Pizza Hut 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

SHARE REPURCHASE PROGRAM

In February 2001, our Board of Directors authorized a share

repurchase program. This program authorizes us to repurchase,

through February 14, 2003, up to $300 million (excluding appli-

cable transaction fees) of our outstanding Common Stock.

During 2001, we repurchased approximately 2.4 million shares

for approximately $100 million at an average price per share of

approximately $42. Based on market conditions and other fac-

tors, additional repurchases may be made from time to time in

the open market or through privately negotiated transactions at

the discretion of the Company.

In 1999, our Board of Directors authorized the repurchase

of up to $350 million (excluding applicable transaction fees) of

our outstanding Common Stock. This share repurchase program

was completed in the second quarter of 2000. During 2000, we

repurchased approximately 6.4 million shares for $216 million

at an average price per share of $34. During 1999, we repur-

chased over 3.3 million shares for approximately $134 million

at an average price of $40 per share.

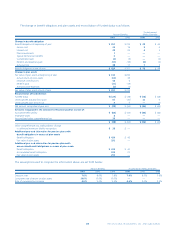

INCOME TAXES

The details of our income tax provision (benefit) are set forth

below:

2001 2000 1999

Current:

Federal $ 200 $ 215 $ 342

Foreign 75 66 46

State 38 41 39

313 322 427

Deferred:

Federal (29) (11) (18)

Foreign (33) (9) 17

State (10) (31) (15)

(72) (51) (16)

$ 241 $ 271 $ 411

Taxes payable were reduced by $13 million, $5 million and

$14 million in 2001, 2000 and 1999, respectively, as a result of

stock option exercises. In addition, goodwill and other intangi-

bles were reduced by $8 million and $2 million in 2001 and

2000, respectively, as a result of the settlement of a disputed

claim with the Internal Revenue Service relating to the

deductibility of reacquired franchise rights and other intangibles.

These reductions were offset by reductions in deferred and

accrued taxes payable.

20

NOTE

19

NOTE

In 2001, valuation allowances related to deferred tax assets

in certain states and foreign countries were reduced by $9 mil-

lion ($6 million, net of federal tax) and $6 million, respectively,

as a result of making a determination that it is more likely than

not that these assets will be utilized in the current and future

years. In 2000, valuation allowances related to deferred tax

assets in certain states and foreign countries were reduced by

$35 million ($23 million, net of federal tax) and $6 million,

respectively, as a result of making a determination that it is more

likely than not that these assets will be utilized in the current

and future years. In 1999, valuation allowances related to

deferred tax assets in certain foreign countries were reduced by

$13 million for the same reason.

The deferred foreign tax provision for 2001 included a

$2 million charge to reflect the impact of changes in statutory

tax rates in various countries. The impact of statutory rate changes

in foreign countries was less than $1 million in 2000. The 1999

deferred foreign provision included a benefit of $1 million.

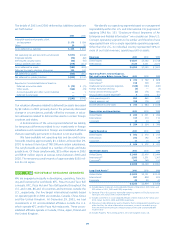

U.S. and foreign income before income taxes are set forth

below:

2001 2000 1999

U.S. $ 599 $ 537 $ 902

Foreign 134 147 136

$ 733 $ 684 $1,038

The reconciliation of income taxes calculated at the U.S. federal

tax statutory rate to our effective tax rate is set forth below:

2001 2000 1999

U.S. federal statutory rate 35.0% 35.0% 35.0%

State income tax, net of federal tax benefit 2.1 3.3 3.0

Foreign and U.S. tax effects attributable

to foreign operations 0.7 0.2 2.8

Effect of unusual items 0.1 (0.5) (0.5)

Adjustments relating to prior years (3.2) 5.5 0.8

Valuation allowance reversals (1.7) (4.2) (1.3)

Other, net (0.2) 0.3 (0.3)

Effective income tax rate 32.8% 39.6% 39.5%