Pentax 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30,000

0

60,000

90,000

120,000

–30,000

–15,000

0

15,000

30,000

45,000

52 HOYA Annual Report 2009

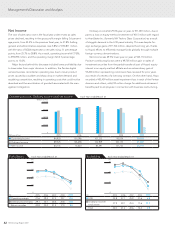

Cash Flows

Net cash provided by operating activities amounted to ¥90,977

million, a decrease of ¥28,832 million from the previous fiscal year. The

main positive factors were income before income taxes and minority

interests of ¥44,059 million (down ¥50,494 million year on year), depre-

ciation and amortization of ¥50,031 million (up ¥5,155 million), impair-

ment loss of ¥30,459 million (up ¥29,877 million) and a decrease in

notes and accounts receivable of ¥30,543 million (up ¥24,289 million).

The main negative factors were a decrease in notes and accounts

payable of ¥23,466 million (up ¥20,296 million) and ¥34,990 million in

income taxes paid (up ¥10,030 million).

Net cash used in investing activities amounted to ¥34,330 million,

a decrease of ¥78,707 million compared with the previous fiscal year.

This was primarily attributable to payments of ¥34,174 million (down

¥4,715 million) for property, plant and equipment, centered on invest-

ments related to next-generation products in the Electro-Optics Divi-

sion, as well as the absence of the ¥72,463 million used in the previous

fiscal year to acquire Pentax’s shares.

Net cash used in financing activities amounted to ¥5,801 million, a

difference of ¥74,054 million from the net cash provided by in the

previous fiscal year. This was mainly due to a net increase of ¥31,466

million in short-term loans, and a total of ¥28,115 million in dividends

paid (an increase of ¥39 million year on year), as well as the absence of

¥99,804 million from long-term bank loans and issuance of corporate

bonds for the tender offer for Pentax’s shares in the previous fiscal year.

As a result of the above, the balance of cash and cash equivalents as

of March 31, 2009, was ¥207,928 million, an increase of ¥26,592 million.

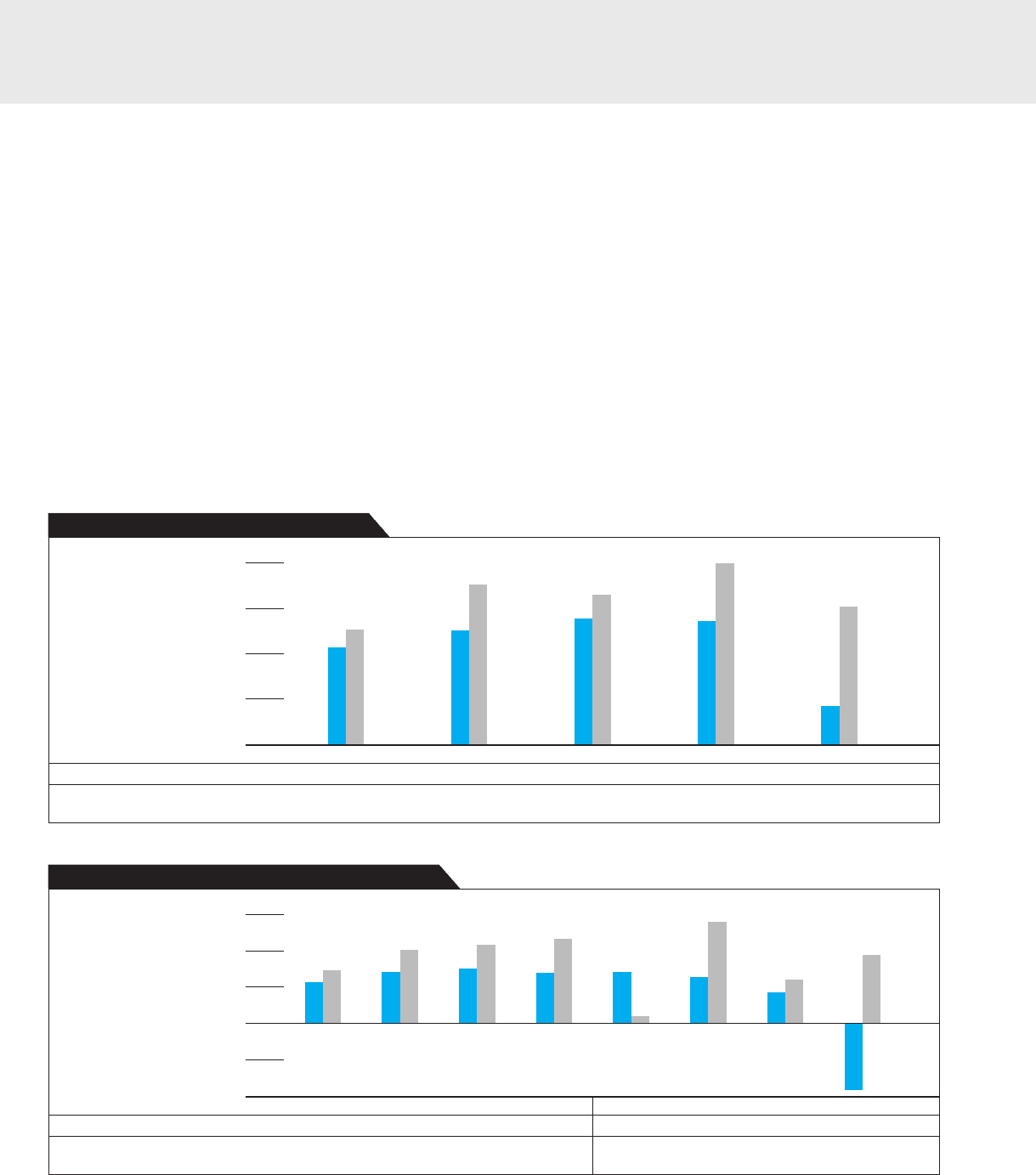

Net Cash Provided by Operating Activities Each Year ended March 31

(Millions of yen) 2005 2006 2007 2008 2009

n Net income 64,135 75,620 83,391 81,725 25,110

n Net cash provided by

operating activities 76,000 105,855 98,793 119,809 90,977

(Millions of yen)

Quarterly Net Cash Provided by Operating Activities Each Year ended March 31

(Millions of yen) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q

(Millions of yen) 2008 2009

n Net income 17,097 21,020 22,603 21,004 21,198 19,136 12,610 –27,834

n Net cash provided by

operating activities 21,815 30,450 32,595 34,948 2,883 41,805 18,006 28,283

Management’s Discussion and Analysis