Pizza Hut 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

it fails because we stand for just one thing.

Let’s face it, no one is waiting with bated breath for a

Taco Bell burger or Pizza Hut breakfast. But consumers

do want more choice, and what we’ve proven is that

consumers love the idea of accessing two brands in the

same restaurant — multibranding.

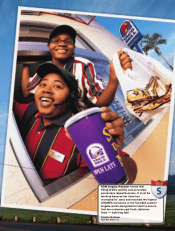

Combinations like KFC-Taco Bell and Taco Bell-

Pizza Hut enable us to add $100,000 to $400,000 per

unit in annual sales — driving a quantum improvement

in unit economics. Right now 5% of our assets, over

1,500 worldwide restaurants, are multibranded, gener-

ating nearly $1.5 billion in annual system sales.

Given these outstanding results, in addition to

Tricon brands, our vision is to look for other multibrand

partners and create our own multibrand concepts.

Our goal is to ultimately offer two brands in the

overwhelming majority of our restaurant locations.

That’s why KFC has developed a new concept called

WingWorks, featuring a wide assortment of flavored

chicken wings. And that’s why we have secured

licensing agreements with A&W and Long John Silver’s

in 2000 and Backyard Burgers in 2001.

Because of the significant sales increases we are

generating with multibranding, we are remodeling our

existing asset base and achieving great returns. We

are also opening high-return new restaurants in trade

areas that used to be too expensive or did not have

enough population to allow us to go to

market with one brand.

We intend for multibranding to

unlock significant shareholder value for

years to come, providing a competitive

advantage that is truly changing the

shape of our company.

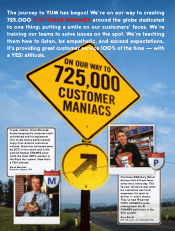

OUR VISION — TRICON

GLOBAL TO YUM! BRANDS It seems like just yesterday

when we began with three leading brands, or “icons”.

We named the company “Tricon” to reflect that. Now,

our business has evolved as we multibrand and explore

other branded partnerships to drive multibranding

leadership. To this end, on the day this Annual Report is

going to the printer, we have announced that we have

signed a definitive agreement to acquire Long John

Silver’s and A&W All-American Food Restaurants, which

are owned by Yorkshire Global Restaurants. This agree-

ment is subject to regulatory approval and other

customary closing conditions, and is expected to close by

the end of May.

Long John Silver’s, with 1,200 U.S. and 25 inter-

national restaurants, is the quick service restaurant

seafood leader. A&W, with 780 U.S. and 190 interna-

tional restaurants, is an all-American brand with a great

heritage. It offers pure-beef hamburgers and hot dogs,

along with its signature root beer float. Together, these

brands bring nearly $1.1 billion in system sales.

This acquisition is based on proven Long John

Silver’s and A&W multibrand test results with both KFC

and Taco Bell. Our customers love the

combinations and more choices. As a

result, we have achieved significant

increases in average unit volumes and profits.

We’re convinced this acquisition strengthens

our business in every

way possible, conser-

vatively more than

doubling the multi-

branding opportunities

we have in the U.S.

5

Tricon U.S. Average

Unit Volumes

vs. McDonald’s

KFC

Pizza Hut

Taco Bell

McDonald’s

$865

$724

$890

$1,647

We are the world’s largest multibrander

with over 1,500 co-branded restaurants

worldwide that generate nearly $1.5

billion in annual system sales.