Pizza Hut 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tricon Global Restaurants

Table of contents

-

Page 1

Tricon Global Restaurants -

Page 2

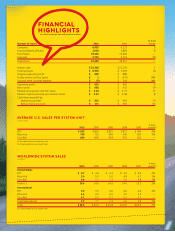

... HIGHLIGHTS (in millions, except for store and per share amounts) Number of stores: 2001 2000 % B(W) change Company Unconsolidated affiliates Franchisees Licensees Total stores System sales Total revenues Ongoing operating profit Facility actions net loss (gain) Unusual items (income) expense... -

Page 3

-

Page 4

... we became a public company in October 1997. We've more than doubled our ongoing operating earnings per share and increased our ongoing operating profit at a 7% compound growth rate. We've grown system sales 9% and opened over 5,200 new restaurants, excluding license restaurants, around the world... -

Page 5

... are in much better shape than a year ago. Most importantly, the new management teams we put in place in 2000 have generated significant same store sales momentum at both KFC and Taco Bell. As a result, Tricon shareholders enjoyed a 49% increase in the price of their shares in 2001. Just think what... -

Page 6

... 70% of our ongoing operating profit in 2001 and we also have our franchise and joint-venture partners driving growth by opening nearly 70% of our new restaurants. China is our shining star with constrained. There's no question we are capable of generating significantly higher sales out of our 20... -

Page 7

... this acquisition strengthens our business in every Tricon U.S. Average Unit Volumes vs. McDonald's KFC Pizza Hut Taco Bell McDonald's are also opening high-return new restaurants in trade areas that used to be too expensive or did not have enough population to allow us to go to market with... -

Page 8

... million in franchise fees with minimal capital investment. We expect to grow fees 4%-6% each year. 5) Return on Investment Capital...at 18%, we are a leader in the quick service restaurant industry. We expect to at least maintain our returns by driving at least 15% margins on the stores we own and... -

Page 9

7 -

Page 10

... Franchise RGM Terry Auld treats his customers as he would a guest in his own home. This 26-year veteran inspires his team to put the customer first, always. That's why they're the #1 CHAMPS restaurant with the second highest same store sales growth in the Pizza Hut system! Now that's Customer... -

Page 11

... coaches his team to pay close attention to their customers, listen and give them exactly what they want. His team has had over 20 perfect 100% CHAMPS scores in Accuracy (and the same in Speed of Service!). That's over a year of perfectly accurate service - fast. Chris Avila Taco Bell, Bensenville... -

Page 12

... CHAMPS store (with the most 100% scores) in the Pizza Hut system. Now that's a YES! attitude. Steve Morozek Pizza Hut, Keyser, WV Franchise RGM Gary Reiner delivers Hot & Fresh food, every hour, every day. This 16-year veteran knows what his customers want and empowers his team to deliver - and... -

Page 13

...that filling orders quickly and accurately guarantees repeat business. It must be working because her store has increased its' sales and received the highest CHAMPS evaluation in the Taco Bell system! Angella works alongside her team to ensure that her customers get fresh, delicious food - lightning... -

Page 14

... satisfaction...completely focused on putting a YUM on our customers' faces. We're working hard to deliver great customer service 100% of the time and it may be a long journey, but we're on our way - and we hope you'll have one word to describe it - YUM! "I crave Taco Bell all of the time. I love... -

Page 15

...time if I can eat at Pizza Hut - every day." Matthew McGrath 5 years old "We grew up eating KFC and we like that our kids enjoy it too. With both of us working, it's not always easy to come home and prepare a meal that everyone will eat. KFC is conveniently located for us, and we can get a complete... -

Page 16

... in Mexico, one of our key growth markets. Bottom: The United Kingdom is a key driver of our international business, growing ongoing operating profit by 33%. Over the years, our International business has successfully built a sandwich business via product innovation. One such example, KFC's Zinger... -

