Pizza Hut 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32.

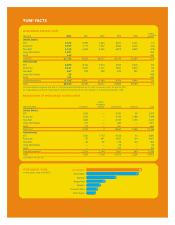

The following table summarizes Company store closure

activities:

2002 2001 2000

Number of units closed 224 270 208

Store closure costs $15 $17 $10

Impairment charges for stores

to be closed $9 $5 $6

The impact on ongoing operating profit arising from our refran-

chising and store closure initiatives as well as the contribution of

Company stores to new unconsolidated affiliates is the net of (a)

the estimated reduction in Company sales, restaurant profit and

G&A expenses; (b) the estimated increase in franchise fees from

the stores refranchised; and (c) the estimated change in equity

income (loss). The amounts presented below reflect the estimated

impact from stores that were operated by us for all or some por-

tion of the respective previous year and were no longer operated

by us as of the last day of the respective year.

The following table summarizes the estimated impact on rev-

enue of refranchising, Company store closures and, in 2001, the

contribution of Company stores to unconsolidated affiliates:

2002

Inter-

U.S. national Worldwide

Decreased sales $ (214) $ (90) $ (304)

Increased franchise fees 448

Decrease in total revenues $ (210) $ (86) $ (296)

2001

Inter-

U.S. national Worldwide

Decreased sales $ (483) $ (243) $ (726)

Increased franchise fees 21 13 34

Decrease in total revenues $ (462) $ (230) $ (692)

The following table summarizes the estimated impact on ongoing

operating profit of refranchising, Company store closures and,

in 2001, the contribution of Company stores to unconsolidated

affiliates:

2002

Inter-

U.S. national Worldwide

Decreased restaurant margin $ (23) $ (5) $ (28)

Increased franchise fees 448

Decreased G&A 123

(Decrease) increase in

ongoing operating profit $ (18) $ 1 $ (17)

2001

Inter-

U.S. national Worldwide

Decreased restaurant margin $ (67) $ (25) $ (92)

Increased franchise fees 21 13 34

Decreased G&A 51318

Decreased equity income

—

(5) (5)

Decrease in ongoing operating profit $ (41) $ (4) $ (45)

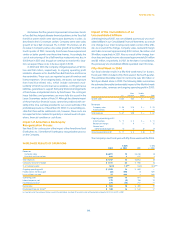

Franchisee Financial Condition

Like others in the QSR industry, from time to time, some of our fran-

chise operators experience financial difficulties with respect to their

franchise operations.

Depending upon the facts and circumstances of each situa-

tion, and in the absence of an improvement in the franchisee’s

business trends, there are a number of potential resolutions of

these financial issues. These include a sale of some or all of the

operator’s restaurants to us or a third party, a restructuring of the

operator’s business and/or finances, or, in the more unusual

cases, bankruptcy of the operator. It is our practice to proactively

work with financially troubled franchise operators in an attempt to

positively resolve their issues.

Since 2000, certain of our franchise operators, principally in

the Taco Bell system, have experienced varying degrees of finan-

cial problems. Through December 28, 2002, restructurings have

been completed for approximately 1,778 Taco Bell franchise restau-

rants. In connection with these restructurings, Taco Bell has

acquired 147 restaurants for approximately $76 million. In addition

to these acquisitions, Taco Bell has purchased land, buildings

and/or equipment related to 52 restaurants from franchisees for

approximately $28 million and simultaneously leased it back to

these franchisees under long-term leases. As part of the restruc-

turings, Taco Bell committed to fund approximately $45 million of

future franchise capital expenditures, principally through leasing

arrangements, approximately $26 million of which has been

funded through December 28, 2002. We substantially completed

the Taco Bell franchisee restructurings in 2002 and expect to final-

ize any remaining restructurings in the first quarter of 2003.

In the fourth quarter of 2000, Taco Bell also established a

$15 million loan program to assist certain franchisees. All fundings

had been advanced by the end of the first quarter of 2001. A

remaining net balance of $7 million at December 28, 2002 for

these notes receivable is included primarily in other assets.