Pentax 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Information Technology

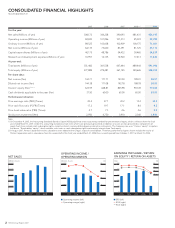

Overall net sales in the Electro-Optics business were ¥163,902 million (down 21.9% compared with the preceding

fiscal year), and operating income came to ¥39,712 million (down 41.1% compared with the preceding fiscal year).

Orders for mask blanks used in semiconductor production were substantially down, reflecting the general

slowdown in the semiconductor market. Photomasks, which have a very specialized market, held up relatively

well until the third quarter, but ultimately recorded a decline in sales for the full year.

Photomasks for LCD panels saw lower sales as capital expenditures in the panel market were halted from

the second quarter of fiscal 2008 due to sluggish demand for LCD televisions.

In glass disks for hard disk drives, sales fell due to the effect of foreign currency movements and falling

prices. In light of the rapid market deterioration and the associated changes in the industry landscape, we

decided to halt negotiations regarding the hard disk media-related business merger with Showa Denko K.K.

that had been scheduled to take place in fiscal 2009.

In optical lenses, production adjustments in the digital camera market resulted in lower orders for lenses for

compact digital cameras, while prices declined, leading to a significant fall in sales.

Eye Care

In the Vision Care business, which produces eyeglass lenses, net sales totaled ¥110,725 million (down 12.4%

compared with the preceding fiscal year) while operating income reached ¥21,807 million (up 5.6% compared

with the preceding fiscal year). Both in Japan and overseas, we saw stronger competition from low-priced lenses

produced in Asian countries, and even though we performed well in Europe and Asia, the yen’s appreciation

resulted in lower sales. Meanwhile, we worked to improve the efficiency and lower the cost of custom product

production, which enabled us to achieve higher profits in this business.

In the Health Care business, net sales were ¥49,968 million (up 8.2% compared with the preceding fiscal year)

and operating income reached ¥11,544 million (up 13.6% compared with the preceding fiscal year). In contact

lenses, we won more customers by focusing on high-value-added products and conducting sales consultations,

while intraocular lenses—and soft IOLs in particular—also performed steadily, helping to boost results.

Pentax

Pentax posted net sales of ¥122,190 million and an operating loss of ¥11,572 million. Although megapixel imag-

ing capable endoscope systems performed well, overall medical endoscope sales were down due to the effects

of foreign currency movements. In digital cameras, both SLR and compact camera sales dropped as a result of

drastically lower demand and intensifying price competition.

Although medical-use endoscopes contributed to profits, the slump in the digital camera business, as well

amortization of goodwill following the merger, resulted in an operating loss for the Pentax business in the fiscal

year under review.

PORTFOLIO MANAGEMENT: GENERATING SOLID VALUE

INTO THE FUTURE

Our results were considerably worse in fiscal 2009 than fiscal 2008. The major reason was the abrupt drop in

demand in the Information Technology field, the pillar of our earnings, as a result of the global economic slow-

down. I think it would be accurate to say that the industry itself has begun the structural transition from a growth

industry to a mature one. In order for Hoya to achieve growth under these conditions, we need to reinvent our

business scheme to respond flexibly to change and build a business structure that can ensure stability and growth.

A MESSAGE TO OUR STAKEHOLDERS

4HOYA Annual Report 2009