Page 17

...% Pizza Hut 33% Taco Bell 2% SOURCE: CREST CREST employed new tracking methodology in 2001, therefore percentages are not comparable to prior years' results. HERE WE GROW AGAIN TRICON RESTAURANTS INTERNATIONAL From Hong Kong to Malaysia, a Customer Mania revolution is taking hold - driving customer... -

Page 18

... meals with dividers to keep food separated. Popular menu items like Popcorn Chicken, meet our customers' on-the-go needs. When our customers told us they wanted us to return Popcorn Chicken to our menu in 2001, we listened. In turn, our customers gave KFC an all-time record-high week of sales... -

Page 19

...tender cooking. It's about homestyle meals, competitive value, friendly service - everything our customers look for in a quick service restaurant. When people think of our brand, they know they can count on our quality promise, now more than ever. In 2001, KFC zoned in on the "P" in CHAMPS - Product... -

Page 20

... a "Rip and Dip" breadstick crust delivered a whole new, fun way to eat pizza. With Twisted Crust, we said to our customers, "Go ahead, play with your food!" Home meal replacement represents the defining battle in the pizza category with delivery making up 50% of Pizza Hut's annual business. -

Page 21

.... What's more, almost 25% of company-owned restaurants have either been re-built, or re-imaged with an extraordinary new look, because we know that's important to driving a better customer experience. Pizza Hut's leadership in product innovation continued in 2001, with the introduction of our highly... -

Page 22

The new Taco Bell restaurants incorporate the very latest in engineering, technology and design - working together to reduce labor, improve food quality and ensure customer satisfaction! In 2001, Taco Bell successfully launched a number of exciting new products. Step up to the great taste of ... -

Page 23

...Steak Tacos, which drove sales and created new customers for The Bell. Working as one system with our outstanding franchisees and company restaurant operators, our aim is to continue creating The Bold Choice for consumers by running better restaurants, improving food quality, introducing new product... -

Page 24

...International 8.2 7.1 5.9 6 16.1 11.7 Total (a) Compounded annual growth rate Domino's Pizza Dairy Queen Burger King McDonald's Wendy's Tricon Subway BREAKDOWN OF WORLDWIDE SYSTEM UNITS Unconsolidated Affiliate Franchised Year-end 2001 Company Licensed Total United States KFC Pizza Hut... -

Page 25

... brands are driven by dinner and lunch. Marketing innovations such as new dayparts can help grow sales. Most of our sales come from offpremises dining, which reflects customers' desire for convenient food. SOURCE: CREST CREST employed new tracking methodology in 2001, therefore percentages are not... -

Page 26

... OF INCOME CONSOLIDATED STATEMENTS OF CASH FLOWS CONSOLIDATED BALANCE SHEETS CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (DEFICIT) AND COMPREHENSIVE INCOME NOTES TO CONSOLIDATED FINANCIAL STATEMENTS MANAGEMENT'S RESPONSIBILITY FOR FINANCIAL STATEMENTS REPORT OF INDEPENDENT AUDITORS 25 38 39... -

Page 27

... TRICON Global Restaurants, Inc. and Subsidiaries (collectively referred to as "TRICON" or the "Company") is comprised of the worldwide operations of KFC, Pizza Hut and Taco Bell ("the Concepts") and is the world's largest quick service restaurant ("QSR") company based on the number of system units... -

Page 28

... Taco Bell franchise restaurants with ï¬nancial issues to be signiï¬cantly less in number and costs in 2002. In 2001 and 2000, the Company charged expenses of $18 million and $26 million, respectively, to ongoing operating profit related to allowances for doubtful franchise and license fee... -

Page 29

...liates: 2001 International Worldwide Store Portfolio Strategy Since 1995, we have been strategically reducing our share of total system units by selling Company restaurants to existing and new franchisees where their expertise can generally be leveraged to improve our overall operating performance... -

Page 30

...13 6 (1) $ (7) $ (115) 52 17 (1) $ (47) WORLDWIDE RESULTS OF OPERATIONS 2001 % B(W) vs. 2000 2000 % B(W) vs. 1999 System sales(a) Company sales Franchise and license fees Revenues Company restaurant margin % of Company sales Ongoing operating proï¬t Facility actions net (loss) gain Unusual items... -

