Pizza Hut 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

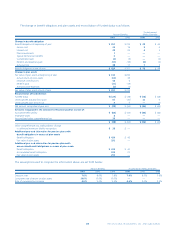

Unusual Items (Income) Expense

2001 2000 1999

U.S. $15 $29 $13

International —83

Unallocated (18) 167 35

Worldwide $ (3) $204 $51

Unusual items income in 2001 primarily included: (a) recoveries

of approximately $21 million related to the AmeriServe Food

Distribution Inc. (“AmeriServe”) bankruptcy reorganization

process; (b) aggregate settlement costs of $15 million associ-

ated with certain litigation; and (c) expenses, primarily severance,

related to decisions to streamline certain support functions. See

Note 22 for discussions of the AmeriServe bankruptcy reorgan-

ization process and litigation.

In the fourth quarter of 2001, we recorded expenses of

approximately $4 million related to streamlining certain support

functions, which included the termination of approximately 90

employees. The reserves established, which primarily related to

severance, were almost fully utilized in the first quarter of 2002.

Unusual items expense in 2000 included: (a) $170 million

of charges and direct incremental costs related to the

AmeriServe bankruptcy reorganization process; (b) an increase

in the estimated costs of settlement of certain wage and hour

litigation and associated defense costs incurred in 2000; (c) costs

associated with the formation of new unconsolidated affiliates;

and (d) the reversal of excess provisions arising from the resolu-

tion of a dispute associated with the disposition of our Non-core

Businesses, which is discussed in Note 22.

Unusual items expense in 1999 included: (a) the write-off

of approximately $41 million owed to us by AmeriServe at the

AmeriServe bankruptcy petition date; (b) an increase in the esti-

mated costs of settlement of certain wage and hour litigation

and associated defense and other costs incurred in 1999; (c)

favorable adjustments to our 1997 fourth quarter charge; (d)

the write-down to estimated fair market value less cost to sell

of our idle Wichita processing facility; (e) costs associated with

the formation of new unconsolidated affiliates; (f) the impair-

ment of enterprise-level goodwill in one of our international

businesses; and (g) severance and other exit costs related to

strategic decisions to streamline the infrastructure of our inter-

national business. The original fourth quarter 1997 charge

included impairments of certain investments in unconsolidated

affiliates to be retained and costs of certain personnel reductions.

Accounting Changes

In 1998 and 1999, we adopted several accounting and human

resource policy changes (collectively, the “accounting changes”)

which favorably impacted our 1999 operating results by approx-

imately $29 million. The estimated impact is summarized below:

1999

General and

Admini-

Restaurant strative Operating

Margin Expenses Profit

U.S. $11 $ 4 $ 15

Unallocated — 14 14

Total $11 $18 $ 29

The accounting changes were as follows:

Effective December 27, 1998, we adopted Statement of

Position 98-1 (“SOP 98-1”), “Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use.”

Based on our adoption of SOP 98-1, we capitalized approxi-

mately $13 million of internal software development costs and

third party software costs in 1999. The amortization of com-

puter software assets that became ready for their intended use

in 1999 was insignificant.

In addition, we adopted Emerging Issues Task Force Issue

No. 97-11 (“EITF 97-11”), “Accounting for Internal Costs

Relating to Real Estate Property Acquisitions,” upon its issuance

in March 1998. In the first quarter of 1999, we also made a dis-

cretionary policy change limiting the types of costs eligible for

capitalization to those direct cost types described as capitaliz-

able under SOP 98-1. This change unfavorably impacted our

1999 operating profit by approximately $3 million.

To conform to the Securities and Exchange Commission’s

April 23, 1998 interpretation of SFAS 121 our store closure

accounting policy was changed in 1998. Effective for closure

decisions made on or subsequent to April 23, 1998, we recog-

nize store closure costs when we have closed the restaurant

within the same quarter the closure decision is made. When we

decide to close a restaurant beyond the quarter in which the clo-

sure decision is made, we review it for impairment. In fiscal year

1999, this change resulted in additional depreciation and amor-

tization of approximately $3 million through April 23, 1999.

In 1999, the methodology used by our independent actu-

ary was refined and enhanced to provide a more reliable

estimate of the self-insured portion of our current and prior

years’ ultimate loss projections related to workers’ compensation,