Pentax 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

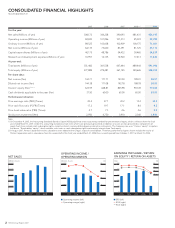

Operating

Income (Billions of Yen) Description of BusinessOperating Margin (%)

The Electro-Optics Division provides mask blanks and photomasks used in the production

of semiconductors and LCD panels which are embedded in digital equipments such as

personal computers, LCD televisions, digital cameras and mobile phones, as well as cutting-

edge glass memory disks and optical lenses to support the miniaturization and enhanced

functionality of those products. Hoya maintains a large global share of each of these mar-

kets, based on proprietary technologies at each stage from development to production.

In the fiscal year under review, both sales and profits for this division were down as a

result of lower demand for finished digital products, the steep appreciation of the yen, and

downward pressure on prices.

The Vision Care Division is engaged in manufacturing and sales of eyeglass lenses in

global markets with a focus on four regions: Japan, Europe, North America and Asia-

Pacific. The IT system linking the factories and sales points enables the division to deliver

high-value-added lenses to customers around the world quickly and efficiently. The Com-

pany holds the top market share in Japan.

In the fiscal year under review downward pressure on prices increased, particularly in

Japan and Europe. Nevertheless, the division secured growth in profits by enhancing price

competitiveness through enhanced efficiency in special order production, as well as active

introduction of new products.

The Photonics Division applies optics technologies cultivated over many years to provide

light source devices and equipment that utilize lasers and UV. Many of these products are

used in manufacturing processes for semiconductors, LCD panels and digital cameras, the

division’s business enjoys the benefits of positive synergies with the Electro-Optics Divi-

sion. The Company also expects to see growth in the polarizing glass products business,

which began commercial operation in the year under review.

In the fiscal year under review, laser equipment performed strongly in the first half as

LCD manufacturers expanded capital expenditures. In the second half, however, orders

declined amid a rapid slowdown in the digital products market, and the division recorded

both lower sales and profits.

The Health Care Division is responsible for the development of the over 150 Eye City

stores, Japan’s largest chain of contact lens specialty stores, serving a total of 6 million

customers to date. It also manufactures and sells intraocular lenses (IOLs) used in the

treatment of cataracts.

In the fiscal year under review, the division ramped up its high-quality consulting sales

and after care service, maintaining a stable customer acquisition from the previous year.

Meanwhile, steady demand for IOLs contributed to increases in both sales and profits. In

addition, the division received approval from the U.S. Food and Drug Administration (FDA)

for its IOLs, and has increased the speed of full-fledged development.

The Pentax business leverages its optics and precision processing technologies to develop

and sell a broad selection of products, including medical devices, digital cameras, lens

units for digital cameras, and microlenses. In the medical devices market, the division is

focusing on endoscopes with the expectation that medical care will progress and the

market will grow in the long-term. In cameras, the Company is working to develop unique

products based around the globally recognized PENTAX brand.

In the fiscal year under review, sales fell significantly in the second half of the year due to

the slowdown in demand for digital cameras and lower product prices. Currency exchange

rates had a major impact on overseas sales, which account for a large proportion of total

sales, resulting in a significant decrease in revenue. The digital camera division performed

poorly, resulting in both lower sales and an operating loss for the division.

2005 2006 2007 20092008

0

50

25

75

100

0

10

20

30

40

2005 2006 2007 20092008

0

0.4

0.2

0.6

1.0

0.8

0

2

4

6

10

8

2005 2006 2007 20092008

0

10

5

15

25

20

0

5

10

15

25

20

2005 2006 2007 20092008

0

8

4

12

0

10

20

30

2005 2006 2007 20092008

–12

0

–6

6

–10

–5

0

5

* Other businesses have not been included in this “HOYA AT A GLANCE” section. In addition, as part of its efforts to strengthen management and improve profitability, effective

March 31, 2009 the Hoya Group has withdrawn from the crystal glassware business, which was previously listed under “other businesses.”

11

HOYA Annual Report 2009