Pentax 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 HOYA Annual Report 2009

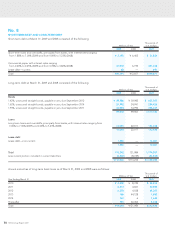

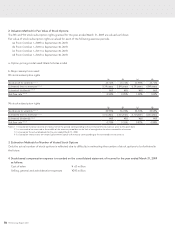

2. Valuation Method for Fair Value of Stock Options

The 8th and 9th stock subscription rights granted for the year ended March 31, 2009 are valued as follows:

Fair value of stock subscription rights is valued for each of the following exercise periods.

(a) From October 1, 2009 to September 30, 2018

(b) From October 1, 2010 to September 30, 2018

(c) From October 1, 2011 to September 30, 2018

(d) From October 1, 2012 to September 30, 2018

a. Option-pricing model used: Black-Scholes model

b. Major assumptions used:

8th stock subscription rights

(a) (b) (c) (d)

Stock price to volatility (Note 1) 36.12% 35.73% 35.90% 35.73%

Estimated time to exercise (Note 2) 5.34 years 5.84 years 6.34 years 6.84 years

Estimated dividends (Note 3) ¥65 ¥65 ¥65 ¥65

Risk free rate (Note 4) 0.90% 0.95% 1.00% 1.05%

9th stock subscription rights

(a) (b) (c) (d)

Stock price to volatility (Note 1) 36.95% 36.74% 36.33% 36.55%

Estimated time to exercise (Note 2) 5.10 years 5.60 years 6.10 years 6.60 years

Estimated dividends (Note 3) ¥65 ¥65 ¥65 ¥65

Risk free rate (Note 4) 0.70% 0.76% 0.82% 0.88%

Notes: 1. It is based on historical volatility of stock price for the period, corresponding to the estimated time to exercise, prior to the grant date.

2. It is assumed to be exercised in the middle of the exercise period due to the lack of enough data for other reasonable estimation.

3. It is based on the actual dividends for the year ended March 31, 2008.

4. It is based on interest rates on national government bonds with maturity corresponding to the estimated time to exercise.

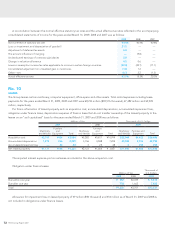

3. Estimation Methods for Number of Vested Stock Options

Only the actual number of stock options is reflected due to difficulty in estimating the number of stock options to be forfeited in

the future.

4. Stock-based compensation expense is recorded on the consolidated statement of income for the year ended March 31, 2009

as follows:

Cost of sales ¥ 63 million

Selling, general and administrative expenses ¥243 million