Pentax 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

30,000

60,000

90,000

120,000

0

10

30

20

40

0

10

20

30

42 HOYA Annual Report 2009

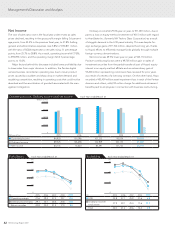

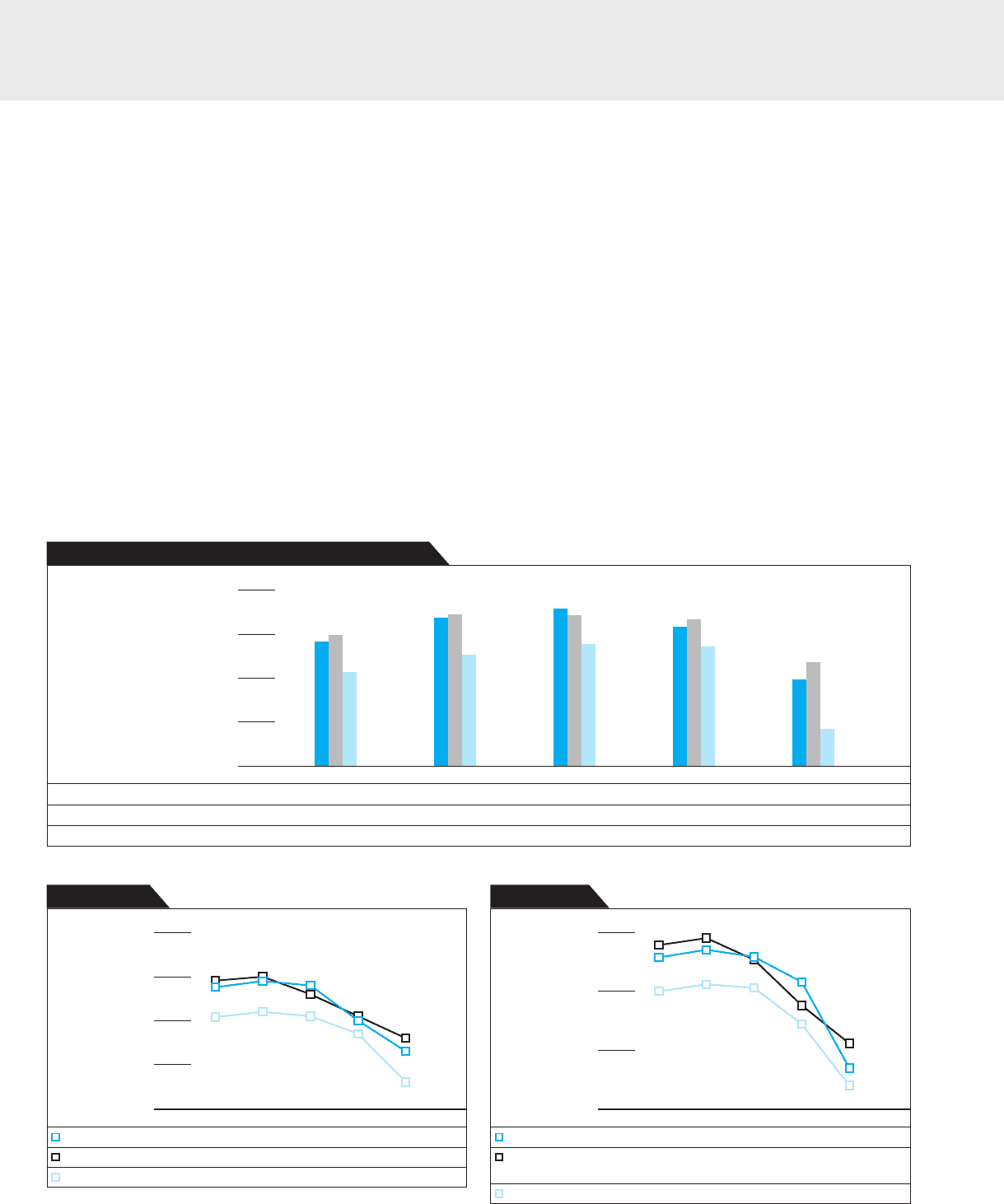

Operating Income, Ordinary Income and Net Income Each Year ended March 31

(Millions of Yen) 2005 2006 2007 2008 2009

n Operating Income 84,920 101,096 107,213 95,074 59,095

n Ordinary Income 89,525 103,638 102,909 100,175 71,081

n Net Income 64,135 75,620 83,391 81,725 25,110

(Millions of Yen)

Net Income

The cost of sales ratio rose in the fiscal year under review as sales

prices declined, resulting in the gross profit margin falling 3.6 percent-

age points, from 45.4% in the previous fiscal year, to 41.8%. Selling,

general and administrative expenses rose 5.8% to ¥130,811 million,

with the ratio of SG&A expenses to net sales rising 3.1 percentage

points, from 25.7% to 28.8%. As a result, operating income fell 37.8%,

to ¥59,095 million, and the operating margin fell 6.7 percentage

points, to 13.0%.

Major factors behind this decrease included lower profitability due

to lower sales from major divisions. In addition, the Pentax digital

camera business recorded an operating loss due to lower product

prices caused by a sudden and sharp drop in market demand and

escalating competition, resulting in operating costs that could not be

absorbed and the amortization of goodwill associated with the man-

agement integration.

Ordinary income fell 29.0% year on year, to ¥71,081 million, due in

part to a loss on equity-method investment of ¥315 million with regard

to AvanStrate Inc. (formerly NH Techno Glass Corporation) as a result

of sluggish demand in the LCD panel industry. This was despite for-

eign exchange gains of ¥7,152 million, despite the strong yen, thanks

to Hoya’s efforts to efficiently manage funds globally through multiple

foreign-currency denominations.

Net income was 69.3% lower year on year, at ¥25,110 million.

Positive contributing factors were a ¥9,705 million gain on sales of

investment securities from the partial transfer of part of Hoya’s equity

interest in an equity-method affiliate and an extraordinary gain of

¥3,200 million representing commission fees received for prior years

as a result of a review of a licensing contract. On the other hand, Hoya

recorded a ¥30,459 million asset impairment loss in each of the Pentax

divisions and others, a ¥6,743 million charge for additional retirement

benefits paid to employees in connection with business restructuring,

(%) (%)

Profit Ratios Each Year ended March 31 Profitability Each Year ended March 31

(%) 2005 2006 2007 2008 2009

Operating margin 27.6 29.4 27.5 19.7 13.0

Ordinary income ratio 29.1 30.1 26.4 20.8 15.6

Return on sales 20.8 22.0 21.4 17.0 5.5

(%) 2005 2006 2007 2008 2009

ROE 25.8 27.1 25.9 21.6 6.9

Ordinary income/

total assets 27.9 29.1 25.4 17.6 11.1

ROA 20.0 21.2 20.6 14.4 3.9

Management’s Discussion and Analysis