Pizza Hut 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

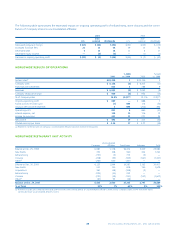

See Note 12 for a discussion of short-term borrowings and long-

term debt and Note 13 for a discussion of leases.

In addition, we have certain other commercial commit-

ments where payment is contingent upon the occurrence of

certain events. As of December 29, 2001, the maximum expo-

sure under these commercial commitments, which are shown

on a nominal basis, include:

Contingent liabilities associated with lease assignments $ 435

Standby letters of credit(a) 204

Guarantees of unconsolidated affiliates’ debt 12

Other commercial commitments 44

(a) Includes $32 million related to guarantees of financial arrangements of franchisees,

which are supported by stand-by letters of credit.

See Notes 12 and 22 for a further discussion of these commitments.

Our unconsolidated affiliates also have long-term debt out-

standing. As of December 29, 2001 this debt totaled

approximately $134 million, our share of which was approxi-

mately $68 million. As noted above, we have guaranteed

$12 million of this total debt obligation. Our unconsolidated

affiliates had total assets of over $900 million as of year-end

2001 and total revenues of approximately $1.6 billion in 2001.

OTHER SIGNIFICANT KNOWN EVENTS, TRENDS

OR UNCERTAINTIES EXPECTED TO IMPACT

2002 ONGOING OPERATING PROFIT COMPARISONS

WITH 2001

Euro Conversion

Twelve of the fifteen member countries of the European

Economic and Monetary Union adopted the Euro as a common

legal currency. We have Company and franchise businesses in

the adopting member countries. Beginning January 1, 2002,

new Euro-denominated bills and coins were issued, and a tran-

sition period of two months began. During the transition period

local currencies were removed from circulation. We took actions

to mitigate our risks related to the Euro conversion efforts

including the rollout of Euro-ready point-of-sale (“POS”) equip-

ment and back-of-house hardware and software. We have not

experienced any significant issues or unexpected business prob-

lems resulting from the Euro conversion. Given the absence of

any significant problems to date, we do not expect Euro con-

version issues to have a material adverse effect on TRICON’s

operations or financial results in 2002.

Expenditures associated with our conversion efforts totaled

approximately $5 million of which $3 million was incurred dur-

ing 2001. Approximately 30% of these costs related to capital

expenditures for new POS equipment and back-of-house hard-

ware and software. The remaining expenditures were mainly

related to consulting expenses for initial impact studies and head

office accounting systems. We do not expect to incur significant

Euro-related expenditures in 2002.

Consumer acceptance of the Euro has not significantly

impacted our business to date. From a competitive perspective,

we continue to assess the impact of product price transparency,

potential revisions to our product bundling strategies, and the cre-

ation of Euro-friendly price points. We do not believe that these

activities will have sustained adverse impacts on our businesses.

New Accounting Pronouncements

See Note 2.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

The Company is exposed to financial market risks associated

with interest rates, foreign currency exchange rates and com-

modity prices. In the normal course of business and in

accordance with our policies, we manage these risks through a

variety of strategies, which include the use of derivative finan-

cial and commodity instruments to hedge our underlying

exposures. Our policies prohibit the use of derivative instruments

for trading purposes, and we have procedures in place to mon-

itor and control their use.

Interest Rate Risk

Our primary market risk exposure is to changes in interest rates,

principally in the United States. We attempt to minimize this risk

and lower our overall borrowing costs through the utilization of

derivative financial instruments, primarily interest rate swaps.

These swaps are entered into with financial institutions and have

reset dates and critical terms that match those of the underly-

ing debt. Accordingly, any change in market value associated

with interest rate swaps is offset by the opposite market impact

on the related debt.

At December 29, 2001 and December 30, 2000, a hypo-

thetical 100 basis point increase in short-term interest rates

would result in a reduction of $4 million and $19 million, respec-

tively, in annual income before taxes. The estimated reductions

are based upon the unhedged portion of our variable rate debt

and assume no changes in the volume or composition of debt.

In addition, the fair value of our interest rate swaps at December

29, 2001 and December 30, 2000 would decrease approxi-

mately $5 million and $11 million, respectively. The fair value of

our Senior Unsecured Notes at December 29, 2001 and

December 30, 2000 would decrease approximately $72 million

and $25 million, respectively. The significant change in the

decrease of the fair market value between 2001 and 2000 was