Pizza Hut 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

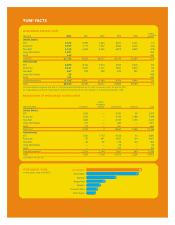

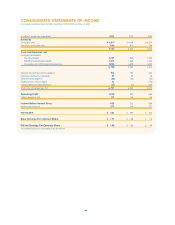

WORLDWIDE COMPANY RESTAURANT MARGIN

2002 2001 2000

Company sales 100.0% 100.0% 100.0%

Food and paper 30.6 31.1 30.8

Payroll and employee benefits 27.2 27.1 27.7

Occupancy and other operating expenses 26.2 27.0 26.4

Company restaurant margin 16.0% 14.8% 15.1%

Restaurant margin as a percentage of sales increased approxi-

mately 120 basis points in 2002. The increase included the

favorable impact of approximately 50 basis points from the adop-

tion of SFAS 142, partially offset by the unfavorable impact of

approximately 15 basis points from the YGR acquisition. U.S.

restaurant margin increased approximately 80 basis points and

International restaurant margin increased approximately 210

basis points.

Restaurant margin as a percentage of sales decreased

approximately 30 basis points in 2001. U.S. restaurant margin was

flat and International restaurant margin declined approximately

120 basis points.

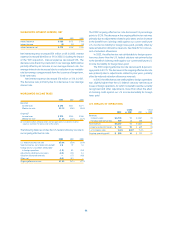

WORLDWIDE GENERAL AND ADMINISTRATIVE

EXPENSES

G&A expenses increased $117 million or 15% in 2002. Excluding the

unfavorable impact of the YGR acquisition, G&A expenses increased

10%. The increase was primarily driven by higher compensation-

related costs and higher corporate and project spending.

G&A expenses decreased $34 million or 4% in 2001. Exclud-

ing the favorable impact of lapping the fifty-third week in 2000,

G&A expenses decreased 3%. The decrease was driven by lower

corporate and project spending, the formation of unconsolidated

affiliates and refranchising. The decrease was partially offset by

higher compensation-related costs.

WORLDWIDE FRANCHISE AND LICENSE EXPENSES

Franchise and license expenses decreased $10 million or 18% in

2002. The decrease was primarily attributable to lower allowances

for doubtful franchise and license fee receivables and the favor-

able impact of lapping support costs related to the financial

restructuring of certain Taco Bell franchisees in 2001. The decrease

was partially offset by higher marketing support costs in certain

international markets.

Franchise and license expenses increased $10 million or 20%

in 2001. The increase was primarily due to support costs related

to the financial restructuring of certain Taco Bell franchisees. The

increase was partially offset by lower allowances for doubtful fran-

chise and license fee receivables.

35.

Yum! Brands Inc.

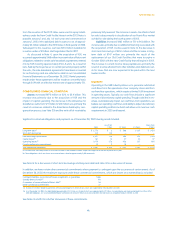

WORLDWIDE OTHER (INCOME) EXPENSE

Other (income) expense is comprised of equity (income) loss from

investments in unconsolidated affiliates and foreign exchange net

(gain) loss.

Other (income) expense increased $7 million or 28% in 2002.

Equity income increased $3 million or 12%. The impact from for-

eign currency translation was not significant on equity income. The

increase included a $4 million favorable impact from the adoption

of SFAS 142.

Other (income) expense decreased $2 million or 8% in 2001.

Equity income increased $1 million or 3%, after a 6% unfavorable

impact from foreign currency translation.

WORLDWIDE FACILITY ACTIONS NET LOSS (GAIN)

We recorded facility actions net loss of $32 million in 2002 and

$1 million in 2001 and facility actions net gain of $176 million in

2000. See the Store Portfolio Strategy section for more detail of our

refranchising and closure activities and Note 7 for a summary of

the components of facility actions net loss (gain) by reportable

operating segment.

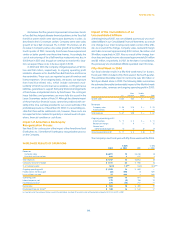

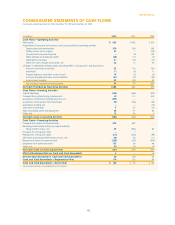

WORLDWIDE ONGOING OPERATING PROFIT

% B(W) % B(W)

2002 vs. 2001 2001 vs. 2000

United States $ 825 14 $ 722 (3)

International 389 22 318 3

Unallocated and

corporate expenses (178) (20) (148) 9

Unallocated other

income (expense) (1) 59 (3) NM

Ongoing operating profit $ 1,035 16 $ 889

—

The changes in U.S. and International ongoing operating profit for

2002 and 2001 are discussed in the respective sections.

Unallocated and corporate expenses increased $30 million

or 20% in 2002. The increase was primarily driven by higher com-

pensation-related costs and higher corporate and project spending.

Unallocated and corporate expenses decreased $15 million

or 9% in 2001. Excluding the favorable impact of lapping the fifty-

third week in 2000, G&A decreased 8%. The decline was primarily

due to lower corporate and project spending partially offset by

higher compensation-related costs.