Pizza Hut 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impairment measurement test for an investment in an unconsol-

idated affiliate is similar to that for our restaurants except that we

use discounted cash flows after interest and taxes instead of dis-

counted cash flows before interest and taxes as used for our

restaurants.

See Note 2 for a further discussion of our policy regarding the

impairment of investments in unconsolidated affiliates.

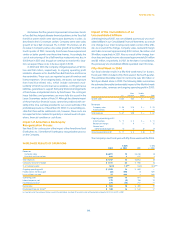

Impairment of Goodwill

We evaluate goodwill for impairment on an annual basis through

the comparison of fair value of our reporting units to their carrying

values. Our reporting units are our operating segments in the U.S.

and our business management units internationally (typically indi-

vidual countries). Fair value is the price a willing buyer would pay

for the reporting unit, and is generally estimated by discounting

expected future cash flows from the reporting units over twenty

years plus an expected terminal value. We limit assumptions

about important factors such as sales growth and margin

improvement to those that are supportable based upon our plans

for the reporting unit.

We impaired $5 million of goodwill during 2002 related to our

Pizza Hut France reporting unit. For the remainder of our report-

ing units with goodwill, the fair value is generally significantly in

excess of the recorded carrying value. Thus, we do not believe that

we have material goodwill that is at risk to be impaired given cur-

rent business performance.

See Note 2 for a further discussion of our policies regarding

goodwill.

Allowances for Franchise and License

Receivables and Contingent Liabilities

We reserve a franchisee’s or licensee’s entire receivable balance

based upon pre-defined aging criteria and upon the occurrence of

other events that indicate that we may not collect the balance due.

As a result of reserving using this methodology, we have an

immaterial amount of receivables that are past due that have not

been reserved for at December 28, 2002. See Note 2 for a further

discussion of our policies regarding franchise and license opera-

tions.

Primarily as a result of our refranchising efforts, we remain

liable for certain lease assignments and guarantees. We record

a liability for our exposure under these lease assignments and

guarantees when such exposure is probable and estimable. At

December 28, 2002, we have recorded an immaterial liability for

our exposure which we consider to be probable and estimable.

The potential total exposure under such leases is significant, with

$278 million representing the present value of the minimum pay-

ments of the assigned leases at December 28, 2002, discounted

at our pre-tax cost of debt. Current franchisees are the primary

lessees under the vast majority of these leases. We generally have

cross-default provisions with these franchisees that would put

them in default of their franchise agreement in the event of non-

payment under the lease. We believe these cross-default

provisions significantly reduce the risk that we will be required to

make payments under these leases and, historically, we have not

been required to make such payments in significant amounts. See

Note 24 for a further discussion of our lease guarantees.

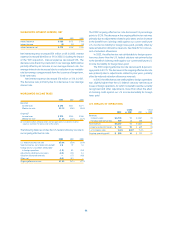

Self-Insured Property and Casualty Losses

We record our best estimate of the remaining cost to settle incurred

self-insured property and casualty claims. The estimate is based

on the results of an independent actuarial study and considers

historical claim frequency and severity as well as changes in fac-

tors such as our business environment, benefit levels, medical

costs and the regulatory environment that could impact overall

self-insurance costs. Additionally, a risk margin to cover unfore-

seen events that may occur over the several years it takes for

claims to settle is included in our reserve, increasing our confi-

dence level that the recorded reserve is adequate.

See Note 24 for a further discussion of our insurance programs.

Income Tax Valuation Allowances

and Tax Reserves

At December 28, 2002, we have recorded a valuation allowance

of $137 million primarily to reduce our net operating loss and tax

credit carryforwards of $176 million to an amount that will more

likely than not be realized. These net operating loss and tax credit

carryforwards exist in many state and foreign jurisdictions and

have varying carryforward periods and restrictions on usage. The

estimation of future taxable income in these state and foreign juris-

dictions and our resulting ability to utilize net operating loss and

tax credit carryforwards can significantly change based on future

events, including our determinations as to the feasibility of cer-

tain tax planning strategies. Thus, recorded valuation allowances

may be subject to material future changes.

As a matter of course, we are regularly audited by federal,

state and foreign tax authorities. We provide reserves for poten-

tial exposures when we consider it probable that a taxing authority

may take a sustainable position on a matter contrary to our posi-

tion. We evaluate these reserves, including interest thereon, on a

quarterly basis to insure that they have been appropriately

adjusted for events that may impact our ultimate payment for

such exposures.

See Note 22 for a further discussion of our income taxes.

30.