Pentax 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 HOYA Annual Report 2009

c. Cash Equivalents—Cash equivalents are short-term invest-

ments that are readily convertible into cash, and are exposed to

insignificant risk of changes in value. Cash equivalents include

time deposits, certificate of deposits, commercial paper and

bond funds. Cash equivalents mature or become due within

three months of the date of acquisition.

d. Inventories—Prior to April 1, 2008, inventories were stated at

cost, determined by the average method. In July 2006, the

Accounting Standards Board of Japan (ASBJ) issued ASBJ

Statement No. 9,” Accounting Standard for Measurement of

Inventories”, which was effective for fiscal years beginning on or

after April 1, 2008 with early adoption permitted. This standard

requires that inventories held for sale in the ordinary course of

business be measured at the lower of cost or net selling value,

which is defined as the selling price less additional estimated

manufacturing costs and estimated direct selling expenses. The

replacement cost may be used in place of the net selling value,

if appropriate. The Company applied the new accounting stan-

dard for measurement of inventories effective April 1, 2008. The

effect of this change in accounting methods on profit or loss

and on business segment information was minimal.

e. Investment Securities—All investment securities are classi-

fied as available-for-sale securities. Marketable available-for-sale

securities are reported at fair value, with unrealized gains and

losses, net of applicable taxes, reported in a separate compo-

nent of equity. The cost of securities sold is determined based

on the moving-average method.

Non-marketable available-for-sale securities are stated at

cost determined by the moving-average method. For other

than temporary declines in fair value, investment securities are

reduced to net realizable value by a charge to income.

f. Property, Plant and Equipment—Property, plant and equip-

ment are stated at cost. Depreciation of property, plant and

equipment of the Company and its consolidated domestic

subsidiaries is computed substantially by the declining-balance

method based on the estimated useful lives of the assets, while

the straight-line method is applied to buildings acquired on or

after April 1, 1998 by the Company and its consolidated domes-

tic subsidiaries, and to almost all property, plant and equipment

of consolidated foreign subsidiaries. The ranges of useful lives

are from 10 to 50 years for buildings and structures and from 3

to 12 years for machinery and vehicles.

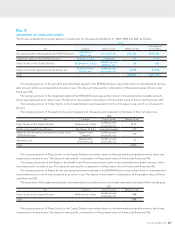

g. Impairment of Long-Lived Assets—The Group reviews its

long-lived assets for impairment whenever events or changes in

circumstance indicate the carrying amount of an asset or asset

group may not be recoverable. An impairment loss is recog-

nized if the carrying amount of an asset or asset group exceeds

the sum of the undiscounted future cash flows expected to

result from the continued use and eventual disposition of the

asset or asset group. The impairment loss is measured as the

amount by which the carrying amount of the asset exceeds its

recoverable amount, which is the higher of the discounted cash

flows from the continued use and eventual disposition of the

asset or the net selling price at disposition.

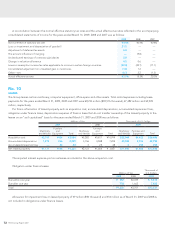

h. Intangible Assets—Intangible assets are carried at cost less

accumulated amortization, which is calculated by the straight-

line method. Amortization of software is calculated over 5 years.

Amortization of patent is calculated over 8 years. Amortization

of technological assets is calculated over 10 years. Goodwill is

amortized on a straight-line basis over its estimated useful life

determined for each investment, which does not exceed 20

years. However, insignificant goodwill is charged to income

when incurred.

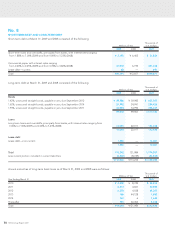

i. Accounting for Significant Allowances and Reserves—

i) Allowance for doubtful receivables: Allowance for doubtful

receivables is provided at an amount determined based on

the historical experience of bad debts with respect to ordi-

nary receivables, plus an estimate of uncollectible amounts

for receivables from companies in financial difficulty.

ii) Accrued bonuses to employees: Accrued bonuses to employ-

ees are provided based on the estimated amount to be paid.

iii) Employees’ pension and retirement benefits: To prepare for

retirement benefits payment to employees, an amount

deemed to have accrued at the end of the consolidated

fiscal year under review is provided as an allowance in certain

divisions and overseas subsidiaries, based on estimated

amounts of retirement benefit obligations and pension

assets at the end of the year. Past service costs are amortized