Pentax 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

–40,000

40,000

80,000

120,000

160,000 40

10

20

30

0

–10

30,000

0

60,000

90,000

51

HOYA Annual Report 2009

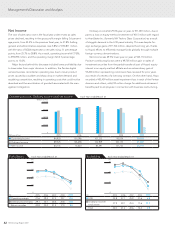

Depreciation and amortization costs for the fiscal year under

review increased 11.5%, to ¥50,031 million. The Electro-Optics Divi-

sion accounted for just over 50% of this, at ¥27,430 million. In addition,

the Pentax Division incurred depreciation of property, plant and

equipment, as well as amortization of goodwill that arose as a result of

the merger.

Moreover, as shown in the lower graph, amortization of goodwill

and impairment losses are included in addition to the depreciation

costs. For the fiscal year under review, each of the Pentax business

divisions and others applied impairment accounting, resulting in an

impairment loss of ¥30,459 million.

Interest-Bearing Debt Each Year ended March 31

Capital Expenditures/Depreciation, Amortization and other Each Year ended March 31

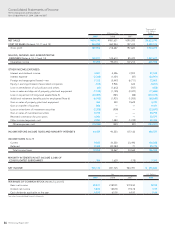

(Millions of yen) 2005 2006 2007 2008 2009

n Short-term loans 194 — — 6,465 2,145

nLong-term debt with current maturities — — — 8,749 4,402

nCommercial paper — — — 6,192 41,978

nLong-term debt — — — 13,268 9,688

nCorporate bonds — — — 99,967 99,972

Subtotal 194 — — 134,641 158,185

nLease obligations — — — — 1,348

nDiscounted promissory notes — — — 1,551 181

Total 194 — — 136,192 159,714

Leverage ratio (%) 0.1 — — 19.8 27.0

Note: Corporate bonds were issued to fund a public tender offer to acquire Pentax Corporation. The balance as of March 31, 2009 is: Five-year bonds: ¥39,986

million Seven-year bonds: ¥24,992 million Ten-year bonds: ¥34,994 million

(Millions of yen) 2005 2006 2007 2008 2009

n Capital Expenditures 40,175 48,786 54,432 39,465 34,839

n Depreciation, amortization and other 22,520 27,485 36,427 45,457 80,490

Note: Depreciation, amortization and other includes the loss on impairment of long-lived assets and amortization of goodwill.

(Millions of yen)

(Millions of yen)

(%)