Pizza Hut 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

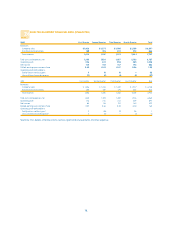

Fiscal Year

(in millions, except per share and unit amounts) 2002 2001 2000 1999 1998

Summary of Operations

Revenues

Company sales(a) $ 6,891 $ 6,138 $ 6,305 $ 7,099 $ 7,852

Franchise and license fees 866 815 788 723 627

Total 7, 757 6,953 7,093 7,822 8,479

Facility actions net (loss) gain(b) (32) (1) 176 381 275

Unusual items income (expense)(b) (c) 27 3 (204) (51) (15)

Operating profit 1,030 891 860 1,240 1,028

Interest expense, net 172 158 176 202 272

Income before income taxes 858 733 684 1,038 756

Net income 583 492 413 627 445

Basic earnings per common share(d) 1.97 1.68 1.41 2.05 1.46

Diluted earnings per common share(d) 1.88 1.62 1.39 1.96 1.42

Cash Flow Data

Provided by operating activities $ 1,088 $ 832 $ 491 $ 565 $ 674

Capital spending, excluding acquisitions 760 636 572 470 460

Proceeds from refranchising of restaurants 81 111 381 916 784

Balance Sheet

Total assets $ 5,400 $ 4,425 $ 4,149 $ 3,961 $ 4,531

Operating working capital deficit(e) (801) (663) (634) (832) (960)

Long-term debt 2,299 1,552 2,397 2,391 3,436

Total debt 2,445 2,248 2,487 2,508 3,532

Other Data

System sales(f)

U.S. $ 15,839 $ 14,596 $14,514 $ 14,516 $ 14,013

International 8,380 7,732 7,645 7,246 6,607

Total 24,219 22,328 22,159 21,762 20,620

Number of stores at year end

Company 7,526 6,435 6,123 6,981 8,397

Unconsolidated Affiliates 2,148 2,000 1,844 1,178 1,120

Franchisees 20,724 19,263 19,287 18,414 16,650

Licensees 2,526 2,791 3,163 3,409 3,596

System 32,924 30,489 30,417 29,982 29,763

U.S. Company same store sales growth

KFC

—

3% (3)% 2% 3%

Pizza Hut

——

1 % 9% 6%

Taco Bell 7%

—

(5)%

—

3%

Blended(g) 2% 1% (2)% 4% 4%

Shares outstanding at year end (in millions)(d) 294 293 293 302 306

Market price per share at year end(d) $ 24.12 $ 24.62 $ 16.50 $ 18.97 $ 23.82

Fiscal years 2002, 2001, 1999 and 1998 include 52 weeks. Since May 7, 2002, fiscal year 2002, includes Long John Silver’s (“LJS”) and A&W All-American Food Restaurants (“A&W”), which

were added when we acquired Yorkshire Global Restaurants, Inc. Fiscal year 2002 includes the impact of the adoption of Statement of Financial Accounting Standards No. 142, “Goodwill

and Other Intangible Assets” (“SFAS 142”). See Note 12 to the Consolidated Financial Statements for further discussion of SFAS 142. Fiscal year 2000 includes 53 weeks. The selected financial

data should be read in conjunction with the Consolidated Financial Statements and the Notes thereto.

(a) The decline in Company sales through 2001 was largely the result of our refranchising initiatives.

(b) In the fourth quarter of 1997, we recorded a charge to facility actions net (loss) gain and unusual items income (expense) which included (a) costs of closing stores; (b) reductions to fair

market value, less cost to sell, of the carrying amounts of certain restaurants that we intended to refranchise; (c) impairments of certain restaurants intended to be used in the business;

(d) impairments of certain unconsolidated affiliates to be retained; and (e) costs of related personnel reductions. In 1999, we recorded favorable adjustments of $13 million in facility

actions net gain and $11 million in unusual items related to the 1997 fourth quarter charge. In 1998, we recorded favorable adjustments of $54 million in facility actions net gain and $11

million in unusual items related to the 1997 fourth quarter charge.

(c) See Note 7 to the Consolidated Financial Statements for a description of unusual items income (expense) in 2002, 2001 and 2000.

(d) Per share and share amounts have been adjusted to reflect the two-for-one stock split distributed on June 17, 2002.

(e) Operating working capital deficit is current assets excluding cash and cash equivalents and short-term investments, less current liabilities excluding short-term borrowings.

(f) System sales represents the combined sales of Company, unconsolidated affiliates, franchise and license restaurants.

(g) U.S. same-store sales growth for LJS and A&W are not included.

SELECTED FINANCIAL DATA

74.