Pizza Hut 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

PENSION AND POSTRETIREMENT

MEDICAL BENEFITS

Pension Benefits

We sponsor noncontributory defined benefit pension plans cov-

ering substantially all full-time U.S. salaried employees, certain

hourly employees and certain international employees. During

2001, the TRICON Retirement Plan (the “Plan”) was amended

such that any salaried employee hired or rehired by TRICON after

September 30, 2001 will not be eligible to participate in the

Plan. Benefits are based on years of service and earnings or

stated amounts for each year of service.

Postretirement Medical Benefits

Our postretirement plan provides health care benefits, princi-

pally to U.S. salaried, retirees and their dependents. This plan

includes retiree cost-sharing provisions. During 2001, the plan

was amended such that any salaried employee hired or rehired

by TRICON after September 30, 2001 will not be eligible to par-

ticipate in this plan. Employees hired prior to September 30,

2001 are eligible for benefits if they meet age and service

requirements and qualify for retirement benefits.

15

NOTE

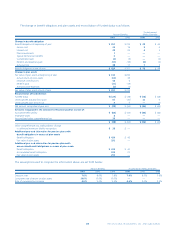

The components of net periodic benefit cost are set forth

below:

Pension Benefits

2001 2000 1999

Service cost $20 $19 $20

Interest cost 28 24 22

Amortization of prior service cost 111

Expected return on plan assets (29) (25) (24)

Recognized actuarial loss 1——

Net periodic benefit cost $21 $19 $19

Additional (gain) loss recognized due to:

Curtailment $— $ (4) $ (4)

Special termination benefits 2——

Postretirement Medical Benefits

2001 2000 1999

Service cost $2 $2 $2

Interest cost 433

Amortization of prior service cost (1) (1) (2)

Net periodic benefit cost $5 $4 $3

Additional (gain) recognized due to:

Curtailment $— $ (1) $ (1)

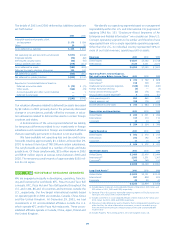

Prior service costs are amortized on a straight-line basis over the

average remaining service period of employees expected to

receive benefits. Curtailment gains have generally been recog-

nized in facility actions net gain as they have resulted primarily

from refranchising and closure activities.