Pizza Hut 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

SHORT-TERM BORROWINGS AND

LONG-TERM DEBT

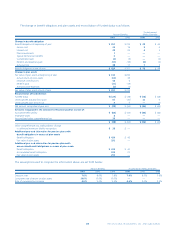

2001 2000

Short-term Borrowings

Current maturities of long-term debt $ 545 $10

International lines of credit 138 68

Other 13 12

$ 696 $90

Long-term Debt

Senior, unsecured Term Loan Facility,

due October 2002 $ 442 $ 689

Senior, unsecured Revolving Credit Facility,

expires October 2002 94 1,037

Senior, Unsecured Notes, due May 2005 (7.45%) 351 351

Senior, Unsecured Notes, due April 2006 (8.50%) 198 —

Senior, Unsecured Notes, due May 2008 (7.65%) 251 251

Senior, Unsecured Notes, due April 2011 (8.875%) 644 —

Capital lease obligations (See Note 13) 79 74

Other, due through 2010 (6%–12%) 45

2,063 2,407

Less current maturities of long-term debt (545) (10)

Long-term debt excluding SFAS 133 adjustment 1,518 2,397

Derivative instrument adjustment under SFAS 133

(See Note 14) 34 —

Long-term debt including SFAS 133 adjustment $ 1,552 $ 2,397

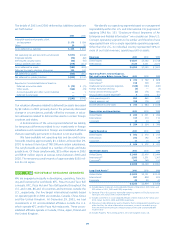

Our primary bank credit agreement, as amended, is comprised

of a senior unsecured Term Loan Facility and a $1.75 billion sen-

ior unsecured Revolving Credit Facility, which was reduced from

$3 billion as part of the amendment discussed below (collec-

tively referred to as the “Credit Facilities”). The Credit Facilities

mature on October 2, 2002. Amounts outstanding under our

Revolving Credit Facility are expected to fluctuate, but Term

Loan Facility reductions may not be reborrowed.

Under the terms of the Revolving Credit Facility, we may

borrow up to the maximum borrowing limit less outstanding let-

ters of credit. At December 29, 2001, we had unused Revolving

Credit Facilities aggregating $2.7 billion, net of outstanding let-

ters of credit of $0.2 billion. We expensed facility fees on the

Revolving Credit Facility of approximately $4 million in each of

2001, 2000 and 1999.

Amounts outstanding under our Credit Facilities at

December 29, 2001 have been classified as short-term bor-

rowings in the Consolidated Balance Sheet due to the October

2002 maturity. We are currently in negotiations to replace the

Credit Facilities prior to the maturity date with new borrow-

ings, which will reflect the market conditions and terms

available at that time.

The Credit Facilities are subject to various covenants includ-

ing financial covenants relating to maintenance of specific

leverage and fixed charge coverage ratios. In addition, the Credit

Facilities contain affirmative and negative covenants including,

12

NOTE

among other things, limitations on certain additional indebted-

ness, guarantees of indebtedness, cash dividends, aggregate

non-U.S. investment and certain other transactions, as defined

in the agreement. The Credit Facilities require prepayment of a

portion of the proceeds from certain capital market transactions

and refranchising of restaurants.

Interest on amounts borrowed is payable at least quarterly

at variable rates, based principally on the London Interbank

Offered Rate (“LIBOR”) plus a variable margin factor. At

December 29, 2001 and December 30, 2000, the weighted

average interest rate on our variable rate debt was 3.4% and

7.2%, respectively, which includes the effects of associated inter-

est rate swaps. See Note 14 for a discussion of our use of

derivative instruments, our management of credit risk inherent

in derivative instruments and fair value information related to

debt and interest rate swaps.

On February 22, 2002, we entered into an agreement to

amend certain terms of our Credit Facilities. This amendment

provides for, among other things, additional flexibility with

respect to acquisitions and other investments. In addition, we

voluntarily reduced our maximum borrowings under the

Revolving Credit Facility from $3.0 billion to $1.75 billion. As a

result of this amendment, we capitalized debt costs of approx-

imately $1.5 million. These costs will be amortized into interest

expense over the remaining life of the Credit Facilities.

In 1997, we filed a shelf registration statement with the

Securities and Exchange Commission with respect to offerings

of up to $2 billion of senior unsecured debt. In May 1998, we

issued $350 million of 7.45% Unsecured Notes due May 15,

2005 (“2005 Notes”) and $250 million of 7.65% Unsecured

Notes due May 15, 2008 (“2008 Notes”). Interest on the 2005

Notes and 2008 Notes commenced on November 15, 1998 and

is payable semi-annually thereafter. The effective interest rate

on the 2005 Notes and the 2008 Notes is 7.6% and 7.8%,

respectively. In April 2001, we issued $200 million of 8.5%

Senior Unsecured Notes due April 15, 2006 (“2006 Notes”) and

$650 million of 8.875% Senior Unsecured Notes due April 15,

2011 (“2011 Notes”) (collectively referred to as the “Notes”).

The net proceeds from the issuance of the Notes were used to

reduce amounts outstanding under the Credit Facilities. Interest

on the Notes is payable April 15 and October 15 and com-

menced on October 15, 2001. The effective interest rate on the

2006 Notes and the 2011 Notes is 9.0% and 9.2%, respectively.

We still have $550 million available for issuance under the $2 bil-

lion shelf registration statement.

Interest expense on the short-term borrowings and long-

term debt was $172 million, $190 million and $218 million in

2001, 2000 and 1999, respectively. Net interest expense of

$9 million on incremental borrowings related to the AmeriServe

bankruptcy reorganization process was included in unusual

items in 2000.

12

NOTE