Pentax 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R&D ACTIVITIES

Aiming to achieve sustainable growth and increase corporate value, the Hoya Group devotes

considerable effort to formulating business strategy from a long-term perspective and devel-

oping technology, as well as acquiring and cultivating new businesses. The R&D Center con-

ducts various R&D with an eye on the future. It conducts R&D in new business fields, develops

technologies and products that enhance the competitiveness of existing businesses, and

supports development on technology themes common to more than one business division.

In March 2008, Hoya merged with Pentax, in the process adding a new business domain:

Pentax’s precision devices, such as medical-use endoscopes and digital cameras, which the

company has built up over the years. In addition to Hoya’s traditional electro-optics, the

Group is investing substantial management resources in the promising medical and health-

care field, aiming to use its advanced technological capabilities to achieve sustained growth

into the future. Here we present some of the R&D themes that Hoya is currently pursuing.

Nanoimprint Technology: Verifying Molds for Next-Generation HDDs

Hoya is putting its years of expertise in lithographic technologies to good use in the develop-

ment of nanoimprint molds, which will be used to create the discrete track recording (DTR)

media for next-generation hard disk drives (HDDs). Eyeing 2010 as the date for practical appli-

cation of DTR media, HDD manufacturers are working on commercializing products, with high

hopes for using Hoya’s microfabrication technologies to achieve a track pitch of 50 nanometers.

3C-SiC: Success with Prototype Devices

Hoya is promoting the development of 3C-SiC cubic monocrystal silicon carbide semiconduc-

tor wafers and devices, which are expected to offer superior energy efficiency. 3C-SiC can be

used in automobiles and home appliances such as air conditioners to help combat global

warming. Taking volume production efficiency into account, Hoya is currently developing

six-inch wafers and testing and evaluating the power devices that will be the end product. The

Company is aiming for practical application in 2010.

Connectors for Optical Communications: Completion of Ultra-Small FTTH Components

As the FTTH (Fiber to the Home) environment widens around the world, Hoya is working to

develop a GE-PON/G-PON*1-compliant module for converting optical signals to electrical

ones at optical communication access points. GE-PON/G-PON is the next-generation stan-

dard for high-speed optical communications, and is expected to become common from 2010

and beyond. By building a functional device on top of a wafer, Hoya is aiming to create prod-

ucts that are significantly smaller than existing products.

*1 GE-PON/G-PON (Gigabyte Passive Optical Network): A technology that enables high-speed transmission of 1 giga-

byte per second over fiber optic lines and networks.

3C-SiC wafers and devices

Quartz nanoimprint mold for

DTR media

Connectors for optical communications

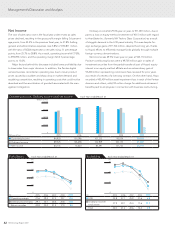

R&D EXPENSES

2005 2006 2007 20092008

0

5,000

10,000

15,000

20,000

25,000 5

4

3

2

1

0

(Millions of Yen) (%)

R&D ACTIVITIES/INTELLECTUAL PROPERTY ACTIVITIES

Forward Looking Research & Development

n R&D Expenses (left)

Ratio of R&D expenses to sales (right)

32 HOYA Annual Report 2009