Pizza Hut 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

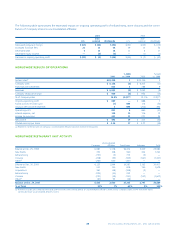

WORLDWIDE OTHER (INCOME) EXPENSE

2001 2000 1999

Equity income $ (26) $ (25) $ (19)

Foreign exchange net loss 3—3

Other (income) expense $ (23) $ (25) $ (16)

Equity income increased $1 million or 3% in 2001, after a 6%

unfavorable impact from foreign currency translation. The

increase was driven by improved results of our unconsolidated

affiliate in the United Kingdom. The increase was offset by

equity losses from Poland and the consolidation of a previously

unconsolidated affiliate.

Equity income increased $6 million or 32% in 2000. The

increase was primarily due to improved results of our unconsol-

idated affiliates in Japan, the United Kingdom and China.

WORLDWIDE FACILITY ACTIONS NET LOSS (GAIN)

We recorded facility actions net loss of $1 million in 2001 and

facility actions net gain of $176 million in 2000 and $381 mil-

lion in 1999. See the Store Portfolio Strategy section for more

detail of our refranchising and closure activities and Note 5 for

a summary of the components of facility actions net loss (gain)

by reportable operating segment.

WORLDWIDE ONGOING OPERATING PROFIT

% B(W) % B(W)

2001 vs. 2000 2000 vs. 1999

United States $ 722 (3) $ 742 (9)

International 318 3 309 16

Unallocated and corporate

expenses (148) 9 (163) 16

Foreign exchange net loss (3) NM —NM

Ongoing operating profit $ 889 — $ 888 1

The changes in U.S. and International ongoing operating profit

for 2001 and 2000 are discussed in the respective sections.

Unallocated and corporate expenses decreased $15 million

or 9% in 2001. Excluding the favorable impact of lapping the

fifty-third week in 2000, G&A decreased 8%. The decline was

primarily due to lower corporate and project spending partially

offset by higher incentive and deferred compensation.

Excluding the unfavorable impact from lapping the 1999

accounting changes, unallocated and corporate expenses

decreased $31 million or 16% in 2000. The decline was prima-

rily due to lower Year 2000 spending and lower incentive

compensation expense.

WORLDWIDE INTEREST EXPENSE, NET

2001 2000 1999

Interest expense $ 172 $190 $ 218

Interest income (14) (14) (16)

Interest expense, net $ 158 $176 $ 202

Net interest expense decreased $18 million or 10% in 2001.

The decrease was primarily due to a decrease in our average

interest rates.

Net interest expense decreased $26 million or 13% in

2000. The decline was due to lower average debt outstanding

in 2000 as compared

to 1999, partially off-

set by an increase in

interest rates on our

variable rate debt. As

discussed in Note 22,

interest expense on

incremental borrow-

ings related to the

AmeriServe bankruptcy reorganization process of $9 million has

been included in unusual items expense in 2000.

WORLDWIDE INCOME TAXES

2001 2000 1999

Reported

Income taxes $ 241 $ 271 $ 411

Effective tax rate 32.8% 39.6% 39.5%

Ongoing(a)

Income taxes $ 243 $ 268 $ 267

Effective tax rate 33.1% 37.7% 39.3%

(a) Excludes the effects of facility actions net (loss) gain, unusual items (income)

expense and the 1999 accounting changes. See Note 5 for a discussion of these

items.

The following table reconciles the U.S. federal statutory tax rate

to our ongoing effective tax rate:

2001 2000 1999

U.S. federal statutory tax rate 35.0% 35.0% 35.0%

State income tax, net of federal tax benefit 1.9 1.8 2.3

Foreign and U.S. tax effects attributable to

foreign operations 0.2 (0.4) 4.6

Adjustments relating to prior years (2.2) 5.3 (0.7)

Valuation allowance reversals (1.7) (4.0) (2.0)

Other, net (0.1) — 0.1

Ongoing effective tax rate 33.1% 37.7% 39.3%

Net interest

expense decreased

10% in 2001.