Pizza Hut 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

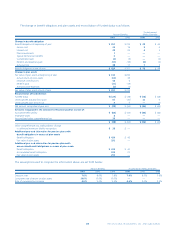

We have assumed the annual increase in cost of postretirement

medical benefits was 8.0% for non-Medicare eligible retirees

and 12.0% for Medicare eligible retirees in 2001 and will be

7.5% and 11.0%, respectively, in 2002. We are assuming the

rates for non-Medicare and Medicare eligible retirees will

decrease to an ultimate rate of 5.5% by 2008 and 2010, respec-

tively, and remain at that level thereafter. There is a cap on our

medical liability for certain retirees. The cap for Medicare eligi-

ble retirees was reached in 2000 and the cap for non-Medicare

eligible retirees is expected to be reached between the years

2010–2012; once the cap is reached, our annual cost per retiree

will not increase.

Assumed health care cost trend rates have a significant effect

on the amounts reported for our postretirement health care plans.

A one percent increase or decrease in the assumed health care

cost trend rates would have increased or decreased our accumu-

lated postretirement benefit obligation at December 29, 2001 by

approximately $3 million. The impact on our 2001 benefit cost

would not have been significant.

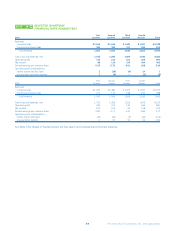

EMPLOYEE STOCK-BASED

COMPENSATION

At year-end 2001, we had four stock option plans in effect: the

TRICON Global Restaurants, Inc. Long-Term Incentive Plan

(“1999 LTIP”), the 1997 Long-Term Incentive Plan (“1997 LTIP”),

the TRICON Global Restaurants, Inc. Restaurant General

Manager Stock Option Plan (“YUMBUCKS”) and the TRICON

Global Restaurants, Inc. SharePower Plan (“SharePower”).

We may grant awards of up to 7.6 million shares and 22.5

million shares of stock under the 1999 LTIP and the 1997 LTIP,

respectively. Potential awards to employees and non-employee

directors under the 1999 LTIP include stock options, incentive

stock options, stock appreciation rights, restricted stock, stock

units, restricted stock units, performance shares and perform-

ance units. Potential awards to employees and non-employee

directors under the 1997 LTIP include stock appreciation rights,

restricted stock and performance restricted stock units. Prior to

January 1, 2002, we also could grant stock options and incen-

tive stock options under the 1997 LTIP. We have issued only

stock options and performance restricted stock units under the

1997 LTIP and have issued only stock options under the 1999 LTIP.

We may grant stock options under the 1999 LTIP to pur-

chase shares at a price equal to or greater than the average

market price of the stock on the date of grant. New option

grants under the 1999 LTIP can have varying vesting provisions

and exercise periods. Previously granted options under the 1997

LTIP and 1999 LTIP vest in periods ranging from immediate to

2006 and expire ten to fifteen years after grant.

16

NOTE

We may grant options to purchase up to 7.5 million shares

of stock under YUMBUCKS at a price equal to or greater than

the average market price of the stock on the date of grant.

YUMBUCKS options granted have a four year vesting period and

expire ten years after grant. We may grant options to purchase

up to 7.0 million shares of stock at a price equal to or greater

than the average market price of the stock under SharePower

on the date of grant. SharePower grants have not been made

since Spin-off. Previously granted SharePower options could be

outstanding through 2006.

At the Spin-off Date, we converted certain of the unvested

options to purchase PepsiCo stock that were held by our

employees to TRICON stock options under either the 1997 LTIP

or SharePower. We converted the options at amounts and exer-

cise prices that maintained the amount of unrealized stock

appreciation that existed immediately prior to the Spin-off. The

vesting dates and exercise periods of the options were not

affected by the conversion. Based on their original PepsiCo grant

date, our converted options vest in periods ranging from one to

ten years and expire ten to fifteen years after grant.

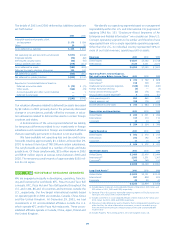

The following table reflects pro forma net income and earn-

ings per common share had we elected to adopt the fair value

approach of SFAS 123.

2001 2000 1999

Net Income

As reported $ 492 $ 413 $ 627

Pro forma 462 379 597

Basic Earnings per Common Share

As reported $3.36 $ 2.81 $ 4.09

Pro forma 3.15 2.58 3.90

Diluted Earnings per Common Share

As reported $3.24 $ 2.77 $ 3.92

Pro forma 3.04 2.55 3.73

The effects of applying SFAS 123 in the pro forma disclosures

are not likely to be representative of the effects on pro forma

net income for future years because variables such as the num-

ber of option grants, exercises and stock price volatility included

in these disclosures may not be indicative of future activity.

We estimated the fair value of each option grant made dur-

ing 2001, 2000 and 1999 as of the date of grant using the

Black-Scholes option-pricing model with the following weighted

average assumptions:

2001 2000 1999

Risk-free interest rate 4.7% 6.4% 4.9%

Expected life (years) 6.0 6.0 6.0

Expected volatility 32.7% 32.6% 29.7%

Expected dividend yield 0.0% 0.0% 0.0%