Pizza Hut 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

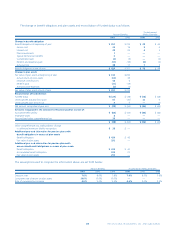

See Note 5 for additional operating segment disclosures related

to impairment and the carrying amount of assets held for disposal.

COMMITMENTS AND CONTINGENCIES

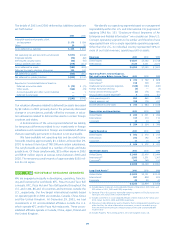

AmeriServe Bankruptcy Reorganization Process

We and our franchisees and licensees are dependent on fre-

quent replenishment of the food ingredients and paper supplies

required by our restaurants. We and a large number of our fran-

chisees and licensees operated under multi-year contracts, which

were assumed by McLane Company, Inc. (“McLane”), that had

required the use of AmeriServe to purchase and make deliver-

ies of most of these supplies. AmeriServe filed for protection

under Chapter 11 of the U.S. Bankruptcy Code on January 31,

2000. A plan of reorganization for AmeriServe (the “POR”) was

approved by the U.S. Bankruptcy Court on November 28, 2000.

During the AmeriServe bankruptcy reorganization process,

we took a number of actions to ensure continued supply to our

system. These actions resulted in a total expense of $170 mil-

lion which was recorded as unusual items in 2000. These costs

included the net funding of $70 million under a debtor-in pos-

session revolving credit facility, $59 million of net charges related

to the global settlement with holders of allowed secured and

administrative priority claims in the bankruptcy and other costs

of $41 million. The other costs included allowances for esti-

mated uncollectible receivables arising from supply sales to our

franchisees and licensees under a temporary program. The costs

also included incremental interest expenses arising from the

additional debt required to finance inventory purchases and the

receivables arising from these supply sales. In 2001, we recorded

unusual items income of $21 million related to net recoveries of

residual assets and certain preference claims under the POR. We

will record additional recoveries, if any, as unusual items as they

are realized.

Other Commitments and Contingencies

Contingent Liabilities

We were directly or indirectly contingently liable in the amounts

of $353 million and $401 million at year-end 2001 and 2000,

respectively, for certain lease assignments and guarantees. At

December 29, 2001, $293 million represented contingent lia-

bilities to lessors as a result of assigning our interest in and

obligations under real estate leases as a condition to the refran-

chising of certain Company restaurants, the contribution of

22

NOTE

certain Company restaurants to unconsolidated affiliates and

guarantees of certain other leases. The $293 million represented

the present value of the minimum payments of the assigned

leases, excluding any renewal option periods, discounted at our

pre-tax cost of debt. On a nominal basis, the contingent liabil-

ity resulting from the assigned leases is $435 million.

The contingent liabilities also include guarantees of approx-

imately $32.4 million to support financial arrangements of

certain franchisees, including partial guarantees of franchisee

loan pools originated primarily in connection with the

Company’s refranchising programs. The total loans outstanding

under these loan pools were approximately $180 million at

December 29, 2001. In support of these guarantees, we have

posted $32.4 million of letters of credit. Also, TRICON provides

a standby letter of credit under which TRICON could potentially

be required to fund a portion (up to $25 million) of one of the

franchisee loan pools. Any such funding under the standby let-

ter of credit would be secured by franchisee loan collateral. We

believe that we have appropriately provided for our estimated

probable exposures under these contingent liabilities. These pro-

visions were primarily charged to refranchising (gains) losses.

The remaining contingent liabilities of $28 million primarily

related to our guarantees of financial arrangements of certain

unconsolidated affiliates and third parties. These financial

arrangements primarily include lines of credit, loans and letters

of credit. If all lines of credit and letters of credit were fully

drawn down, the maximum contingent liability under these

arrangements would be approximately $56 million as of

December 29, 2001.

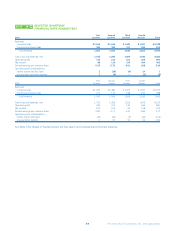

Insurance Programs

We are currently self-insured for a portion of our current and

prior years’ losses related to workers’ compensation, general lia-

bility and automobile liability insurance programs (collectively,

“casualty loss[es]”) as well as property losses and certain other

insurable risks. To mitigate the cost of our exposures for certain

property and casualty losses, we make annual decisions to either

retain the risks of loss up to certain maximum per occurrence or

aggregate loss limits negotiated with our insurance carriers or

to fully insure those risks. Since the Spin-off, we have elected to

retain the risks subject to certain insured limitations. Effective

August 16, 1999, we made changes to our U.S. and portions of

our International property and casualty insurance programs. For

fiscal years 2001, 2000 and the period from August 16, 1999

through the end of fiscal year 1999, we have bundled our risks