Pizza Hut 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

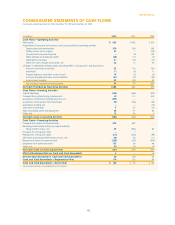

Liabilities assumed included approximately $48 million of

bank indebtedness that was paid off prior to the end of the

second quarter of 2002 and approximately $11 million in capital

lease obligations. We also assumed approximately $168 million

in present value of future rent obligations related to existing

sale-leaseback agreements entered into by YGR involving approx-

imately 350 LJS units. As a result of liens held by the buyer/lessor

on certain personal property within the units, the sale-leaseback

agreements have been accounted for as financings and reflected

as debt.

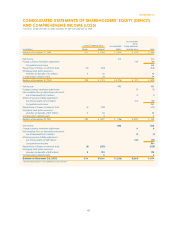

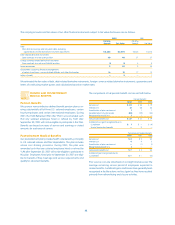

Additionally, as of the date of acquisition we recorded

approximately $49 million of reserves (“exit liabilities”) related to

our plans to consolidate certain support functions, and exit certain

markets through store refranchisings and closures, as presented

in the table below. The consolidation of certain support functions

included the termination of approximately 100 employees. Plans

associated with exiting certain markets through store refranchis-

ings and closures are expected to be finalized prior to May 7,

2003. Adjustments to the purchase price allocation related to the

finalization of these plans are not expected to be material. The

unpaid exit liabilities as of December 28, 2002 have been

reflected on our Consolidated Balance Sheet as accounts payable

and other current liabilities ($30 million) and other liabilities and

deferred credits ($10 million). Amounts recorded as other liabili-

ties and deferred credits are expected to result in payments

principally in 2004.

Lease and

Other

Contract

Severance Termi- Other

Benefits nations Costs Total

Total reserve as of

May 7, 2002 $ 13 $ 31 $ 5 $ 49

Amounts utilized in 2002 (8)

—

(1) (9)

Total reserve as of

December 28, 2002 $ 5 $ 31 $ 4 $ 40

Additionally, we expensed approximately $6 million of integration

costs related to the acquisition in 2002. These costs were recorded

as unusual items expense. See Note 7 for further discussion

regarding unusual items (income) expense.

The results of operations for YGR have been included in our

Consolidated Financial Statements since the date of acquisition. If

the acquisition had been completed as of the beginning of the

years ended December 28, 2002 and December 29, 2001, pro

forma Company sales, and franchise and license fees would have

been as follows:

2002 2001

Company sales $ 7,139 $ 6,683

Franchise and license fees 877 839

The impact of the acquisition, including interest expense on debt

incurred to finance the acquisition, on net income and diluted earn-

ings per share would not have been significant in 2002 and 2001.

The pro forma information is not necessarily indicative of the

results of operations had the acquisition actually occurred at the

beginning of each of these periods nor is it necessarily indicative

of future results.

