Pentax 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 HOYA Annual Report 2009

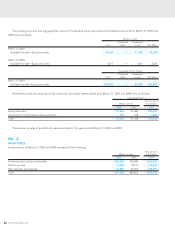

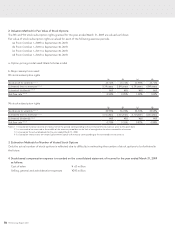

No. 14

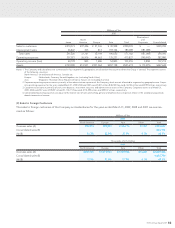

STOCK OPTION PLANS

1. Description of Stock Option

(1) Description of Stock Option Plans

3rd stock

subscription rights

4th stock

subscription rights

5th stock

subscription rights

Type and number

of recipients (Note 1)

Directors of the Company 8 Directors of the Company 8 Directors of the Company 8

Directors of subsidiaries 14 Directors of subsidiaries 5 Directors of subsidiaries 13

Employees of the Company 60 Employees of the Company 54 Employees of the Company 85

Employees of subsidiaries 35 Employees of subsidiaries 43 Employees of subsidiaries 77

Number of stock options by

type of stock to be issued Common stock 700,000 Common stock 635,600 Common stock 890,000

Grant date December 12, 2003 December 13, 2004 January 1, 2006

Vesting requirements

Remain employed from the grant

date (December 12, 2003) to the end

of the vesting period.

Remain employed from the grant

date (December 13, 2004) to the end

of the vesting period.

Remain employed from the grant

date (January 1, 2006) to the end of

the vesting period.

Service period From the grant date to the end of

the vesting period.

From the grant date to the end of

the vesting period.

From the grant date to the end of

the vesting period.

Exercise period (Note 2) From October 1, 2004 to September

30, 2008

From October 1, 2005 to September

30, 2009

From October 1, 2006 to September

30, 2015

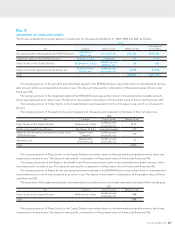

6th stock

subscription rights

7th stock

subscription rights

8th stock

subscription rights

9th stock

subscription rights

Type and number

of recipients

Directors of the Company 8 Directors of the Company 8 Directors of the Company 9

Directors of subsidiaries 73 Directors of subsidiaries 28 Directors of subsidiaries 1

Employees of the Company 12 Employees of the Company 86

Employees of subsidiaries 88 Employees of subsidiaries 10

Number of stock options by

type of stock to be issued Common stock 780,800 Common stock 77,600 Common stock 1,036,000 Common stock 60,000

Grant date November 7, 2006 November 14, 2007 November 28, 2008 February 24, 2009

Vesting requirements

Remain employed from the grant

date (November 7, 2006) to the end

of the vesting period.

Remain employed from the grant

date (November 14, 2007) to the end

of the vesting period.

Remain employed from the grant

date (November 28, 2008) to the end

of the vesting period.

Remain employed from the grant

date (February 24, 2009) to the end

of the vesting period.

Service period From the grant date to the end of

the vesting period.

From the grant date to the end of

the vesting period.

From the grant date to the end of

the vesting period.

From the grant date to the end of

the vesting period.

Exercise period From October 1, 2007 to September

30, 2016

From October 1, 2008 to September

30, 2017

From October 1, 2009 to September

30, 2018

From October 1, 2009 to September

30, 2018

Notes: 1. Number of stock options is expressed in number of shares to be issued upon exercise. The number of shares to be issued has been adjusted taking into account

a four-for-one stock split for common stock as of November 15, 2005.

2. Exercise of stock options during the exercise period is subject to terms and conditions stipulated in the agreement of allotment of stock subscription rights

entered into with respective recipients.