Page 31

... was driven by new unit development, partially offset by store closures and same store sales declines. WORLDWIDE COMPANY RESTAURANT MARGIN 2001 2000 1999 Company sales Food and paper Payroll and employee beneï¬ts Occupancy and other operating expenses Company restaurant margin 100.0% 31.1 27... -

Page 32

... related to the AmeriServe bankruptcy reorganization process of $9 million has been included in unusual items expense in 2000. WORLDWIDE INCOME TAXES WORLDWIDE ONGOING OPERATING PROFIT 2001 % B(W) vs. 2000 2000 % B(W) vs. 1999 2001 2000 1999 United States International Unallocated and corporate... -

Page 33

... same stores sales declines at Taco Bell and KFC as well as store closures, partially offset by new unit development. EARNINGS PER SHARE The components of earnings per common share ("EPS") were as follows: 2001(a) Basic 2000(a) Diluted Basic Diluted Ongoing operating earnings Facility actions net... -

Page 34

... at Pizza Hut and Taco Bell. The G&A declines were partially offset by higher franchise-related expenses, primarily allowances for doubtful franchise and license fee receivables. INTERNATIONAL RESULTS OF OPERATIONS 2001 % B(W) vs. 2000 2000 % B(W) vs. 1999 U.S. COMPANY RESTAURANT MARGIN 2001 2000... -

Page 35

... offset by new unit development and same store sales growth. Franchise and license fees increased $16 million or 6% in 2001, after a 6% unfavorable impact from foreign currency INTERNATIONAL COMPANY RESTAURANT MARGIN 2001 2000 1999 Company sales Food and paper Payroll and employee beneï¬ts... -

Page 36

... operating and investing activities, as described above. In February 2001, our Board of Directors authorized a new share repurchase program. This program authorizes us to repurchase, through February 14, 2003, up to $300 million of our outstanding common stock (excluding applicable transaction fees... -

Page 37

... generate substantial cash ï¬,ows from the operations of our company stores and from our franchise operations, which require a limited TRICON investment in operating assets. Typically, our cash flows include a signiï¬cant amount of discretionary capital spending. Though a decline in revenues could... -

Page 38

... $900 million as of year-end 2001 and total revenues of approximately $1.6 billion in 2001. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK The Company is exposed to financial market risks associated with interest rates, foreign currency exchange rates and commodity prices. In the normal... -

Page 39

... including the liabilities related to the sale of the non-core businesses; our ability to secure alternative distribution of products and equipment to our restaurants and our ability to ensure adequate supply of restaurant products and equipment in our stores; our ability to complete our Euro... -

Page 40

...per share data) 2001 2000 1999 Revenues Company sales Franchise and license fees $ 6,138 815 6,953 $ 6,305 788 7,093 $ 7,099 723 7,822 Costs and Expenses, net Company restaurants Food and paper Payroll and employee beneï¬ts Occupancy and other operating expenses 1,908 1,666 1,658 5,232 General... -

Page 41

...119) - (32) 121 89 Net Cash Provided by Operating Activities Cash Flows - Investing Activities Capital spending Proceeds from refranchising of restaurants Acquisition of restaurants AmeriServe funding, net Short-term investments Sales of property, plant and equipment Other, net Net Cash (Used in... -

Page 42

Consolidated Balance Sheets December 29, 2001 and December 30, 2000 (in millions) 2001 2000 ASSETS Current Assets Cash and cash equivalents Short-term investments, at cost Accounts and notes receivable, less allowance: $77 in 2001 and $82 in 2000 Inventories Prepaid expenses and other current ... -

Page 43

... Statements of Shareholders' Equity (Deficit) and Comprehensive Income Fiscal years ended December 29, 2001, December 30, 2000 and December 25, 1999 Issued Common Stock (in millions) Shares Amount Accumulated Deï¬cit Accumulated Other Comprehensive Income (Loss) Total Balance at December... -

