Pizza Hut 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OTHER SIGNIFICANT KNOWN EVENTS, TRENDS OR

UNCERTAINTIES EXPECTED TO IMPACT 2003

OPERATING PROFIT COMPARISONS WITH 2002

New Accounting Pronouncements

See Note 2.

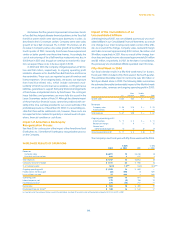

Pension Plan Funded Status

Certain of our employees are covered under noncontributory

defined benefit pension plans. The most significant of these plans

was amended in 2001 such that employees hired after September

30, 2001 are no longer eligible to participate. As of our September

30, 2002 measurement date, these plans had a projected bene-

fit obligation (“PBO”) of $501 million, an accumulated benefit

obligation (“ABO”) of $448 million and a fair value of plan assets of

$251 million. Subsequent to the measurement date but prior to

December 28, 2002, we made an additional $25 million contri-

bution to the plans which is not included in this fair value of plan

assets. As a result of the $250 million underfunded status of the

plans relative to the PBO at September 30, 2002, we have

recorded a $71 million charge to shareholders’ equity (net of tax of

$43 million) as of December 28, 2002.

The PBO and ABO reflect the actuarial present value of all

benefits earned to date by employees. The PBO incorporates

assumptions as to future compensation levels while the ABO

reflects only current compensation levels. Due to the relatively long

time frame over which benefits earned to date are expected to be

paid, our PBO and ABO are highly sensitive to changes in discount

rates. We measured our PBO and ABO using a discount rate of

6.85% at September 30, 2002. A 50 basis point increase in this

discount rate would have decreased our PBO by approximately

$49 million at September 30, 2002. Conversely, a 50 basis point

decrease in this discount rate would have increased our PBO by

approximately $56 million at September 30, 2002.

Due to recent stock market declines, our pension plan assets

have experienced losses in value in 2002 and 2001 totaling

approximately $75 million. We changed our expected long-term

rate of return on plan assets from 10% to 8.5% for the determina-

tion of our 2002 expense. We believe that this assumption is

appropriate given the composition of our plan assets and histor-

ical market returns thereon. This change resulted in the recognition

of approximately $5 million in incremental expense in compari-

son to 2001. We will continue to use the 8.5% expected rate of

return on plan assets assumption for the determination of pension

expense in 2003. Given no change to the market-related value of

our plan assets as of September 30, 2002, a one percentage point

increase or decrease in our expected rate of return on plan assets

assumption would decrease or increase, respectively, our pension

plan expense by approximately $3 million.

The losses our plan assets have experienced, along with the

decrease in discount rates, have largely contributed to the unrec-

ognized actuarial loss of $169 million in our plans as of September

30, 2002. For purposes of determining 2002 expense our funded

status was such that we recognized $1 million of unrecognized

actuarial loss in 2002. We will recognize approximately $7 million

of unrecognized actuarial loss in 2003. Given no change to the

assumptions at our September 30, 2002 measurement date, actu-

arial loss recognition will increase gradually over the next few

years, however, we do not believe the increase will materially

impact our results of operations.

In total, we expect pension expense to increase approxi-

mately $14 million to $41 million in 2003. We have incorporated

this incremental expense into our operating plans and outlook.

The increase is driven by an increase in interest cost because of

the higher PBO and the recognition of actuarial losses as dis-

cussed in the preceding paragraph. Service cost will also increase

as a result of the lower discount rate, though as previously men-

tioned the plans are closed to new participants. A 50 basis point

change in our discount rate assumption of 6.85% at September

30, 2002 would impact our pension expense by approximately

$11 million.

We do not believe that the underfunded status of the pension

plans will materially affect our financial position or cash flows in

2003 or future years. Given current funding levels and discount

rates we would anticipate making contributions to fully fund the

pension plans over the course of the next five years. We believe

our cash flows from operating activities of approximately $1 billion

per year are sufficient to allow us to make necessary contributions

to the plans, and anticipated fundings have been incorporated

into our cash flow projections. We have included known and

expected increases in our pension expense as well as future

expected plan contributions in our operating plans and outlook.

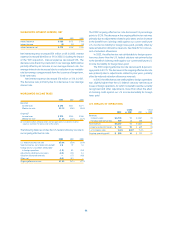

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

The Company is exposed to financial market risks associated with

interest rates, foreign currency exchange rates and commodity

prices. In the normal course of business and in accordance with

our policies, we manage these risks through a variety of strate-

gies, which may include the use of derivative financial and

commodity instruments to hedge our underlying exposures. Our

policies prohibit the use of derivative instruments for trading pur-

poses, and we have procedures in place to monitor and control

their use.

Interest Rate Risk

We have a significant market risk exposure to changes in interest

rates, principally in the United States. We attempt to minimize this

risk and lower our overall borrowing costs through the utilization

of derivative financial instruments, primarily interest rate swaps.

42.