Pizza Hut 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

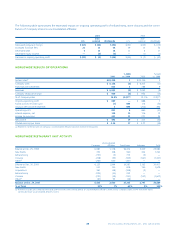

INTERNATIONAL ONGOING OPERATING PROFIT

Ongoing operating profit increased $9 million or 3%, after a

7% unfavorable impact from foreign currency translation.

Excluding the unfavorable impact of foreign currency transla-

tion and lapping the fifty-third week in 2000, ongoing operating

profit increased 12%. The increase was driven by new unit

development and same store sales growth, partially offset by

higher restaurant operating costs.

Ongoing operating profit increased $44 million or 16% in

2000, after a 2% unfavorable impact from foreign currency

translation. Excluding the unfavorable impact of foreign currency

translation and the favorable impact of the fifty-third week,

ongoing operating profit increased 16%. The increase was pri-

marily due to new unit development.

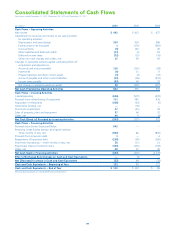

CONSOLIDATED CASH FLOWS

Net cash provided by operating activities increased

$341 million to $832 million. The increase was primarily due to

the collection of receivables established in 2000 and the absence

of the unusual charges taken in 2000 related to the AmeriServe

bankruptcy reorganization process. Excluding the AmeriServe-

related items, cash provided by operating activities was $704

million versus $734 million in 2000. See Note 22 for a discus-

sion of the AmeriServe bankruptcy reorganization process.

In 2000, net cash provided by operating activities decreased

$74 million to $491 million. The decrease was primarily due to

unusual charges related to the AmeriServe bankruptcy reor-

ganization process and the related use of working capital. The

primary driver of the net use of working capital was an increase

in receivables arising from the AmeriServe bankruptcy reorgan-

ization process, which resulted in a net use of working capital

of approximately $135 million. Excluding these AmeriServe-

related items, cash from operating activities increased by

$143 million to $734 million. This increase was driven by a lower

reduction of our working capital deficit than in 1999.

Our working capital deficit, excluding cash and cash equiv-

alents, short-term investments and short-term borrowings, is

typical of restaurant operations where a majority of sales are for

cash while payment to suppliers carry longer payment terms,

generally from 10–30 days. The lower working capital deficit

reduction in 2000 is the result of refranchising significantly fewer

restaurants in 2000 versus 1999, partially offset by a change in

payment terms in our food and supply distribution agreement

from 30 to 15 days.

Net cash used in investing activities was $503 million

versus $237 million in 2000. The increase in cash used was pri-

marily due to lower gross refranchising proceeds as a result of

selling fewer restaurants in 2001 and increased acquisition and

capital spending. The increase was partially offset by lapping the

funding of a debtor-in-possession revolving credit facility to

AmeriServe in 2000.

In 2000, net cash used in investing activities was $237 mil-

lion versus net cash provided of $522 million in 1999. The

decline in cash flow from investing activities was primarily due

to lower gross refranchising proceeds as a result of selling fewer

restaurants to franchisees in 2000 versus 1999, increased capi-

tal spending related to development and funding of a

debtor-in-possession revolving credit facility to AmeriServe.

Although we report gross proceeds in our Consolidated

Statements of Cash Flows, we also consider refranchising pro-

ceeds on an “after-tax” basis. We define after-tax proceeds as

gross refranchising proceeds less the settlement of working cap-

ital liabilities (primarily accounts payable and property taxes)

related to the units refranchised and payment of taxes on the

gains. The after-tax proceeds can be used to pay down debt or

repurchase shares. After-tax proceeds were approximately

$90 million in 2001 which reflects a 65% decrease from 2000.

This decrease was due to the refranchising of fewer restaurants

in 2001 versus 2000. After-tax proceeds were approximately

$261 million in 2000, a 62% decrease versus 1999. This

decrease was also due to refranchising fewer restaurants in

2000 than 1999.

Net cash used in financing activities was $352 million

compared to $207 million in 2000. The increase in cash used

is primarily due to

higher repayment of

debt partially offset

by fewer shares

repurchased in 2001

compared to 2000.

In 2000, net

cash used in financ-

ing activities decreased to $207 million versus $1.1 billion in

1999 due to lower debt repayments. Less cash was available for

financing activities in 2000 due to lower cash flow from oper-

ating and investing activities, as described above.

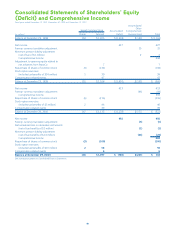

In February 2001, our Board of Directors authorized a new

share repurchase program. This program authorizes us to repur-

chase, through February 14, 2003, up to $300 million of our

outstanding common stock (excluding applicable transaction

fees). During 2001, we repurchased approximately 2.4 million

shares for approximately $100 million. See Note 19 for a dis-

cussion of the share repurchase program.

In 1999, our Board of Directors authorized the repurchase

of up to $350 million of our outstanding common stock (exclud-

ing applicable transaction fees). This share repurchase program

was completed in 2000. During 2000, we repurchased over

6.4 million shares for approximately $216 million. See Note 19

for a discussion of the share repurchase program.

We repaid

$300 million of

debt in 2001.