Pentax 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 HOYA Annual Report 2009

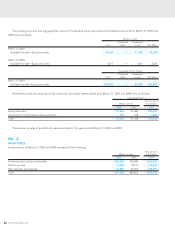

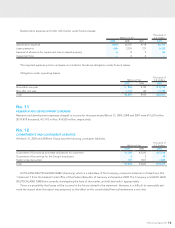

A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompanying

consolidated statements of income for the years ended March 31, 2009, 2008 and 2007 was as follows:

2009 2008 2007

Normal effective statutory tax rate 40.4% 40.4% 40.4%

Loss on impairment and depreciation of goodwill 21.5 — —

Adjustment of deferred tax assets 6.8 — —

The amount influence of merging —(9.0) —

Undistributed earnings of overseas subsidiaries 5.8 — —

Change in valuation allowance 4.5 0.6 —

Lower or exemption income tax rates applicable to income in certain foreign countries (32.8) (20.1) (17.1)

Consolidated adjustment on unrealized gain in inventories (1.8) 1.2 —

Other—net (0.7) 2.2 (1.3)

Actual effective tax rate 43.7% 15.3% 22.0%

No. 10

LEASES

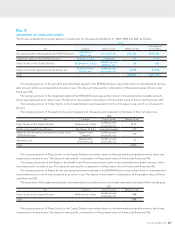

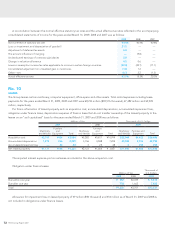

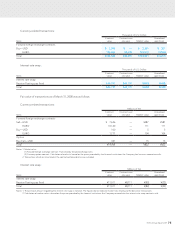

The Group leases certain machinery, computer equipment, office space and other assets. Total rental expenses including lease

payments for the years ended March 31, 2009, 2008 and 2007 were ¥8,210 million ($83,576 thousand), ¥7,482 million and ¥3,909

million, respectively.

Pro forma information of leased property such as acquisition cost, accumulated depreciation, accumulated impairment loss,

obligation under finance lease, depreciation expense of finance lease that do not transfer ownership of the leased property to the

lessee on an “as if capitalized” basis for the years ended March 31, 2009 and 2008 was as follows:

Millions of Yen Thousands of U.S. Dollars

2009 2008 2009

Machinery

and Vehicles

Furniture

and

Equipment Total

Machinery

and Vehicles

Furniture

and

Equipment Total

Machinery

and Vehicles

Furniture and

Equipment Total

Acquisition cost ¥3,150 ¥434 ¥3,584 ¥5,282 ¥5,637 ¥10,919 $32,064 $4,422 $36,486

Accumulated depreciation 1,973 266 2,239 3,156 4,048 7,204 20,084 2,706 22,790

Accumulated impairment loss — 24 24 3 25 28 0 250 250

Net leased property ¥1,177 ¥144 ¥1,321 ¥2,123 ¥1,564 ¥ 3,687 $11,980 $1,466 $13,446

The imputed interest expense portion as lessee is included in the above acquisition cost.

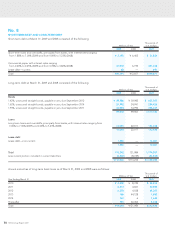

Obligation under finance leases

Millions of Yen

Thousands of

U.S. Dollars

2009 2008 2009

Due within one year ¥ 552 ¥2,039 $ 5,615

Due after one year 778 1,662 7,922

Total ¥1,330 ¥3,701 $13,537

Allowance for impairment loss on leased property of ¥9 million ($90 thousand) and ¥14 million as of March 31, 2009 and 2008 is

not included in obligations under finance leases.