Pizza Hut 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

Such transactions were not significant for the Company through

December 29, 2001.

Historically, the Company’s business combinations have pri-

marily consisted of acquiring restaurants from our franchisees

and have been accounted for using the purchase method of

accounting. The primary intangible asset to which we have

generally allocated value in these business combinations is reac-

quired franchise rights. We have determined that reacquired

franchise rights do not meet the criteria of SFAS 141 to be rec-

ognized as an asset apart from goodwill.

In 2001, the FASB also issued SFAS 142, which supersedes

APB Opinion No. 17, “Intangible Assets.” SFAS 142 eliminates

the requirement to amortize goodwill and indefinite-lived intan-

gible assets, addresses the amortization of intangible assets with

a defined life, and addresses impairment testing and recogni-

tion for goodwill and intangible assets. SFAS 142 applies to

goodwill and intangible assets arising from transactions com-

pleted before and after its effective date. SFAS 142 is effective

for the Company for fiscal year 2002.

If SFAS 142 had been effective for fiscal year 2001, the ces-

sation of amortization of goodwill and indefinite-lived

intangibles would have resulted in our reported net income

being approximately $26 million higher. We have not yet deter-

mined the impact of the transitional goodwill impairment test,

which is required to be performed in connection with the adop-

tion of SFAS 142.

In 2001, the FASB issued SFAS No. 143, “Accounting for

Asset Retirement Obligations” (“SFAS 143”), which will be

effective for the Company beginning fiscal year 2003. SFAS 143

addresses the financial accounting and reporting for obligations

associated with the retirement of tangible long-lived assets and

the associated asset retirement costs. We have not yet deter-

mined the impact of adopting SFAS 143 on the Company’s

Financial Statements.

In 2001, the FASB issued SFAS No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”)

which supersedes SFAS No. 121, “Accounting for the Impairment

of Long-Lived Assets and for Long-Lived Assets to Be Disposed

Of” (“SFAS 121”) and the accounting and reporting provisions

of APB No. 30, “Reporting the Results of Operations —

Reporting the Effects of Disposal of a Segment of a Business,

and Extraordinary, Unusual and Infrequently Occurring Events

and Transactions” for the disposal of a segment of a business.

SFAS 144 retains many of the fundamental provisions of

SFAS 121, but resolves certain implementation issues associated

with that Statement. SFAS 144 is effective for the Company for

fiscal year 2002. We do not anticipate that the adoption of SFAS

144 will have a significant impact on our results of operations.

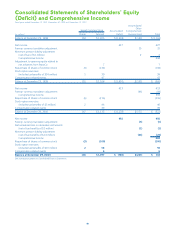

ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

Accumulated other comprehensive income (loss) includes:

2001 2000

Foreign currency translation adjustment $ (182) $ (177)

Minimum pension liability adjustment,

net of tax (24) —

Unrealized losses on derivative instruments,

net of tax (1) —

Total accumulated other

comprehensive income (loss) $ (207) $ (177)

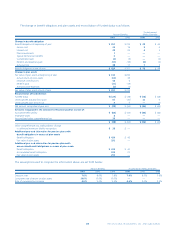

EARNINGS PER

COMMON SHARE (“EPS”)

2001 2000 1999

Net income $ 492 $ 413 $ 627

Basic EPS:

Weighted-average common

shares outstanding 147 147 153

Basic EPS $3.36 $ 2.81 $ 4.09

Diluted EPS:

Weighted-average common

shares outstanding 147 147 153

Shares assumed issued on exercise

of dilutive share equivalents 27 19 24

Shares assumed purchased with

proceeds of dilutive share equivalents (22) (17) (17)

Shares applicable to diluted earnings 152 149 160

Diluted EPS $3.24 $ 2.77 $ 3.92

Unexercised employee stock options to purchase approximately

2.6 million, 10.8 million and 2.5 million shares of our Common

Stock for the years ended December 29, 2001, December 30,

2000 and December 25, 1999, respectively, were not included

in the computation of diluted EPS because their exercise prices

were greater than the average market price of our Common

Stock during the year.

4

NOTE

3

NOTE