Page 44

.... TRICON Global Restaurants, Inc. and Subsidiaries (collectively referred to as "TRICON" or the "Company") is comprised of the worldwide operations of KFC, Pizza Hut and Taco Bell (the "Concepts") and is the world's largest quick service restaurant company based on the number of system units, with... -

Page 45

... their representative organizations and our company-operated restaurants. These expenses, along with other costs of sales and servicing of franchise and license agreements are charged to general and administrative expenses as incurred. Certain direct costs of our franchise and license operations are... -

Page 46

... on the best information available, we write down an impaired restaurant to its estimated fair market value, which becomes its new cost basis. We generally measure estimated fair market value by discounting estimated future cash ï¬,ows. In addition, when we decide to close a store beyond the quarter... -

Page 47

... over the amount the employee must pay for the stock. Our policy is to generally grant stock options at the average market price of the underlying Common Stock at the date of grant. Derivative Financial Instruments Our policy prohibits the use of derivative instruments for trading purposes, and we... -

Page 48

... for the years ended December 29, 2001, December 30, 2000 and December 25, 1999, respectively, were not included in the computation of diluted EPS because their exercise prices were greater than the average market price of our Common Stock during the year. 46 TRICON GLOBAL RESTAURANTS, INC. AND... -

Page 49

... and restaurant margin related to stores held for disposal at December 29, 2001 or disposed of through refranchising or closure during 2001, 2000 and 1999. Restaurant margin represents Company sales less the cost of food and paper, payroll and employee beneï¬ts and occupancy and other operating... -

Page 50

...Force Issue No. 97-11 ("EITF 97-11"), "Accounting for Internal Costs Relating to Real Estate Property Acquisitions," upon its issuance in March 1998. In the ï¬rst quarter of 1999, we also made a discretionary policy change limiting the types of costs eligible for capitalization to those direct cost... -

Page 51

general liability and automobile liability insurance programs. The change in methodology resulted in a one-time increase in our 1999 operating proï¬t of over $8 million. At the end of 1998, we changed our method of determining the pension discount rate to better reflect the assumed investment ... -

Page 52

... the proceeds from certain capital market transactions and refranchising of restaurants. Interest on amounts borrowed is payable at least quarterly at variable rates, based principally on the London Interbank Offered Rate ("LIBOR") plus a variable margin factor. At December 29, 2001 and December 30... -

Page 53

... pay-variable interest rate swaps with notional amounts of $350 million. These swaps have reset dates and ï¬,oating rate indices which match those of our underlying ï¬xed-rate debt and have been designated as fair value hedges of a portion of that debt. As the swaps qualify for the short-cut method... -

Page 54

... large number of franchisees and licensees of each Concept and the short-term nature of the franchise and license fee receivables. Fair Value At December 29, 2001 and December 30, 2000, the fair values of cash and cash equivalents, short-term investments, accounts receivable, and accounts payable... -

Page 55

... salaried employee hired or rehired by TRICON after September 30, 2001 will not be eligible to participate in the Plan. Benefits are based on years of service and earnings or stated amounts for each year of service. 2001 1999 Service cost Interest cost Amortization of prior service cost Expected... -

Page 56

...Employer contributions Beneï¬ts paid Administrative expenses Fair value of plan assets at end of year Reconciliation of funded status Funded status Unrecognized actuarial loss (gain) Unrecognized prior service cost Net amount recognized at year-end Amounts recognized in the statement of financial... -

Page 57

...16 EMPLOYEE STOCK-BASED COMPENSATION At year-end 2001, we had four stock option plans in effect: the TRICON Global Restaurants, Inc. Long-Term Incentive Plan ("1999 LTIP"), the 1997 Long-Term Incentive Plan ("1997 LTIP"), the TRICON Global Restaurants, Inc. Restaurant General Manager Stock Option... -

Page 58

... our matching contribution. Our obligations under the RDC program as of the end of 2001 and 2000 were $13 million and $10 million, respectively. We recognized annual compensation expense of $3 million in 2001 and $1 million in both 2000 and 1999 for the RDC Plan. 56 TRICON GLOBAL RESTAURANTS, INC... -

