Pentax 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 HOYA Annual Report 2009

p. Derivatives and Hedging Activities—The Group uses deriva-

tive financial instruments to manage its exposures to fluctua-

tions in foreign currency exchange rates. Foreign exchange

forward contracts are utilized by the Group to reduce foreign

currency exchange risks. The Group does not enter into deriva-

tives for trading or speculative purposes.

Derivative financial instruments and foreign currency trans-

actions are classified and accounted for as follows: (a) all deriva-

tives are recognized as either assets or liabilities and measured

at fair value, and gains or losses on derivative transactions are

recognized in the statements of income and (b) for derivatives

used for hedging purposes, if derivatives qualify for hedge

accounting because of high correlation and effectiveness

between the hedging instruments and the hedged items, gains

or losses on derivatives are deferred until maturity of the

hedged transactions.

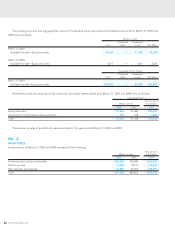

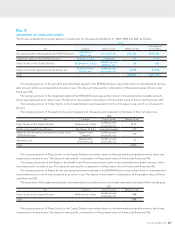

There were no hedging instruments and hedged items as of

March 31, 2009. Hedging instruments and hedged items as of

March 31, 2008 were as follows:

Hedging instruments: Forward exchange contracts

Hedged items: Loans payable denominated in foreign currency

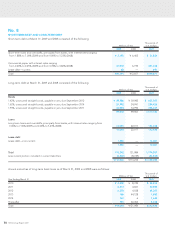

q. Per Share Information—Basic net income per share is com-

puted by dividing net income available to common sharehold-

ers by the weighted-average number of common shares

outstanding for the period, retroactively adjusted for stock

splits. Diluted net income per share reflects the potential dilu-

tion that could occur if the outstanding stock options were

exercised. Diluted net income per share of common stock

assumes full exercise of the outstanding stock options at the

beginning of the year (or at the time of grant). Cash dividends

per share presented in the accompanying consolidated state-

ments of income are dividends applicable to the respective

years including dividends to be paid after the end of the year.

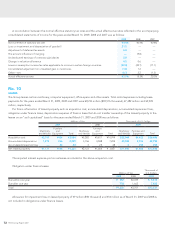

r. Stock Option—In December 2005, the ASBJ issued ASBJ

Statement No. 8, “Accounting Standard for Stock Options” and

related guidance. The new standard and guidance are appli-

cable to stock options newly granted on and after May 1, 2006.

This standard requires companies to recognize compensation

expense for employee stock options based on the fair value at

the date of grant and over the vesting period as consideration

for receiving goods or services. The standard also requires com-

panies to account for stock options granted to non-employees

based on the fair value of either the stock option or the goods

or services received. In the balance sheet, the stock option is

presented as a stock subscription right as a separate

component of equity until exercised. The standard covers

equity- settled, share-based payment transactions, but does not

cover cash-settled, share-based payment transactions. In addi-

tion, the standard allows unlisted companies to measure

options at their intrinsic value if they cannot reliably estimate

fair value. The Company has applied this accounting standard

for stock options to those granted on and after May 1, 2006.

s. New Accounting Pronouncements

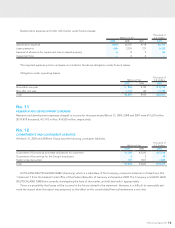

Business Combinations—On December 26, 2008, the ASBJ

issued a revised accounting standard for business combina-

tions, ASBJ Statement No. 21, “Accounting Standard for Busi-

ness Combinations.” Major accounting changes under the

revised accounting standard are as follows;

(1) The current accounting standard for business combinations

allows companies to apply the pooling of interests method of

accounting when certain specific criteria are met such that the

business combination is essentially regarded as a uniting-of-

interests. The revised standard requires to account for such

business combination by the purchase method and the pooling

of interests method of accounting is no longer allowed.

(2) The current accounting standard accounts for the research

and development costs to be charged to income as incurred.

Under the revised standard, in-process research and develop-

ment (IPR&D) acquired in the business combination is capital-

ized as an intangible asset.

(3) The current accounting standard accounts for a bargain pur-

chase gain (negative goodwill) to be systematically amortized

within 20 years. Under the revised standard, the acquirer recog-

nizes a bargain purchase gain in profit or loss on the acquisition

date after reassessing whether it has correctly identified all of

the assets acquired and all of the liabilities assumed with a

review of such procedures used.

This standard is applicable to business combinations under-

taken on or after April 1, 2010 with early adoption permitted for

fiscal years beginning on or after April 1, 2009.

Unification of Accounting Policies Applied to Foreign

Associated Companies for the Equity Method—The current

accounting standard requires unification of accounting policies

within the consolidation group. However, the current guidance

allows for applying the equity method to the financial state-

ments of its foreign associated company which have been pre-

pared in accordance with generally accepted accounting

principles in their respective jurisdictions without unification of

accounting policies.