Pizza Hut 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

FINANCING ACTIVITIES

As more fully discussed in Note 12, our primary bank credit

agreement, as amended, is comprised of a senior, unsecured

Term Loan Facility and a $1.75 billion senior unsecured

Revolving Credit Facility, which was reduced from $3 billion as

part of the amendment discussed below (collectively referred to

as the “Credit Facilities”). The Credit Facilities mature on

October 2, 2002. At December 29, 2001, we had unused

Revolving Credit Facility borrowings available aggregating

$2.7 billion, net of outstanding letters of credit of $0.2 billion.

Amounts outstanding under our Credit Facilities of $536

million at December 29, 2001 have been classified as short-term

borrowings in the Consolidated Balance Sheet due to the

October 2002 maturity. We are currently in negotiations to

replace the Credit Facilities prior to the maturity date with new

borrowings, which will reflect the market conditions and terms

available at that time.

The Credit Facilities subject us to certain mandatory princi-

pal repayment obligations, including prepayment events as

defined in the credit agreement. Interest on the Credit Facilities

is based principally on the London Interbank Offered Rate

(“LIBOR”) plus a variable margin factor; therefore, our borrow-

ing costs fluctuate depending upon the volatility in LIBOR.

On February 22, 2002, we entered into an agreement to

amend certain terms of our Credit Facilities. This amendment

provides for, among other things, additional flexibility with

respect to acquisitions and other investments. In addition, we

voluntarily reduced our maximum borrowings under the

Revolving Credit Facility from $3.0 billion to $1.75 billion. As a

result of this amendment, we capitalized debt costs of approx-

imately $1.5 million. These costs will be amortized into interest

expense over the remaining life of the Credit Facilities.

We issued $850 million of unsecured Notes in 2001. The

issuance included $200 million of 8.5% Senior Unsecured Notes

due April 15, 2006 and $650 million of 8.875% Senior Unsecured

Notes due April 15, 2011. We used the proceeds, net of issuance

costs, to reduce amounts outstanding under the Credit Facilities.

We still have $550 million available for issuance under a $2 bil-

lion shelf registration. See Note 12 for further discussion.

We use derivative financial instruments, including interest

rate swaps, to lower interest expense and manage our exposure

to interest rate risk. See Notes 2 and 14 as well as our market

risk disclosure for further discussion of our interest rate risk.

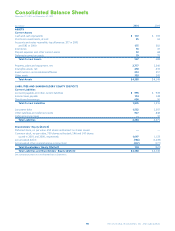

CONSOLIDATED FINANCIAL CONDITION

Assets increased $239 million or 6% to $4.4 billion. The

increase was primarily attributable to a net increase in property,

plant and equipment driven by capital spending and acquisitions

in excess of depreciation, refranchising and disposition of assets.

The fair value of derivatives recorded as a result of the adoption

of Statement of Financial Accounting Standards No. 133

“Accounting for Derivative Instruments and Hedging Activities”

(“SFAS 133”) also contributed to the increase. These increases

were partially offset by a reduction in net receivables primarily

related to the AmeriServe bankruptcy reorganization process.

Liabilities decreased $187 million or 4% to $4.3 billion.

The decrease was primarily attributable to net paydown of debt,

partially offset by increases related to the adoption of SFAS 133.

LIQUIDITY

Operating in the QSR industry allows us to generate substantial

cash flows from the operations of our company stores and from

our franchise operations, which require a limited TRICON invest-

ment in operating assets. Typically, our cash flows include a

significant amount of discretionary capital spending. Though a

decline in revenues could adversely impact our cash flows from

operations, we believe our operating cash flows and our ability

to adjust discretionary capital spending and borrow funds will

allow us to meet our cash requirements in 2002 and beyond.

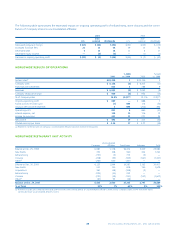

Significant contractual obligations and payments as of

December 29, 2001 due by year include:

Less than

1 Year 1-3 Years 4-5 Years Thereafter Total

Long-term debt(a) $ 537 $ 2 $ 551 $ 900 $ 1,990

Short-term borrowings 151———151

Debt excluding capital leases 688 2 551 900 2,141

Operating leases(b) 221 383 294 893 1,791

Capital leases(b) 11 22 17 87 137

Franchisee financing obligations 15 14 — — 29

Contractual obligations $ 935 $421 $862 $1,880 $ 4,098

(a) Excludes the derivative instrument adjustment, which is discussed in Note 14.

(b) These obligations, which are shown on a nominal basis, relate to operating and capital leases for approximately 4,400 restaurants.