Pizza Hut 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Management’s Discussion and Analysis

INTRODUCTION

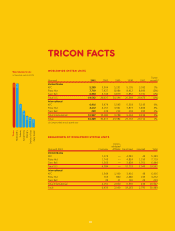

TRICON Global Restaurants, Inc. and Subsidiaries (collectively

referred to as “TRICON” or the “Company”) is comprised of the

worldwide operations of KFC, Pizza Hut and Taco Bell (“the

Concepts”) and is the world’s largest quick service restaurant

(“QSR”) company based on the number of system units.

Separately, each brand ranks in the top ten among QSR chains

in U.S. system sales and units. Our 10,927 international units

make us the second largest QSR company outside the U.S. TRI-

CON became an independent, publicly owned company on

October 6, 1997 (the “Spin-off Date”) via a tax-free distribution

of our Common Stock (the “Distribution” or “Spin-off”) to the

shareholders of our former parent, PepsiCo, Inc. (“PepsiCo”).

TRICON has numerous registered trademarks and service

marks. We believe that many of these marks, including our

Kentucky Fried Chicken,

®KFC,

®Pizza Hut®and Taco Bell®trade-

marks, have significant value and are materially important to our

business. Our policy is to pursue registration of important trade-

marks whenever feasible and to oppose vigorously any

infringement of our trademarks. From time to time we may

become involved in litigation to defend and protect our use of

such registered marks. The use of our trademarks by franchisees

and licensees has

been authorized in

KFC, Pizza Hut and

Taco Bell franchise

and license agree-

ments. Under current

law and with proper

use, our rights in

trademarks can generally last indefinitely. We also have certain

patents on restaurant equipment which, while valuable, are not

material to our business.

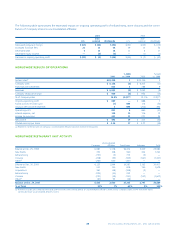

Throughout Management’s Discussion and Analysis

(“MD&A”), we make reference to ongoing operating profit

which represents our operating profit excluding the impact of

facility actions net loss (gain), unusual items income (expense)

and our accounting and human resources policy changes in

1999 (the “1999 accounting changes”). See Note 5 to the

Consolidated Financial Statements for a detailed discussion of

these exclusions. We use ongoing operating profit as a key per-

formance measure of our results of operations for purposes of

evaluating performance internally and as the base to forecast

future performance. Ongoing operating profit is not a measure

defined in accounting principles generally accepted in the U.S.

and should not be considered in isolation or as a substitution

for measures of performance in accordance with accounting

principles generally accepted in the U.S.

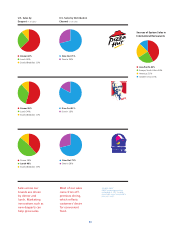

In 2001, our international business, Tricon Restaurants

International (“TRI” or “International”) accounted for 35% of

system sales, 31% of revenues and 31% of ongoing operating

profit excluding unallocated and corporate expenses and foreign

exchange net loss. We anticipate that, despite the inherent risks

and typically higher general and administrative expenses

required by international operations, we will continue to invest

in key international markets with substantial growth potential.

This MD&A should be read in conjunction with our

Consolidated Financial Statements on pages 38 through 64 and

the Cautionary Statements on page 37. All Note references

herein refer to the Notes to the Consolidated Financial

Statements on pages 42 through 64. Tabular amounts are dis-

played in millions except per share and unit count amounts, or

as otherwise specifically identified.

CRITICAL ACCOUNTING POLICIES

Our reported results are impacted by the application of certain

accounting policies that required us to make subjective or com-

plex judgments. These judgments involve estimations about the

effect of matters that are inherently uncertain and may signifi-

cantly impact our quarterly or annual results of operations,

financial condition or cash flows. Changes in the estimates and

judgments could significantly affect our results of operations,

financial condition and cash flows in future years. We believe

that our most significant policies require:

• Estimation of cash flows associated with the disposition of

restaurants, and the impairment of long-lived assets and

investments in unconsolidated affiliates. See Note 2 for a fur-

ther discussion.

• Determination of the appropriate allowances and reserves

associated with franchise and license receivables and contin-

gent liabilities. See Note 2 for a discussion of the allowance

for uncollectible franchise and license receivables and Note 22

for a discussion of franchise contingent liabilities.

• Estimation, using actuarially-determined methods, of our self-

insured losses under our property and casualty loss programs.

See Note 22 for a discussion of our insurance programs.

• Determination of the appropriate valuation allowances for

deferred tax assets and reserves for potential tax exposures.

See Note 20 for a discussion of income taxes.

We are the largest

QSR Company

based on system

units.