate operated over 100 stores.

Fifty-third Week in 2000

Our fiscal calendar results in a fifty-third week every 5 or 6 years.

Fiscal year 2000 included a fifty-third week in the fourth quarter.

The estimated favorable impact in net income was $10 million or

$0.03 per diluted share in 2000. The following table summarizes

the estimated favorable/(unfavorable) impact of the fifty-third week

on system sales, revenues and ongoing operating profit in 2000:

Inter- Unallo-

U.S. national cated Total

System sales $ 230 $ 65 $

—

$ 295

Revenues

Company sales $ 58 $ 18 $

—

$76

Franchise fees 92

—

11

Total revenues $ 67 $ 20 $

—

$87

Ongoing operating profit

Franchise fees $9 $2 $

—

$11

Restaurant margin 11 4

—

15

General and

administrative expenses (3) (2) (2) (7)

Ongoing operating profit $ 17 $ 4 $ (2) $ 19

The Company’s next fiscal year with fifty-three weeks will be 2005.