Pizza Hut 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

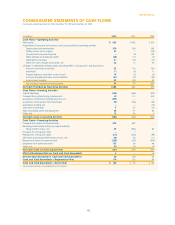

ITEMS AFFECTING COMPARABILITY OF NET

INCOME

Facility Actions Net Loss (Gain)

Facility actions net loss (gain) consists of the following components

as described in Note 2:

•Refranchising net (gains) losses;

•Store closure costs;

•Impairment of long-lived assets for stores we intend to continue

to use in the business and stores we intend to close;

•Impairment of goodwill subsequent to the adoption of SFAS 142.

2002 2001 2000

U.S.

Refranchising net (gains) losses(a) (b) $ (4) $ (44) $ (202)

Store closure costs 813 6

Store impairment charges 15 14 8

SFAS 142 goodwill impairment charges

———

Facility actions net loss (gain) 19 (17) (188)

International

Refranchising net (gains) losses(a) (b) (15) 52

Store closure costs 744

Store impairment charges 16 96

SFAS 142 goodwill impairment charges(c) 5

——

Facility actions net loss (gain) 13 18 12

Worldwide

Refranchising net (gains) losses(a) (b) (19) (39) (200)

Store closure costs 15 17 10

Store impairment charges(d) 31 23 14

SFAS 142 goodwill impairment charges(c) 5

——

Facility actions net loss (gain) $32 $ 1 $ (176)

(a) Includes initial franchise fees in the U.S. of $1 million in 2002, $4 million in 2001, and

$17 million in 2000 and in International of $5 million in 2002 and $3 million in both

2001 and 2000. See Note 9.

(b) In 2001, U.S. refranchising net (gains) included $12 million of previously deferred

refranchising gains and International refranchising net (gains) losses included a

charge of $11 million to mark to market the net assets of the Singapore business,

which was held for sale. The Singapore business was subsequently sold during the

third quarter of 2002.

(c) Represents a $5 million charge related to the impairment of the goodwill of our Pizza

Hut reporting unit.

(d) Store impairment charges for 2002, 2001 and 2000 were recorded against the follow-

ing asset categories:

2002 2001 2000

Property, plant and equipment $31 $23 $12

Goodwill

——

2

Total impairment $31 $23 $14

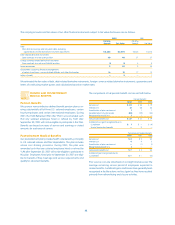

NOTE 7

55.

Yum! Brands Inc.

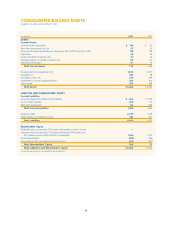

The following table summarizes the 2002 and 2001 activity related

to reserves for remaining lease obligations for stores we intend

to close:

Estimate/

Beginning Amounts New Decision Ending

Balance Used Decisions Changes Other Balance

2001 Activity $ 50 (18) 6 1 9 $ 48

2002 Activity $ 48 (17) 16 3 1 $ 51

The following table summarizes the carrying values of the major

classes of assets held for sale at December 28, 2002 and

December 29, 2001. The carrying values of liabilities held for sale

at December 28, 2002 and December 29, 2001 were not sig-

nificant. U.S. amounts primarily represent land on which we

previously operated restaurants and are net of impairment

charges of $4 million and $5 million, respectively. The carrying val-

ues in International at December 28, 2002 relate primarily to our

Puerto Rico business. The carrying values in International at

December 29, 2001 relate primarily to our Singapore business, net

of impairment charges of $11 million. We subsequently sold the

Singapore business during the third quarter of 2002 at a price

approximately equal to its carrying value, net of impairment.

December 28, 2002

Inter-

U.S. national Worldwide

Property, plant and equipment, net $7 $ 89 $96

Goodwill

—

13 13

Other assets

—

22

Assets classified as held for sale $ 7 $ 104 $ 111

December 29, 2001

Inter-

U.S. national Worldwide

Property, plant and equipment, net $ 8 $ 32 $ 40

Other assets

—

44

Assets classified as held for sale $ 8 $ 36 $ 44

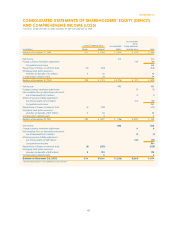

The following table summarizes Company sales and restaurant

profit related to stores held for sale at December 28, 2002 or

disposed of through refranchising or closure during 2002, 2001

and 2000. As discussed in Note 2, the operations of such stores

classified as held for sale as of December 28, 2002 or disposed

of during 2002 which meet the conditions of SFAS 144 for report-

ing as discontinued operations were not material. Restaurant

profit represents Company sales less the cost of food and paper,