Pentax 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 HOYA Annual Report 2009

No. 13

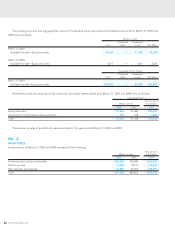

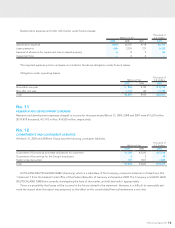

DERIVATIVES AND HEDGING ACTIVITIES

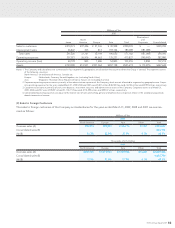

Derivatives and hedging activities as of March 31, 2009 and 2008 consisted of the following:

1. Conditions of transactions

The Group enters into derivative financial instruments (“derivatives”), including forward foreign exchange contracts and interest

rate swap contracts to hedge foreign exchange risk and interest rate exposures on certain assets and liabilities.

Foreign exchange forward contracts are utilized by the Group to reduce foreign currency exchange risks. The Group does not

enter into derivatives for trade or speculative purposes.

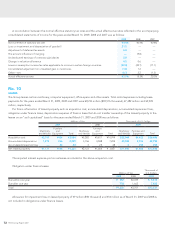

(1) Hedge accounting methods

Deferral hedging is applied. Loans payable denominated in foreign currencies for which foreign exchange forward contracts are

used to hedge the foreign currency fluctuations are translated at the contracted rate if the forward contracts qualify for hedge

accounting.

(2) Hedging methods and hedged items

Exchange risks are hedged based mainly on the Company’s ‘Internal Management Regulations’, and the Company has adopted a

policy of not conducting any speculative derivative trading.

Hedging method: Forward exchange contracts

Item hedged: Loans payable denominated in foreign currencies

There were no hedging instruments and hedged items as of March 31, 2009.

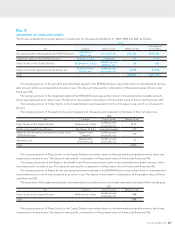

2. Fair value of transactions

Fair value of transactions as of March 31, 2009 was as follows:

Currency-related transactions:

Millions of Yen

Items

Contract

value

Contract over

one year Market value

Unrealized

gain (loss)

Forward foreign exchange contracts

Buy—USD ¥ 197 ¥ — ¥ 231 ¥ 34

EURO 12,383 2,426 12,034 (349)

Total ¥12,580 ¥2,426 ¥12,265 ¥(315)

Notes: 1. Market value:

Forward foreign exchange contract: Translated by forward exchange rates

2. Transactions which are translated at the contracted forward rates are excluded.

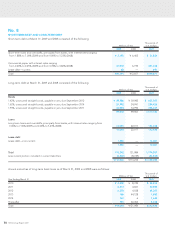

Interest rate swap:

Millions of Yen

Items

Contract

value

Contract over

one year Market value

Unrealized

gain (loss)

Interest rate swap

Receive floating pay fixed ¥4,342 ¥4,342 ¥(43) ¥(43)

Total ¥4,342 ¥4,342 ¥(43) ¥(43)

Notes: 1. The principal amount regarding the interest rate swap is notional. The figures do not indicate market risks relating to the derivative transactions

2. Calculation of market value is based on the prices provided by the financial institutions the Company entered into the interest rate swap contracts with.