Pentax 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

50,000

100,000

150,000

200,000

250,000

0

10

20

30

40

50

46 HOYA Annual Report 2009

Information Technology (Electro-Optics Division)

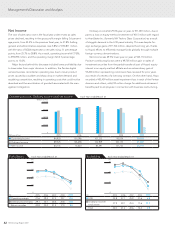

In the Electro-Optics Division, net sales decreased 21.9%, to ¥163,902

million. In mask blanks for semiconductor production, sales fell amid

worsening business conditions in the semiconductor industry caused

by the economic slump, with demand dropping precipitously as com-

panies reduced development budgets and curbed capital expendi-

tures. In photomasks for semiconductors, although Hoya worked to

provide high-quality, state-of-the-art mask products, sales fell year on

year on account of deteriorating market conditions in the fourth quar-

ter. Downward price pressure on large-sized photomasks for LCDs

remained intense. In the first half of the year panel manufacturers,

Hoya’s customers, relaxed their focus on volume production from the

previous year and introduced new products and products for develop-

ment, resulting in firm sales. From the second half of the year, how-

ever, demand contracted suddenly as a result of increases in panel

inventories, and sales fell year on year accordingly. Sales of glass

memory disks for HDDs were affected significantly by the strong yen

and lower prices due to falling prices for HDDs, and in the fourth

quarter major inventory adjustments were seen in the market, leading

to a decline in sales. Sales of optical lenses also fell, as a worldwide

drop in demand for digital cameras during the second half of the

fiscal year caused a significant fall in orders for compact digital

camera lenses and lower market prices.

Segment operating income fell 41.1%, to ¥39,712 million. The

principal factors behind this decrease were a decline in orders amid a

rising sense that the world economy was slowing, coupled with the

impact of the strong yen and ongoing price declines.

Capital expenditures in this division came to ¥20,242 million, down

17.2% from the preceding term. These expenditures went toward up-

front production-related investment involving next-generation

semiconductor-related miniaturization projects and investment in boost-

ing production of the Company’s HDD glass disk plant in Vietnam.

Information Technology (Photonics Division)

The Photonics Division manufactures and sells defect correction

equipment and laser oscillators used in highly precise processing,

which are used by manufacturers of semiconductors, LCD panels, and

optical devices for producing flat panels and semiconductors. It also

manufactures and sells UV light source devices used to cure UV resins

in the bonding of optical parts, such as optical pickups and camera

modules. In addition, the division provides a wide range of specialty

glasses, including color filters for optical devices and electronic glass

for medical applications. During the fiscal year under review, a glass

polarizer was transferred from the R&D Center for the purpose of

full-fledged commercialization. Going forward, there are high expec-

tations for growth in the optical communications field.

During the fiscal year under review, sales of laser devices were

strong in the first half due to active capital expenditure by LCD panel

manufacturers. In the second half of the fiscal year, however, the eco-

nomic downturn led to a slowdown in customers’ capital expendi-

tures, resulting in significantly lower orders for Hoya’s products.

Although specialty glass materials propped up results, net sales

declined 30.0% to ¥6,367 million. Operating income dropped 64.0%

to ¥297 million.

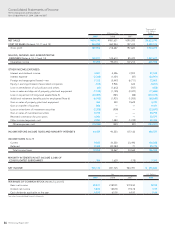

(Millions of Yen) 2007 2008 2009

n Net sales 219,252 209,883 163,902

n Operating income 80,085 67,464 39,712

Operating margin

(%) Note 36.5 32.1 24.2

Assets 258,746 210,007 186,864

Depreciation 27,449 27,653 27,430

Capital expenditures 39,899 24,431 20,242

(Millions of Yen) (%)

Electro-Optics Division Each Year ended March 31

Note: The operating margin above is calculated using sales to customers plus intersegment sales. Please refer to details on page 45, Sales and Operating Income

by Segment.

Management’s Discussion and Analysis