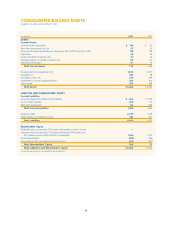

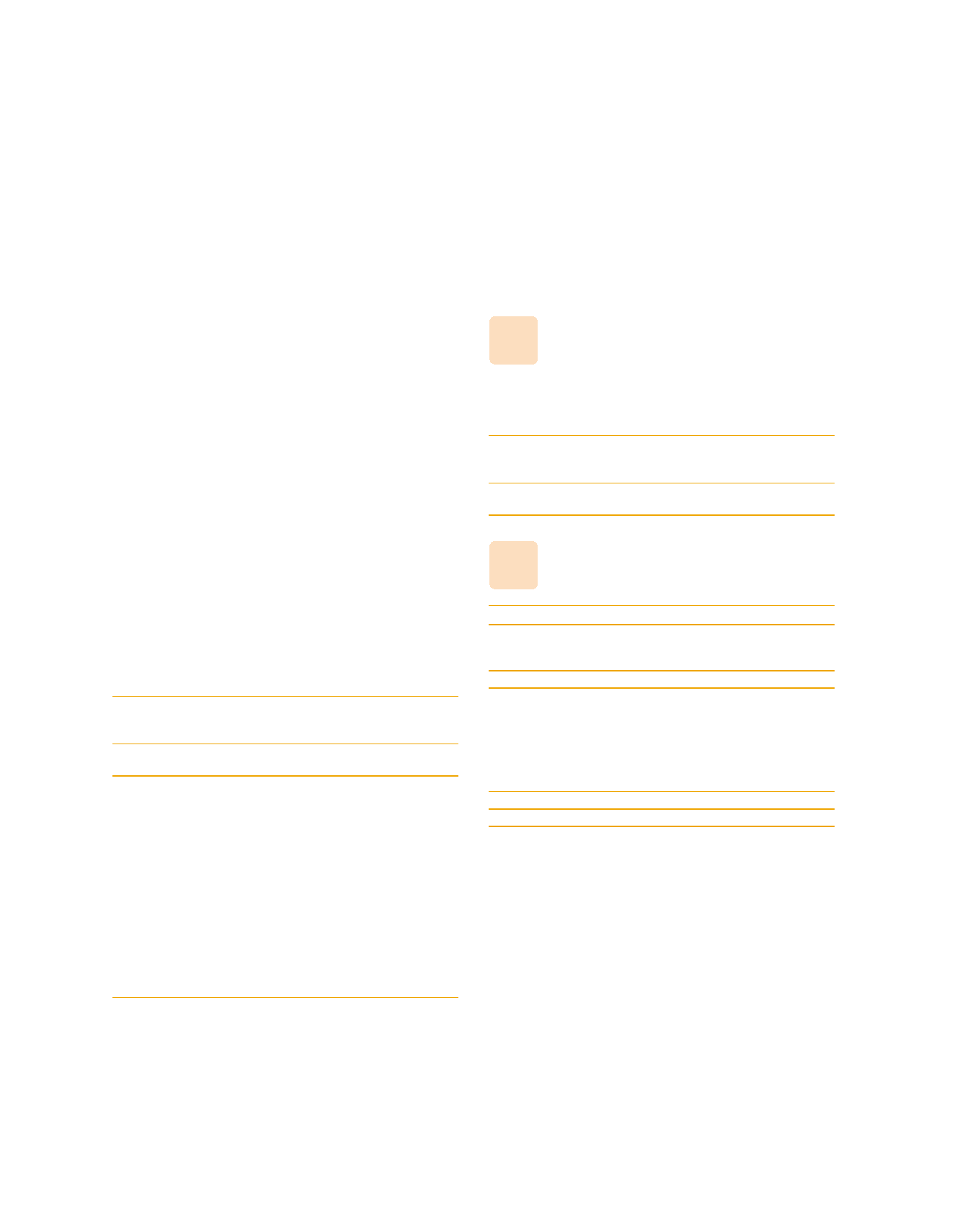

ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

Accumulated other comprehensive income (loss), net of tax,

includes:

2002 2001

Foreign currency translation adjustment $ (176) $ (182)

Minimum pension liability adjustment (71) (24)

Unrealized losses on derivative instruments (2) (1)

Total accumulated other comprehensive

income (loss) $ (249) $ (207)

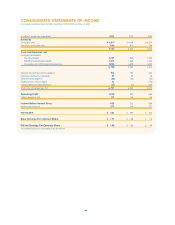

EARNINGS PER COMMON SHARE (“EPS”)

2002 2001 2000

Net income $583 $ 492 $ 413

Basic EPS:

Weighted-average

common shares outstanding 296 293 294

Basic EPS $1.97 $ 1.68 $ 1.41

Diluted EPS:

Weighted-average

common shares outstanding 296 293 294

Shares assumed issued on exercise

of dilutive share equivalents 56 55 37

Shares assumed purchased with

proceeds of dilutive share equivalents (42) (44) (33)

Shares applicable to diluted earnings 310 304 298

Diluted EPS $ 1.88 $ 1.62 $ 1.39

Unexercised employee stock options to purchase approximately

1.4 million, 5.1 million and 21.7 million shares of our Common Stock

for the years ended December 28, 2002, December 29, 2001

and December 30, 2000, respectively, were not included in the

computation of diluted EPS because their exercise prices were

greater than the average market price of our Common Stock dur-

ing the year.

NOTE

6

NOTE

5

54.