Pizza Hut 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6.

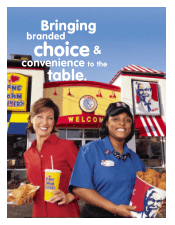

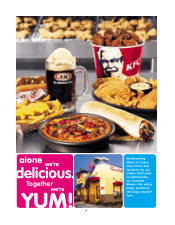

However, historically, each of our brands has focused on one food category. Pizza Hut has pizza in its name. KFC

means Kentucky Fried Chicken. Taco Bell stands for Mexican-style food. And every time we’ve tried to broaden our

appeal by moving into new categories, it fails because our brands stand for just one thing. No one’s looking for a

KFC or Taco Bell hamburger. But at the same time, consumers do want more choice and convenience. And, what

we’ve proven is that consumers love the idea of getting variety with branded authority

—

accessing two brands in

the same restaurant

—

multibranding. Our research tells us that customers prefer multibranded restaurants 6:1 over

stand-alone brands, and we are listening and responding to the voice of our customer.

We started with combinations of KFC-Taco Bell, and Taco Bell-Pizza Hut. We learned that we were able to add

$100,000 to $400,000 per unit in average sales, dramatically improving our already strong unit economics. We then

began testing multibrand combinations of KFC and Taco Bell with Long John Silver’s, the country’s leading seafood

restaurant, and A&W All-American Food, which offers a signature frosty mug Root Beer Float and pure-beef ham-

burgers and hot dogs. Based on proven and encouraging multibrand test results, we acquired Long John Silver’s

and A&W this year. With this acquisition, we have more than tripled our multibranding opportunities in the U.S.

Because of the significant sales increases we are generating with multibranding, we are remodeling much of our

existing U.S. asset base by adding a second brand. This will help us dramatically change our U.S. business over the

next five years. We are also opening high return new restaurants in trade areas that used to be too expensive or

did not have enough population density to allow us to go to market with one brand. With multibranding, we believe

we now can realistically take both KFC and Taco Bell to at least Burger King levels of U.S. distribution. Burger King

has about 8,000 units in the U.S., with $1+ million average unit volumes. In comparison, Taco Bell and KFC each

have over 5,000 restaurants. As we expand Taco Bell and KFC by adding Long John Silver’s and A&W under the

same roof, we expect to take volumes to an average of at least a $1.1 million per restaurant. As we do, we plan to

make Long John Silver’s and A&W national brands and dramatically increase their marketing clout.

Our biggest remaining concept challenge is to develop a multibranding combination for Pizza Hut. We have formed

a licensing agreement with Pasta Bravo, a California fast casual chain with an outstanding line of pastas at great

value. We will begin testing Pasta Bravo with Pizza Hut’s dine-in restaurants in 2003. Next year I hope to report

very good results on this initiative. We are confident multibranding will be every bit as successful for Pizza Hut as

it has been for our other brands.

You might be thinking, if multibranding is such a big idea, why aren’t you moving faster? The quick answer is that

we want to do this in the best possible way. The biggest executional issue we face is building the operating capa-

bility to successfully run these restaurants. As you would expect, these restaurants are more difficult to run because

of the added complexity of offering two menus. To tackle the executional challenge, we have dedicated a team of

“I believe in my team. And they

know that everyone in the

restaurant is critical to making

each customer who comes in

our store feel like they are our

#1 priority.”

Allison Hale, RGM

Taco Bell, Southern Multifoods Inc.

As we expand Taco Bell and KFC

by adding Long John Silver’s and

A&W under the same roof, we

expect to take multibrand volumes

to an average of at least $1.1 million

per restaurant.