Pizza Hut 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

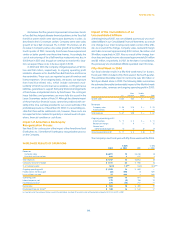

INTERNATIONAL SYSTEM SALES

% B(W) % B(W)

2002 vs. 2001 2001 vs. 2000

System sales $ 8,380 8 $ 7,732 1

System sales increased approximately $648 million or 8% in 2002,

after a 1% unfavorable impact from foreign currency translation.

Excluding the impact of foreign currency translation and the favor-

able impact of the YGR acquisition, system sales increased 8%.

The increase resulted from new unit development and same store

sales growth, partially offset by store closures.

System sales increased approximately $87 million or 1% in

2001, after a 7% unfavorable impact from foreign currency trans-

lation. Excluding the unfavorable impact of foreign currency

translation and lapping the fifty-third week in 2000, system sales

increased 9%. The increase was driven by new unit development

and same store sales growth, partially offset by store closures.

INTERNATIONAL REVENUES

Company sales increased $262 million or 14% in 2002, after a 1%

favorable impact from foreign currency translation. The increase

was driven by new unit development, partially offset by refran-

chising and store closures. The unfavorable impact of refranchising

primarily resulted from the sale of the Singapore business in the

third quarter of 2002.

Company sales increased $79 million or 5% in 2001, after a

5% unfavorable impact from foreign currency translation. Exclud-

ing the unfavorable impact of foreign currency translation and

lapping the fifty-third week in 2000, Company sales increased

11%. The increase was driven by new unit development and acqui-

sitions of restaurants from franchisees. The increase was partially

offset by the contribution of Company stores to new unconsoli-

dated affiliates.

Franchise and license fees increased $22 million or 8% in

2002, after a 1% unfavorable impact from foreign currency trans-

lation. Excluding the impact of foreign currency translation and the

favorable impact of the YGR acquisition, franchise and license fees

increased 8%. The increase was driven by new unit development

and same store sales growth, partially offset by store closures.

Franchise and license fees increased $16 million or 6% in

2001, after a 6% unfavorable impact from foreign currency trans-

lation. Excluding the unfavorable impact of foreign currency

translation and lapping the fifty-third week in 2000, franchise and

license fees increased 13%. The increase was driven by new unit

development, same store sales growth and the contribution of

Company stores to new unconsolidated affiliates. The increase

was partially offset by store closures.

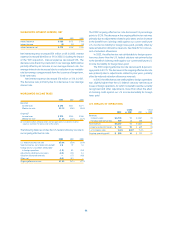

INTERNATIONAL COMPANY RESTAURANT MARGIN

2002 2001 2000

Company sales 100.0% 100.0% 100.0%

Food and paper 36.1 36.9 36.5

Payroll and employee benefits 18.7 19.1 19.5

Occupancy and other operating expenses 29.2 30.1 28.9

Company restaurant margin 16.0% 13.9% 15.1%

Restaurant margin as a percentage of sales increased approxi-

mately 210 basis points in 2002, including the favorable impact of

approximately 60 basis points from the adoption of SFAS 142. The

increase was primarily driven by the favorable impact of lower

restaurant operating costs and the elimination of lower average

margin units through store closures. Lower restaurant operating

costs primarily resulted from lower food and paper costs, partially

offset by higher labor costs.

Restaurant margin as a percentage of sales decreased

approximately 120 basis points in 2001. The decrease was prima-

rily attributable to higher restaurant operating costs and the

acquisition of below average margin stores from franchisees. The

decrease was partially offset by the favorable impact of same

store sales growth.

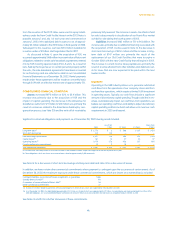

INTERNATIONAL ONGOING OPERATING PROFIT

Ongoing operating profit increased $71 million or 22% in 2002,

after a 1% unfavorable impact from foreign currency translation.

Excluding the impact of foreign currency translation and the favor-

able impact from the adoption of SFAS 142, ongoing operating profit

increased 17%. The increase was driven by new unit development

and the favorable impact of lower restaurant operating costs, pri-

marily lower cost of food and paper. The increase was partially

offset by higher G&A expenses, primarily compensation-related

costs.

Ongoing operating profit increased $9 million or 3% in 2001,

after a 7% unfavorable impact from foreign currency translation.

Excluding the unfavorable impact of foreign currency translation

and lapping the fifty-third week in 2000, ongoing operating profit

increased 12%. The increase was driven by new unit development

and same store sales growth, partially offset by higher restaurant

operating costs.

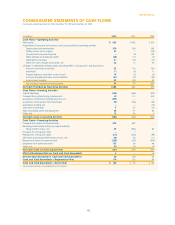

CONSOLIDATED CASH FLOWS

Net cash provided by operating activities was $1,088 mil-

lion compared to $832 million in 2001. Excluding the impact of the

AmeriServe bankruptcy reorganization process, cash provided by

operating activities was $1,043 million versus $704 million in 2001.

This increase was primarily driven by higher operating profit and

timing of tax receipts and payments.

39.

Yum! Brands Inc.