Pizza Hut 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

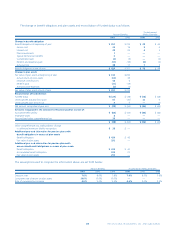

ITEMS AFFECTING COMPARABILITY

OF NET INCOME

Facility Actions Net Loss (Gain)

Facility actions net loss (gain) consists of the following three

components as described in Note 2:

• Refranchising (gains) losses;

• Store closure costs; and

• Impairment of long-lived assets for restaurants we intend to con-

tinue to use in the business and restaurants we intend to close.

2001 2000 1999(a)

U.S.

Refranchising net (gains)(b)(c) $ (44) $ (202) $ (405)

Store closure costs 13 65

Impairment charges for stores that

will continue to be used in the business 10 36

Impairment charges for stores to be closed 459

Facility actions net (gain) (17) (188) (385)

International

Refranchising net losses (gains)(b)(c) 52 (17)

Store closure costs 448

Impairment charges for stores that

will continue to be used in the business 8510

Impairment charges for stores to be closed 113

Facility actions net loss 18 12 4

Worldwide

Refranchising net (gains)(b)(c) (39) (200) (422)

Store closure costs 17 10 13

Impairment charges for stores that

will continue to be used in the business(d) 18 816

Impairment charges for stores to be closed(d) 5612

Facility actions net loss (gain) $1 $ (176) $ (381)

(a) Includes favorable adjustments of $19 million in the U.S. and unfavorable adjust-

ments of $6 million in International related to our 1997 fourth quarter charge.

These adjustments primarily related to lower-than-expected losses from stores dis-

posed of, decisions to retain certain stores originally expected to be disposed of

and changes in estimated costs. The original fourth quarter 1997 charge included

estimates for the costs of closing stores; reductions to fair market value, less costs

to sell, of the carrying amounts of certain restaurants we intended to refranchise;

and impairments of certain restaurants intended to be used in the business.

(b) Includes initial franchise fees in the U.S. of $4 million in 2001, $17 million in 2000

and $38 million in 1999 and in International of $3 million in both 2001 and 2000

and $7 million in 1999. See Note 7.

(c) In 2001, U.S. refranchising net (gains) included $12 million of previously deferred

refranchising gains and International refranchising net losses (gains) included a

charge of $11 million to mark to market the net assets of the Singapore business,

which is held for sale.

(d) Impairment charges for 2001, 2000 and 1999 were recorded against the following

asset categories:

2001 2000 1999

Property, plant and equipment $23 $12 $25

Goodwill ——1

Reacquired franchise rights —22

Total impairment $23 $14 $28

5

NOTE The following table summarizes the 2001 and 2000 activity

related to reserves for stores disposed of or held for disposal.

Asset

Impairment

Allowances Liabilities

Balance at December 25, 1999 $ 20 $ 71

Amounts used (10) (22)

(Income) expense impact:

New decisions 14 5

Estimate/decision changes (4) (7)

Other — 3

Balance at December 30, 2000 $ 20 $ 50

Amounts used (8) (18)

(Income) expense impact:

New decisions 21 6

Estimate/decision changes — 1

Other (6) 9

Balance at December 29, 2001 $ 27 $ 48

The following table summarizes the carrying value of assets held

for disposal by reportable operating segment.

2001 2000

U.S. $8 $6

International(a) 36 —

$44 $6

(a) The carrying value in 2001 related to the Singapore business, which operates

approximately 100 stores as of December 29, 2001.

The following table summarizes Company sales and restaurant

margin related to stores held for disposal at December 29, 2001

or disposed of through refranchising or closure during 2001,

2000 and 1999. Restaurant margin represents Company sales

less the cost of food and paper, payroll and employee benefits

and occupancy and other operating expenses. These amounts

do not include the impact of Company stores that have been

contributed to unconsolidated affiliates.

2001 2000 1999

Stores held for disposal at

December 29, 2001:

Sales $114 $ 114 $ 110

Restaurant margin 9812

Stores disposed of in 2001, 2000

and 1999:

Sales $157 $ 684 $1,716

Restaurant margin 15 88 202

Restaurant margin includes a benefit from the suspension of

depreciation and amortization of approximately $1 million,

$2 million and $9 million in 2001, 2000 and 1999, respectively.

47

5

NOTE