Pizza Hut 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As noted above, on December 30, 2001, we reclassified $241 mil-

lion of reacquired franchise rights to goodwill, net of related

deferred tax liabilities of $53 million.

As a result of adopting SFAS 142, we ceased amortization

of goodwill and indefinite-lived intangible assets beginning

December 30, 2001. Amortization expense for definite-lived intan-

gible assets was $6 million in 2002. Amortization expense for

goodwill and all intangible assets was $37 million and $38 million

in 2001 and 2000, respectively. Amortization expense for definite-

lived intangible assets will approximate $5 million for each of the

next five years.

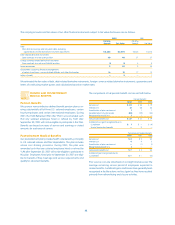

The following table provides a reconciliation of reported net

income to adjusted net income as though SFAS 142 had been

effective for the years ended 2001 and 2000:

2001

Amount Basic EPS Diluted EPS

Reported net income $ 492 $ 1.68 $ 1.62

Add back amortization expense (net of tax):

Goodwill 25 0.09 0.09

Brand/Trademarks 1

——

Adjusted net income $ 518 $ 1.77 $ 1.71

2000

Amount Basic EPS Diluted EPS

Reported net income $ 413 $ 1.41 $ 1.39

Add back amortization expense (net of tax):

Goodwill 23 0.08 0.08

Brand/Trademarks 1

——

Adjusted net income $ 437 $ 1.49 $ 1.47

ACCOUNTS PAYABLE AND OTHER

CURRENT LIABILITIES

2002 2001

Accounts payable $ 417 $ 353

Accrued compensation and benefits 258 210

Other current liabilities 491 469

$1,166 $ 1,032

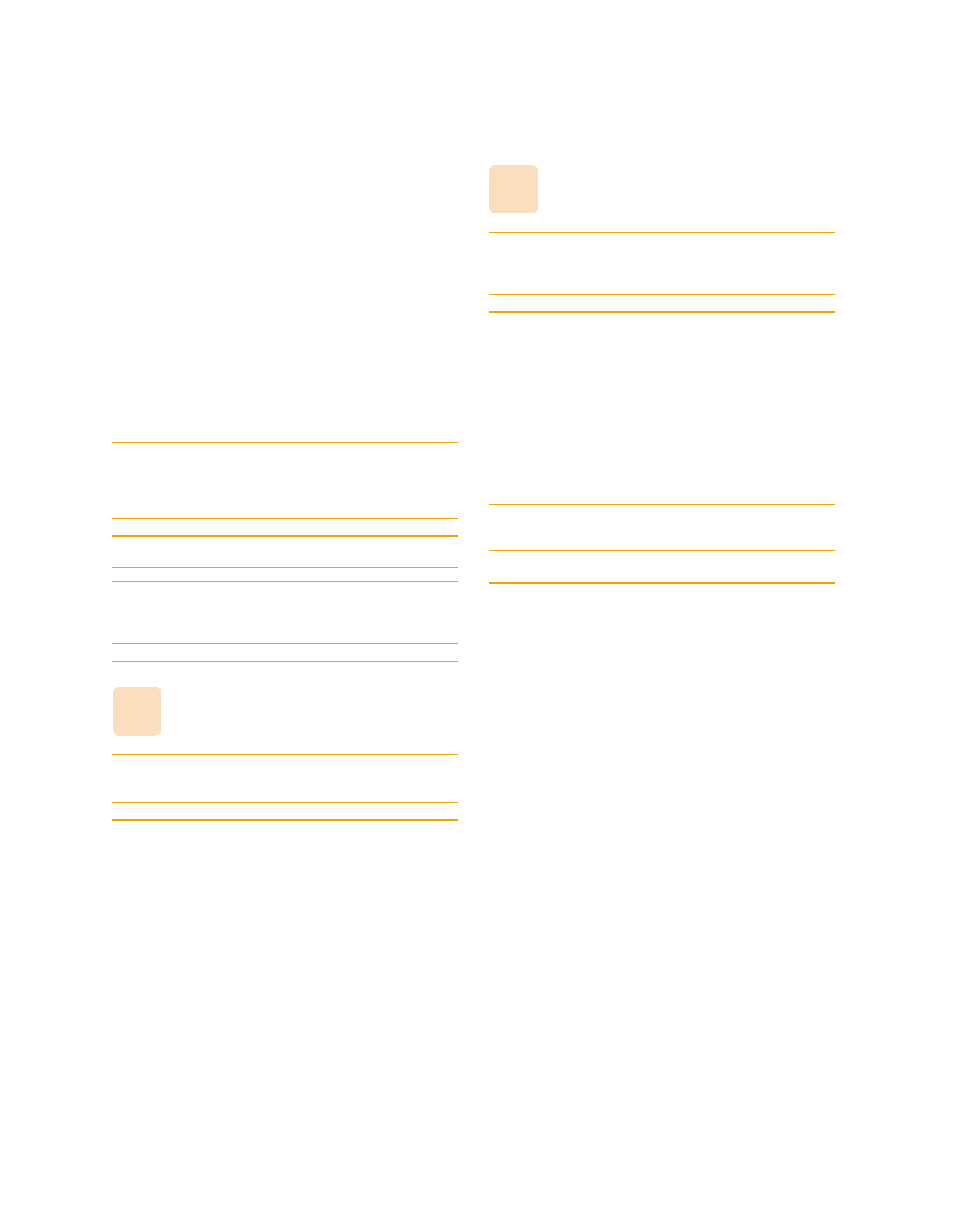

NOTE

13

SHORT-TERM BORROWINGS AND

LONG-TERM DEBT

2002 2001

Short-term Borrowings

Current maturities of long-term debt $12 $ 545

International lines of credit 115 138

Other 19 13

$ 146 $ 696

Long-term Debt

Senior, unsecured Term Loan Facility $

—

$ 442

Senior, unsecured Revolving Credit Facility,

expires June 2005 153 94

Senior, Unsecured Notes, due May 2005 351 351

Senior, Unsecured Notes, due April 2006 200 198

Senior, Unsecured Notes, due May 2008 251 251

Senior, Unsecured Notes, due April 2011 645 644

Senior, Unsecured Notes, due July 2012 398

—

Capital lease obligations (See Note 15) 99 79

Other, due through 2010 (6% - 12%) 170 4

2,267 2,063

Less current maturities of long-term debt (12) (545)

Long-term debt excluding SFAS 133 adjustment 2,255 1,518

Derivative instrument adjustment

under SFAS 133 (See Note 16) 44 34

Long-term debt including

SFAS 133 adjustment $ 2,299 $ 1,552

On June 25, 2002, we closed on a new $1.4 billion senior unse-

cured Revolving Credit Facility (the “New Credit Facility”). The New

Credit Facility replaced the existing bank credit agreement which

was comprised of a senior unsecured Term Loan Facility and a

$1.75 billion senior unsecured Revolving Credit Facility (collectively

referred to as the “Old Credit Facilities”) that were scheduled to

mature on October 2, 2002. Amounts outstanding under the Old

Credit Facilities were classified as short-term borrowings in the

Consolidated Balance Sheet at December 29, 2001. On December

27, 2002, we voluntarily reduced our maximum borrowing limit

under the New Credit Facility to $1.2 billion. The New Credit Facility

matures on June 25, 2005. We used the initial borrowings under

the New Credit Facility to repay the indebtedness under the Old

Credit Facilities.

The New Credit Facility is unconditionally guaranteed by our

principal domestic subsidiaries and contains other terms and

provisions (including representations, warranties, covenants,

NOTE

14

58.