Pizza Hut 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

general liability and automobile liability insurance programs. The

change in methodology resulted in a one-time increase in our

1999 operating profit of over $8 million.

At the end of 1998, we changed our method of determin-

ing the pension discount rate to better reflect the assumed

investment strategies we would most likely use to invest any

short-term cash surpluses. The pension discount methodology

change resulted in a one-time increase in our 1999 operating

profit of approximately $6 million.

In 1999, our vacation policies were conformed to a calen-

dar-year based, earn-as-you-go, use-or-lose policy. The change

provided a one-time favorable increase in our 1999 operating

profit of approximately $7 million. Other accounting policy stan-

dardization changes by our three U.S. Concepts provided a

one-time favorable increase in our 1999 operating profit of

approximately $1 million.

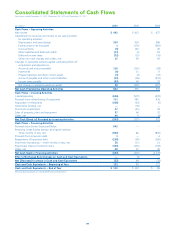

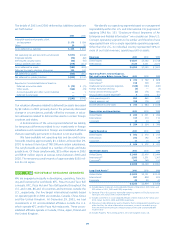

SUPPLEMENTAL CASH FLOW DATA

2001 2000 1999

Cash Paid for:

Interest $ 164 $ 194 $ 212

Income taxes 264 252 340

Significant Non-Cash Investing

and Financing Activities:

Issuance of promissory note to

acquire an unconsolidated affiliate $— $25 $—

Contribution of non-cash net assets

to an unconsolidated affiliate 21 67 —

Assumption of liabilities in connection

with an acquisition 36 61

Fair market value of assets

received in connection with

a non-cash acquisition 9——

Capital lease obligations incurred

to acquire assets 18 44

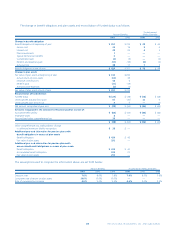

FRANCHISE AND LICENSE FEES

2001 2000 1999

Initial fees, including renewal fees $32 $48 $71

Initial franchise fees included in

refranchising gains (7) (20) (45)

25 28 26

Continuing fees 790 760 697

$ 815 $ 788 $ 723

7

NOTE

6

NOTE

OTHER (INCOME) EXPENSE

2001 2000 1999

Equity income from investments

in unconsolidated affiliates $ (26) $ (25) $ (19)

Foreign exchange net loss 3—3

$ (23) $ (25) $ (16)

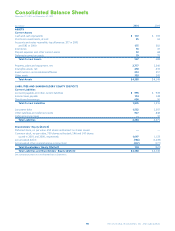

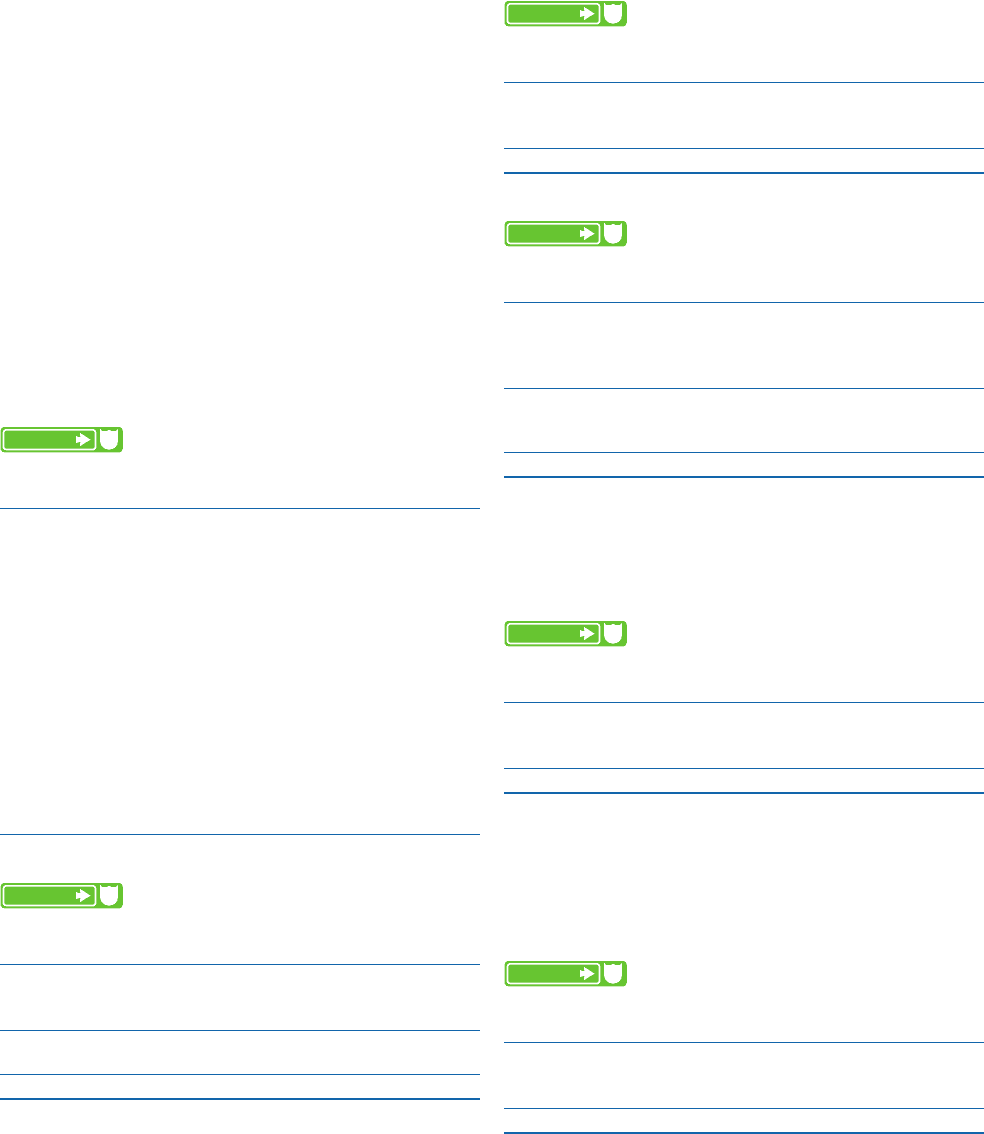

PROPERTY, PLANT AND

EQUIPMENT, NET

2001 2000

Land $ 579 $ 543

Buildings and improvements 2,608 2,469

Capital leases, primarily buildings 91 82

Machinery and equipment 1,647 1,522

4,925 4,616

Accumulated depreciation and amortization (2,121) (2,056)

Impairment allowances (27) (20)

$ 2,777 $ 2,540

Depreciation and amortization expense was $320 million,

$319 million and $345 million in 2001, 2000 and 1999,

respectively.

INTANGIBLE ASSETS, NET

2001 2000

Reacquired franchise rights $ 294 $ 264

Trademarks and other identifiable intangibles 105 102

Goodwill 59 53

$ 458 $ 419

In determining the above amounts, we have subtracted accu-

mulated amortization of $410 million for 2001 and $415 million

for 2000. Amortization expense was $37 million, $38 million

and $44 million in 2001, 2000 and 1999, respectively.

ACCOUNTS PAYABLE AND OTHER

CURRENT LIABILITIES

2001 2000

Accounts payable $ 326 $ 326

Accrued compensation and benefits 210 209

Other current liabilities 459 443

$ 995 $ 978

11

NOTE

10

NOTE

9

NOTE

8

NOTE