Pentax 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

HOYA Annual Report 2009

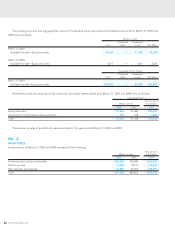

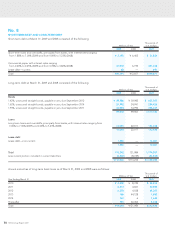

No. 5

IMPAIRMENT OF LONG-LIVED ASSETS

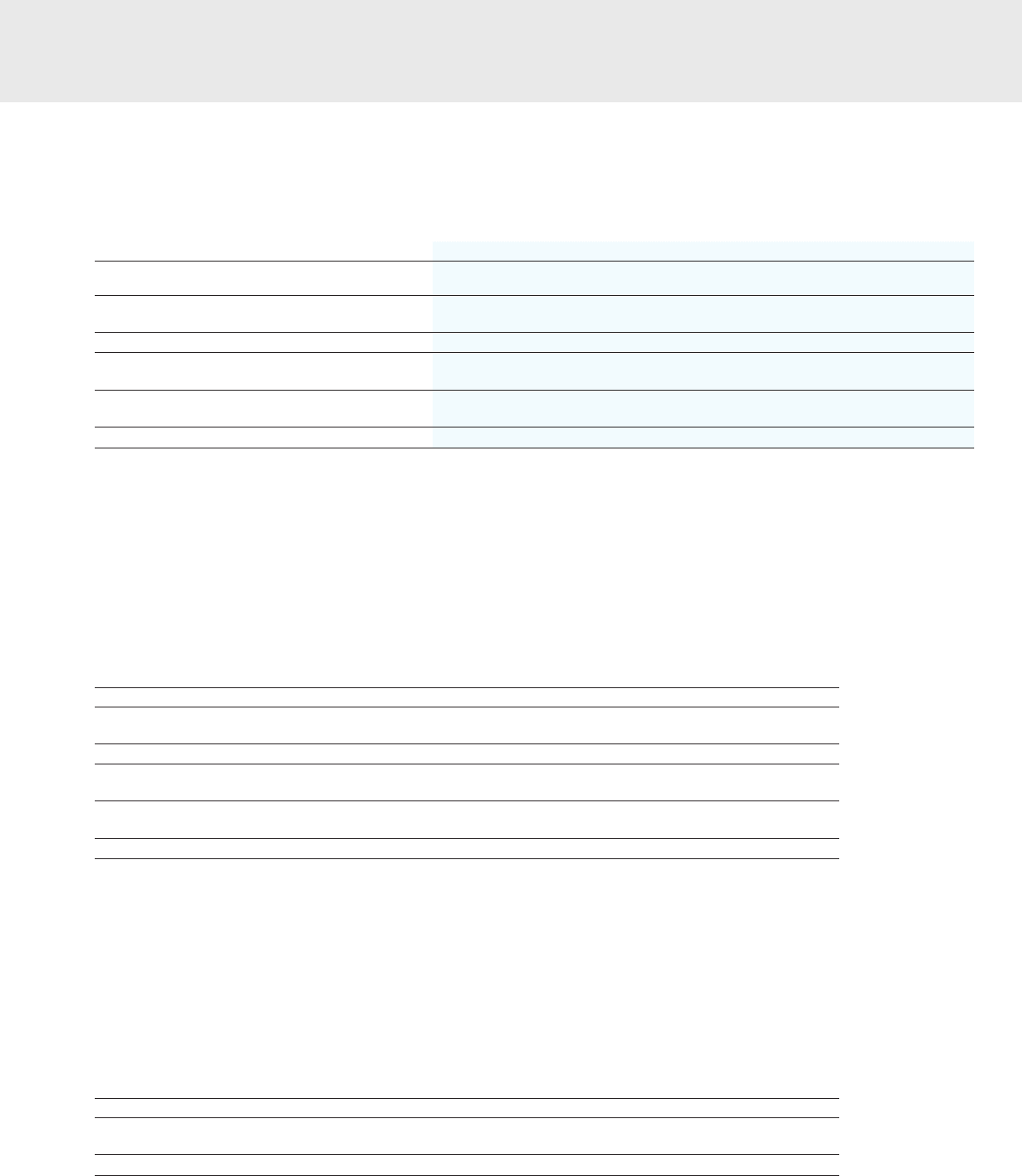

The Group reviewed its long-lived assets for impairment for the years ended March 31, 2009, 2008 and 2007 as follows:

2009

Use Location Type of assets Millions of Yen

Thousands of

U.S. Dollars

Goodwill and other fixed assets for the PENTAX Division Itabashi-ku,

Tokyo, etc. Goodwill, etc. ¥27,436 $279,304

Trademark rights of the PENTAX Division Boston (U.S.A.) Trademark 213 2,172

Tokyo Studio in the Crystal Division Akishima-shi, Tokyo Machinery and

vehicles, etc. 68 683

Assets to be sold, disposed and idle assets, etc. Mashiko-machi,

Tochigi, etc.

Buildings and

structures, etc. 2,742 27,916

Total ¥30,459 $310,075

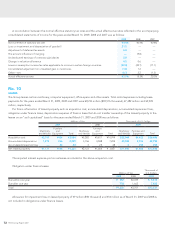

The carrying amount of the goodwill and other fixed assets for the PENTAX Division was written down to the estimated recover-

able amount, which was measured at its value in use. The discount rate used for computation of the present value of future cash

flows was 10%.

The carrying amount of the trademark rights of the PENTAX Division was written down to the estimated recoverable amount,

which was measured at its value in use. The discount rate used for computation of the present value of future cash flows was 16%.

The carrying amount of Tokyo Studio in the Crystal Division was measured in terms of its value in use, which is considered to

be zero.

The carrying amount of the assets to be sold, disposed and idle assets was measured on the basis of their net sale price.

2008

Use Location Type of assets Millions of Yen

Tokyo Studio in the Crystal Division Akishima-shi, Tokyo Buildings and

structures, etc. ¥129

Rights in the Health Care Division San Diego (U.S.A.) Intangible assets 212

Assets for the surveying instrument business in the

PENTAX Division

Ogawa-machi,

Saitama

Buildings and

structures, etc. 149

Idle assets, etc. Mulleheimm

(Germany), etc.

Buildings and

structures, etc. 91

Total ¥581

The carrying amount of Tokyo Studio in the Crystal Division was written down to the estimated recoverable amount, which was

measured at its value in use. The discount rate used for computation of the present value of future cash flows was 5%.

The carrying amounts of the Rights in the Health Care Division were written down to the estimated recoverable amount, which

was measured at its value in use. The discount rate used for computation of the present value of future cash flows was 5%.

The carrying amount of Assets for the surveying instrument business in the PENTAX Division was written down to the estimated

recoverable amount, which was measured at its value in use. The discount rate used for computation of the present value of future

cash flows was 5%.

The book value of idle assets was reduced to their estimated recoverable amount, which was measured on the basis of their net sale price.

2007

Use Location Type of assets Millions of Yen

Tokyo Studio in the Crystal Division Akishima-shi, Tokyo Buildings and

structures, etc. ¥88

Total ¥88

The carrying amount of Tokyo Studio in the Crystal Division was written down to the estimated recoverable amount, which was

measured at its value in use. The discount rate used for computation of the present value of future cash flows was 5%.