Pizza Hut 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

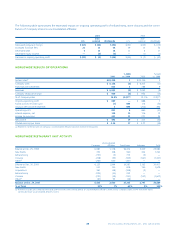

FACTORS AFFECTING COMPARABILITY OF 2001

RESULTS TO 2000 RESULTS

Impact of AmeriServe Bankruptcy

Reorganization Process

See Note 22 for a discussion of the impact of the AmeriServe

Food Distribution, Inc. (“AmeriServe”) bankruptcy reorganiza-

tion process on the Company.

Franchisee Financial Condition

Like others in the QSR industry, from time to time, some of our

franchise operators experience financial difficulties with respect

to their franchise operations. During 2001 and 2000, certain of

our franchise operators, principally in the Taco Bell system expe-

rienced varying degrees of financial problems.

Depending upon the facts and circumstances of each situ-

ation, and in the absence of an improvement in the franchisee’s

business trends, there are a number of potential resolutions of

these financial issues. These include a sale of some or all of the

operator’s restaurants to us or a third party, a restructuring of

the operator’s business and/or finances, or, in the more unusual

cases, bankruptcy of the operator. It is our practice to proac-

tively work with financially troubled franchise operators in an

attempt to positively resolve their issues.

Through February 11, 2002, restructurings have been com-

pleted for approximately 1,000 Taco Bell franchise restaurants.

In connection with these restructurings, Taco Bell has acquired

123 restaurants for approximately $65 million through

December 29, 2001. In addition to these acquisitions, Taco Bell

purchased 19 restaurants from franchisees for approximately

$12 million and simultaneously leased the restaurants back to

these franchisees under long-term leases. As part of the restruc-

turings, Taco Bell has committed to fund approximately

$29 million of future franchise capital expenditures, principally

through leasing arrangements. In the fourth quarter of 2000,

Taco Bell established a $15 million loan program to assist cer-

tain franchisees. All fundings had been advanced by the end of

the first quarter of 2001, and the resulting notes receivable are

primarily included in Other assets.

We believe that the recent improvement in business trends

at Taco Bell has helped alleviate financial problems in the Taco

Bell franchise system which were due to past downturns in sales.

Accordingly, though we continue to monitor this situation, we

expect restructurings of the remaining Taco Bell franchise restau-

rants with financial issues to be significantly less in number and

costs in 2002.

In 2001 and 2000, the Company charged expenses of

$18 million and $26 million, respectively, to ongoing operating

profit related to allowances for doubtful franchise and license

fee receivables. These costs are reported as franchise and license

expenses. On an ongoing basis, we assess our exposure from

franchise-related risks, which include estimated uncollectibility

of franchise and license receivables, contingent lease liabilities,

guarantees to support certain third party financial arrangements

of franchisees and potential claims by franchisees. The contin-

gent lease liabilities and guarantees are more fully discussed in

the Contingent Liabilities section of Note 22. Although the ulti-

mate impact of these franchise financial issues cannot be

predicted with certainty at this time, we have provided for our

current estimate of the probable exposure as of December 29,

2001. It is reasonably possible that there will be additional costs;

however, these costs are not expected to be material to quarterly

or annual results of operations, financial condition or cash flows.

Unusual Items (Income) Expense

We recorded unusual items income of $3 million in 2001 and

unusual items expense of $204 million in 2000 and $51 million

in 1999. See Note 5 for a detailed discussion of our unusual

items (income) expense.

In the fourth quarter of 2001, we recorded expenses of

approximately $4 million related to streamlining certain support

functions, which included the termination of approximately 90

employees. The reserves established, which primarily related to

severance, were almost fully utilized in the first quarter of 2002.

We expect to incur additional costs of approximately $2 million

in 2002 related to these actions, which will be expensed as

incurred. Beginning in 2002, we anticipate savings in general

and administrative expenses (“G&A”) of approximately $6 mil-

lion per year, primarily related to reduced compensation.

However, we expect to reinvest a substantial portion of these

savings in our growth initiatives, including multibranding.

Impact of New Unconsolidated Affiliates

Consistent with our strategy to focus our capital on key inter-

national markets, we formed new ventures in Canada and

Poland with our largest franchisee in each market. The venture

in Canada was formed in the third quarter of 2000 and the ven-

ture in Poland was effective in the first quarter of 2001. The

Canadian venture operates over 700 stores and the Poland ven-

ture operates approximately 100 stores. We did not record any

gain or loss on the transfer of assets to these new ventures.

Previously, the results from the restaurants we contributed

to these ventures were consolidated. The impact of these trans-

actions on operating results is similar to the impact of our

refranchising activities, which is described in the Store Portfolio

Strategy section below. Consequently, these transactions

resulted in a decline in our Company sales, restaurant margin

dollars and G&A as well as higher franchise fees. We also record

equity income (losses) from investments in unconsolidated affil-

iates (“equity income”) and, in Canada, higher franchise fees

since the royalty rate was increased for those stores contributed

by our partner to the venture. The formation of these ventures

did not have a significant net impact on ongoing operating

profit in 2001.