Pizza Hut 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

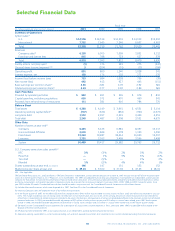

56 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

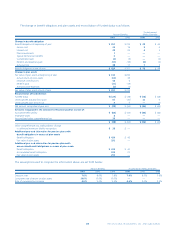

A summary of the status of all options granted to employees and non-employee directors as of December 29, 2001, December 30,

2000 and December 25, 1999, and changes during the years then ended is presented below (tabular options in thousands):

December 29, 2001 December 30, 2000 December 25, 1999

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

Options Price Options Price Options Price

Outstanding at beginning of year 26,679 $ 31.20 24,166 $ 31.18 22,699 $ 26.16

Granted at price equal to average market price 5,009 34.68 7,860 30.33 5,709 49.07

Exercised (1,817) 23.12 (1,829) 21.84 (1,273) 19.51

Forfeited (2,645) 34.31 (3,518) 33.99 (2,969) 31.94

Outstanding at end of year 27,226 $ 32.07 26,679 $ 31.20 24,166 $ 31.18

Exercisable at end of year 6,481 $ 25.53 7,622 $ 24.59 3,665 $ 22.44

Weighted average fair value of options at date of grant $ 14.20 $13.48 $ 19.20

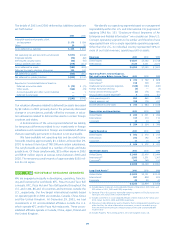

The following table summarizes information about stock options outstanding and exercisable at December 29, 2001 (tabular

options in thousands):

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Remaining Average Average

Contractual Exercise Exercise

Range of Exercise Prices Options Life Price Options Price

$ 0–20 934 2.91 $ 15.21 934 $ 15.21

20–30 7,846 5.32 25.82 3,674 24.34

30–35 13,211 7.89 31.70 1,676 31.77

35–55 4,842 7.69 43.18 192 42.83

55–75 393 7.26 72.75 5 72.75

27,226 6,481

In November 1997, we granted two awards of performance

restricted stock units of TRICON’s Common Stock to our Chief

Executive Officer (“CEO”). The awards were made under the

1997 LTIP and may be paid in Common Stock or cash at the dis-

cretion of the Compensation Committee of the Board of

Directors. Payment of an award of $2.7 million was contingent

upon the CEO’s continued employment through January 25,

2001 and our attainment of certain pre-established earnings

thresholds, as defined. In January 2001, our CEO received a

cash payment of $2.7 million following the Compensation

Committee’s certification of TRICON’s attainment of the pre-

established earnings threshold. Payment of an award of

$3.6 million is contingent upon his employment through

January 25, 2006 and our attainment of certain pre-established

earnings thresholds, as defined. The annual expense related to

these awards included in earnings was $0.5 million for 2001 and

$1.3 million for both 2000 and 1999.

During 2000 and 1999, modifications were made to cer-

tain 1997 LTIP and SharePower options held by terminated

employees. These modifications resulted in additional com-

pensation expense of an insignificant amount in 2000 and

$5.0 million in 1999 with a corresponding increase in our

Common Stock account.

OTHER COMPENSATION AND

BENEFIT PROGRAMS

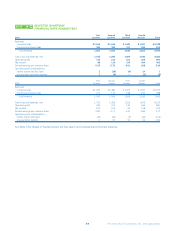

We sponsor two deferred compensation benefit programs, the

Restaurant Deferred Compensation Plan and the Executive

Income Deferral Program (the “RDC Plan” and the “EID Plan,”

respectively) for eligible employees and non-employee directors.

Effective October 1, 2001, participants can no longer defer

funds into the RDC Plan. Prior to that date, the RDC Plan

allowed participants to defer a portion of their annual salary.

The participant’s balances will remain in the RDC Plan until their

scheduled distribution dates. As defined by the RDC Plan, we

credit the amounts deferred with earnings based on the invest-

ment options selected by the participants. Investment options

in the RDC Plan consist of phantom shares of various mutual

funds and TRICON Common Stock. We recognize compensa-

tion expense for the appreciation or depreciation, if any,

attributable to all investments in the RDC Plan as well as for our

matching contribution. Our obligations under the RDC program

as of the end of 2001 and 2000 were $13 million and $10 mil-

lion, respectively. We recognized annual compensation expense

of $3 million in 2001 and $1 million in both 2000 and 1999 for

the RDC Plan.

17

NOTE