Pizza Hut 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

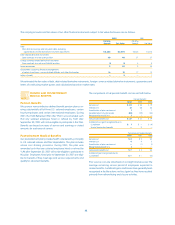

The EID Plan allows participants to defer receipt of a portion

of their annual salary and all or a portion of their incentive com-

pensation. As defined by the EID Plan, we credit the amounts

deferred with earnings based on the investment options selected

by the participants. These investment options are limited to cash

and phantom shares of our Common Stock. The EID Plan allows

participants to defer incentive compensation to purchase phan-

tom shares of our Common Stock at a 25% discount from the

average market price at the date of deferral (the “Discount Stock

Account”). Participants bear the risk of forfeiture of both the dis-

count and any amounts deferred to the Discount Stock Account if

they voluntarily separate from employment during the two year

vesting period. We expense the intrinsic value of the discount over

the vesting period. As investments in the phantom shares of our

Common Stock can only be settled in shares of our Common Stock,

we do not recognize compensation expense for the appreciation

or the depreciation, if any, of these investments. Deferrals into the

phantom shares of our Common Stock are credited to the

Common Stock Account.

Our cash obligations under the EID Plan as of the end of both

2002 and 2001 were $24 million. We recognized compensation

expense of $2 million in 2002, $4 million in 2001 and $6 million in

2000 for the EID Plan.

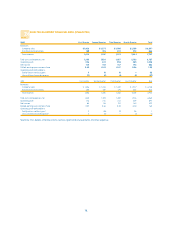

We sponsor a contributory plan to provide retirement bene-

fits under the provisions of Section 401(k) of the Internal Revenue

Code (the “401(k) Plan”) for eligible U.S. salaried and hourly employ-

ees. During 2002, participants were able to elect to contribute up

to 15% of eligible compensation on a pre-tax basis (the maximum

participant contribution increased from 15% to 25% effective

January 1, 2003). Participants may allocate their contributions to

one or any combination of 10 investment options within the 401(k)

Plan. Effective October 1, 2001, the 401(k) Plan was amended such

that the Company matches 100% of the participant’s contribution

up to 3% of eligible compensation and 50% of the participant’s

contribution on the next 2% of eligible compensation. Prior to this

amendment, we made a discretionary matching contribution

equal to a predetermined percentage of each participant’s contri-

bution to the YUM Common Stock Fund. We determined our

percentage match at the beginning of each year based on the

immediate prior year performance of our Concepts. All matching

contributions are made to the YUM Common Stock Fund. We rec-

ognized as compensation expense our total matching contribution

of $8 million in 2002, $5 million in 2001 and $4 million in 2000.

SHAREHOLDERS’ RIGHTS PLAN

In July 1998, our Board of Directors declared a dividend distribu-

tion of one right for each share of Common Stock outstanding as

of August 3, 1998 (the “Record Date”). As a result of the two-for-one

stock split distributed on June 17, 2002, each holder of Common

Stock is entitled to one right for every two shares of Common Stock

(one-half right per share). Each right initially entitles the registered

holder to purchase a unit consisting of one one-thousandth of a

share (a “Unit”) of Series A Junior Participating Preferred Stock, with-

out par value, at a purchase price of $130 per Unit, subject to

adjustment. The rights, which do not have voting rights, will

become exercisable for our Common Stock ten business days fol-

lowing a public announcement that a person or group has

acquired, or has commenced or intends to commence a tender

offer for, 15% or more, or 20% or more if such person or group

owned 10% or more on the adoption date of this plan, of our

Common Stock. In the event the rights become exercisable for

Common Stock, each right will entitle its holder (other than the

Acquiring Person as defined in the Agreement) to purchase, at the

right’s then-current exercise price, YUM Common Stock having a

value of twice the exercise price of the right. In the event the rights

become exercisable for Common Stock and thereafter we are

acquired in a merger or other business combination, each right

will entitle its holder to purchase, at the right’s then-current exer-

cise price, common stock of the acquiring company having a value

of twice the exercise price of the right.

We can redeem the rights in their entirety, prior to becoming

exercisable, at $0.01 per right under certain specified conditions.

The rights expire on July 21, 2008, unless we extend that date or

we have earlier redeemed or exchanged the rights as provided

in the Agreement.

This description of the rights is qualified in its entirety by ref-

erence to the Rights Agreement between YUM and BankBoston,

N.A., as Rights Agent, dated as of July 21, 1998 (including the

exhibits thereto).

NOTE

20

66.