Page 59

...of the Internal Revenue Code (the "401(k) Plan") for eligible full-time U.S. salaried and certain hourly employees. Participants may elect to contribute up to 15% of eligible compensation on a pre-tax basis. Effective October 1, 2001 the 401(k) Plan was amended such that the Company matches 100% of... -

Page 60

... time in the open market or through privately negotiated transactions at the discretion of the Company. In 1999, our Board of Directors authorized the repurchase of up to $350 million (excluding applicable transaction fees) of our outstanding Common Stock. This share repurchase program was completed... -

Page 61

...961 1999 NOTE 21 REPORTABLE OPERATING SEGMENTS Long-lived Assets(e) United States International Corporate 2001 We are engaged principally in developing, operating, franchising and licensing the worldwide KFC, Pizza Hut and Taco Bell concepts. KFC, Pizza Hut and Taco Bell operate throughout the... -

Page 62

... as they are realized. certain Company restaurants to unconsolidated affiliates and guarantees of certain other leases. The $293 million represented the present value of the minimum payments of the assigned leases, excluding any renewal option periods, discounted at our pre-tax cost of debt. On... -

Page 63

... out of the normal course of business. Like certain other large retail employers, Pizza Hut and Taco Bell have been faced in certain states with allegations of purported class-wide wage and hour violations. On August 29, 1997, a class action lawsuit against Taco Bell Corp., entitled Bravo, et al... -

Page 64

... general managers purporting to represent all current and former Taco Bell restaurant general managers and assistant restaurant general managers in California. The lawsuit alleged violations of California wage and hour laws involving unpaid overtime wages and violations of the State Labor Code... -

Page 65

...relating to the restaurant businesses, including California Pizza Kitchen, Chevys Mexican Restaurant, D'Angelo's Sandwich Shops, East Side Mario's and Hot 'n Now (collectively the "Non-core Businesses"), and our indemniï¬cation of PepsiCo with respect to these liabilities. We have included our best... -

Page 66

... QUARTERLY FINANCIAL DATA (UNAUDITED) First Quarter Second Quarter Third Quarter Fourth Quarter Total 2001 Revenues: Company sales Franchise and license fees Total revenues Total costs and expenses, net Operating proï¬t Net income Diluted earnings per common share Operating proï¬t attributable... -

Page 67

..., the financial position of TRICON as of December 29, 2001 and December 30, 2000, and the results of its operations and its cash ï¬,ows for each of the years in the three-year period ended December 29, 2001, in conformity with accounting principles generally accepted in the United States of America... -

Page 68

...Data Number of stores at year end(a) Company Unconsolidated Afï¬liates Franchisees Licensees System U.S. Company same store sales growth(a) KFC Pizza Hut Taco Bell Blended Shares outstanding at year end (in millions) Market price per share at year end N/A - Not Applicable. TRICON Global Restaurants... -

Page 69

... Ofï¬cer, Tricon Executive Vice President, Tricon Restaurants International Aylwin B. Lewis 47 Chief Operating Ofï¬cer, Tricon Michael A. Miles 40 Chief Operating Ofï¬cer, Pizza Hut, U.S.A. Robert T. Nilsen 42 Chief Operating Ofï¬cer, Taco Bell, U.S.A. Denise L. Ramos 45 Senior Vice President... -

Page 70

...Services P.O. Box 30446 New Brunswick, NJ 08989-0446 Telephone: (800) 637-2432 (U.S., Puerto Rico and Canada) (732) 560-9444 (all other locations) Independent Auditors KPMG LLP 400 West Market Street, Suite 2600 Louisville, KY 40202 Telephone: (502) 587-0535 CAPITAL STOCK INFORMATION Stock Trading... -

Page 71

Design: Sequel Studio, New York Hungry for more information? Contact: www.triconglobal.com -

Page 72

"Alone, we're delicious. Together, we're "